The Canadian real estate market has gone through significant changes over the last year and a half, as repeated interest rate hikes sent record-high home prices on a downward trajectory.

In February 2022, the overnight rate sat at 0.25%. But, in March, the Bank of Canada (BoC) began an incessant campaign of increases that brought interest rates to 4.5% by January 2023. However, the BoC has held steady in the months since, leading prices to begin creeping back up.

To determine what effect the rate hikes have had, real estate agency Zoocasa compared homes prices from March 2022 and April 2023 in major markets across Canada. According to the report, Canada's priciest provinces and cities have seen the largest price drops.

Ontario led the decline on a provincial level, with average home prices falling $174,300 to $907,200. British Columbia followed, with a decline of $113,000, which brought the average home price to $961,900 as of April. Alberta saw the smallest decline, with average prices falling just $200 to $473,700.

Meanwhile, prices increased in the four most affordable provinces. Newfoundland and Labrador experienced an increase of $11,400, bringing the average price to $276,600, while New Brunswick saw prices rise $2,300 to $279,000. Prince Edward Island and Saskatchewan saw smaller increases of $1,500 and $200, respectively.

"Interest rate hikes have not hit these provinces as hard," Zoocasa commented of the provinces with prices increases. "The much more affordable home price has meant the cost of a mortgage wouldn’t have as steep of an increase as it would in British Columbia or Ontario."

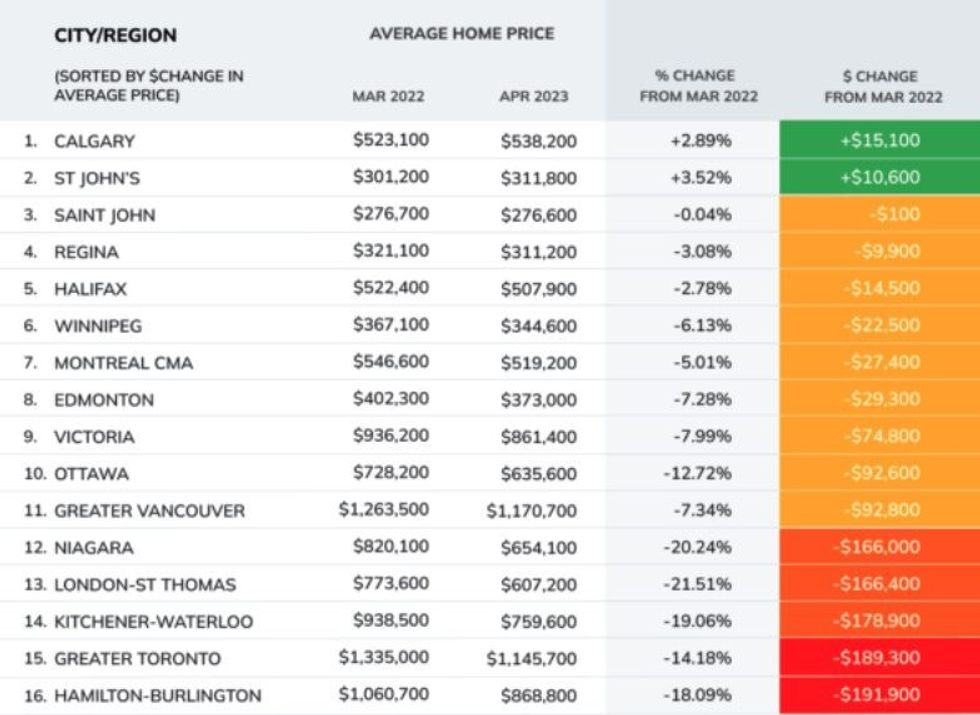

A similar scenario played out on a local level, with cities in Ontario experiencing the largest price declines.

Hamilton-Burlington saw the largest decline, with prices falling $191,900 to $868,800, while the average home price in the Greater Toronto Area dropped $189,300 to $1,145,700. Kitchener-Waterloo, London-St Thomas, and Niagara rounded out the top five, with prices falling $178,900, $166,400, and $166K, respectively.

Only two cities experienced price increases -- Calgary, with a $15,100 rise, and St. John's, with a $10,600 jump. Zoocasa attributed the former's price change to its "increased popularity and more affordable housing."

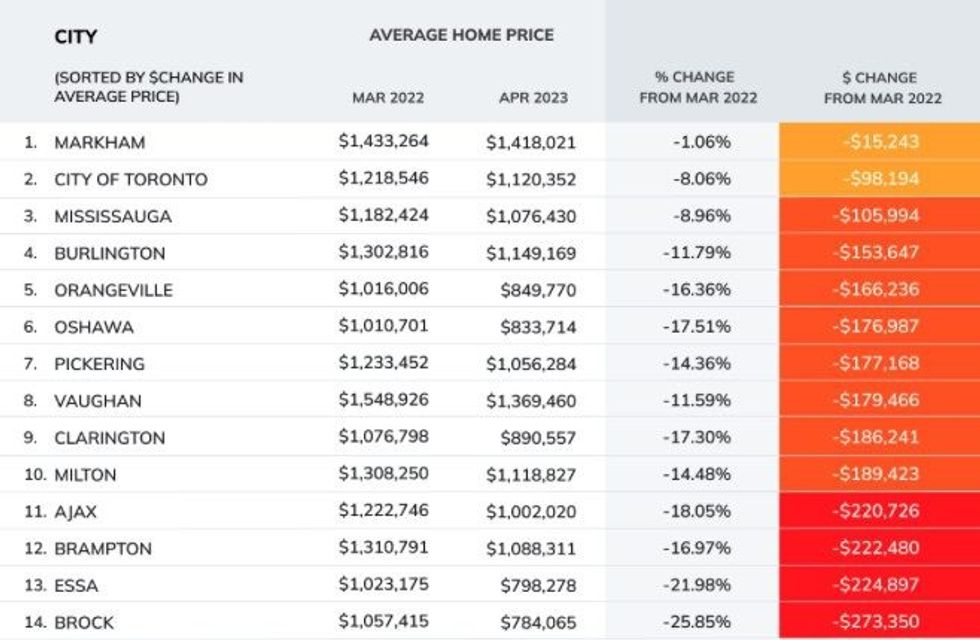

As Ontario had the largest price decline across Canada, Zoocasa elected to take a closer look at major markets in the GTA. The report found that every city in the region has seen a price decline, with only two seeing prices fall less than $100K.

As of April, the average home price in Markham stood at $1,418,021, a $15,243 decline from March 2022, while the City of Toronto saw prices drop $98,194 to $1,120,352 over the same time period.

Four cities saw declines in excess of $200K. In Brock, home prices have fallen $273,350 to $784,065, and in Essa they've dropped $224,897, to $798,278. Prices dropped $222,480 in Brampton and $220,726 in Ajax.

Despite the downward pressure brought on by interest rate hikes, prices in the GTA have begun to reverse course, rising 4% month-over-month in April, due in part to a lack of supply across the region.