Canadian home sales slipped for the first time in six months between June and July as interest rates did their part to quell consumer spending. Prices, on the other hand, continued to trend upward according to new national data.

More specifically, the latest Teranet-National Bank Composite House Price Index — it tracks observed or registered home prices across 11 CMAs, so long as they have been sold at least twice — saw a cumulative month-over-month increase of 1.8% last month (before seasonal adjustments), marking the fifth straight month of increase.

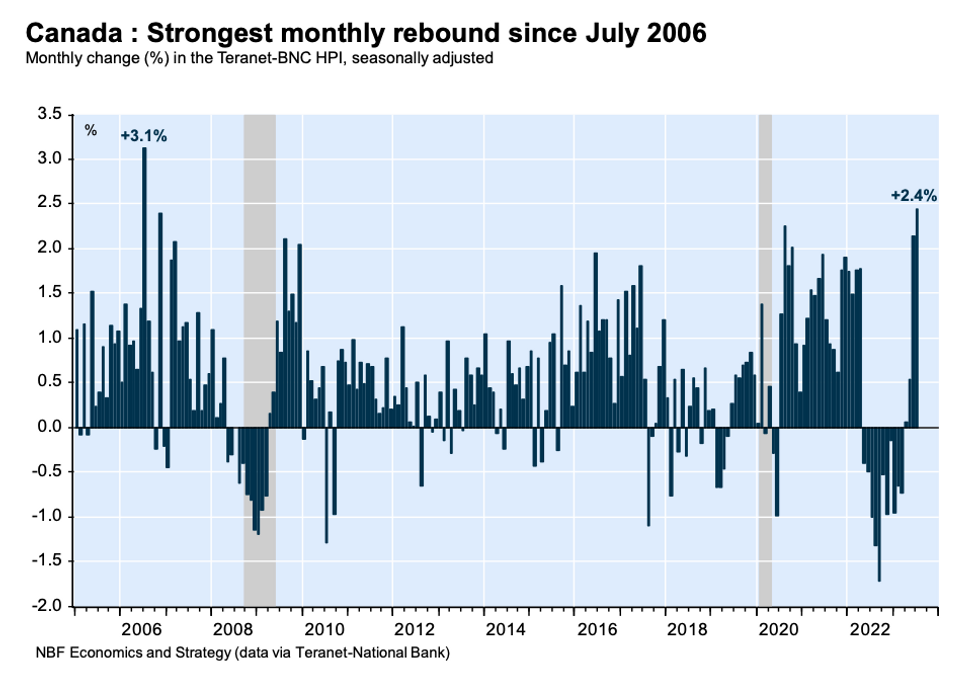

After adjusting for seasonal effects, the index ticked up for the fourth straight month in July, coming in at 2.4%. In an analysis of Friday’s data, Daren King, Senior Wealth Advisor and Portfolio Manager at National Bank Financial, notes that July’s (seasonally-adjusted) rise also represents the “second-highest price increase ever recorded in a single month after the one observed in July 2006.”

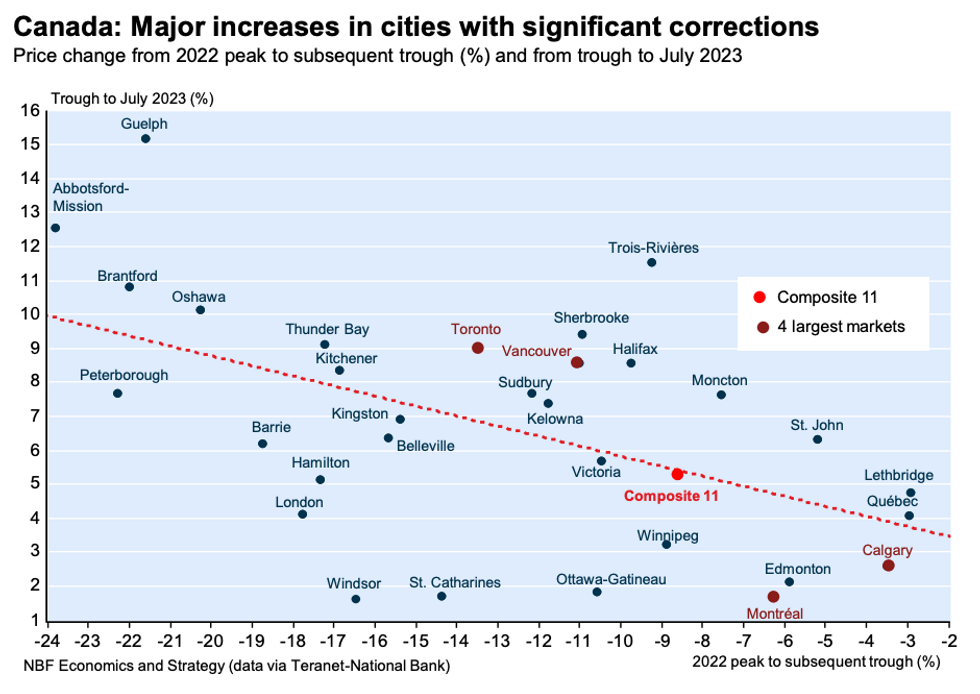

“After a cumulative decline of 8.6% since peaking in April 2022, recent rises in the composite index have erased part of this correction, which now stands at just 3.8%,” writes King. “Interestingly, the recent upturn in prices has been the greatest in cities that have seen the biggest corrections.”

He adds that only Saint John, Lethbridge, Quebec City, and Trois-Rivières have “completely erased their price declines” as of last month.

Of the 11 CMAs considered in the index, eight recorded month-over-month price gains in July, led by Halifax, at 4.9%. The Maritimes city was trailed by Hamilton (+4.4%), Vancouver (+3.9%), Toronto (+3.5%), Victoria (+1.6%), Winnipeg (+1.3%), Ottawa-Gatineau (+0.6%), and Edmonton (+0.3%).

Conversely, prices fell last month in Quebec City (-1.2%), Montreal (-0.9%), and Calgary (-0.3%).

Data is also available for 20 CMAs not included in the index, of which 17 saw price growth, led by Abbotsford-Mission (+7.2%), Saint John (+6.3% after a 4% decline the previous month), and Guelph (+6%). The largest decrease was observed in Sherbrooke (-3.8% after a 5.4% rise the previous month).

Last month’s positive price pressure is likely to persist as the third quarter progresses, says King, pointing to Canada’s strong demographic growth and a “lack” of properties to serve the market. However, he continues, “the deterioration in affordability with recent interest rate hikes in a less buoyant economic context should represent a headwind for house prices thereafter.”

Year over year, the national composite index slid by 1.9% in July, which was a “smaller annual contraction” than observed in June. Even so, price gains were reported in three of the 11 cities informing the national composite, including Calgary (+3.3%), Halifax (+2.1%), and Quebec City (+1.1%). Conversely, prices fell in Hamilton (-7.9%), Ottawa-Gatineau (-5.4%), and Winnipeg (-5.2%).

Strong annual gains were also recorded in Lethbridge (+7.2%) and Trois-Rivières (+5.8%), while sharp declines were observed in St. Catharines (-10.5%), London (-9.3%), and Branford (-9.1%).