As remote work persisted and recession fears surged, Canada’s downtown offices were as empty as ever at the end of 2023 — literally.

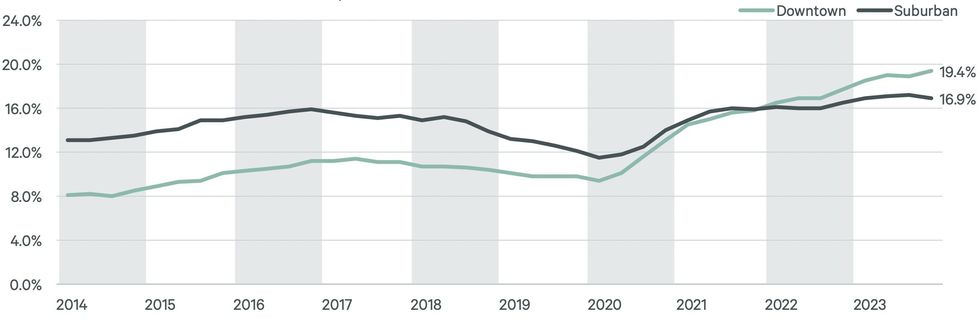

According to new office market data from CBRE, the national downtown office vacancy rate reached 19.4% in Q4 2023, a record high for the measure and a 50-basis-point (bps) increase from Q3.

Despite a modest improvement in the suburban market, which saw the vacancy rate fall to 16.9%, Canada’s overall office vacancy rate increased 10 bps on a quarterly basis to 18.3%. Year over year, the figure came in 110 bps higher than at year-end 2022.

"Remote work, recession fears, and the tech sector are definitely having an influence on the Canadian office market," Marc Meehan, Director of Canadian Research at CBRE, told STOREYS of the rising vacancy rate. "The biggest factor though is new supply. That’s the one having quite a bit of an impact on vacancy rates across Canada. That’s largely the case in Toronto."

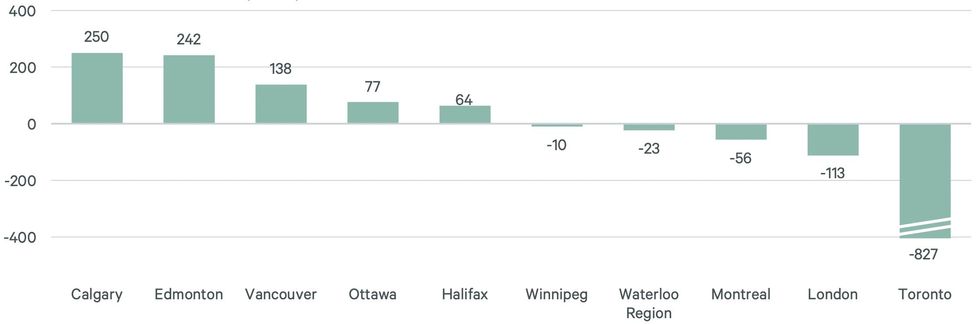

Toronto’s office market gave a "lacklustre" performance in Q4, with the downtown office vacancy rate jumping 160 bps to 17.4%. The quarterly increase was largely due to 624,550 sq. ft of new space being delivered to an already struggling market.

The 1.1 million sq. ft of new office space constructed in downtown Toronto last year resulted in negative net absorption of 2.7 million sq. ft, the highest the city has recorded in a year since 2020.

If Toronto was excluded, national net absorption of office space would have been positive in Q4, CBRE noted. Instead, negative net absorption of 258,816 sq. ft. was reported for the quarter, contributing to a year-end total of negative 5 million sq. ft.

"Toronto has been a little bit slower on the return to work than a lot of other cities," Meehan said. "Groups are largely on hold right now. They’re pushing back leasing decisions as much as possible given the evolving uncertainty that is facing the office market. That includes the higher interest rate environment, which makes rent growth bigger."

There are also still a fair share of adjustments happening in the Toronto market, Meehan said, as companies continue to right-size their space and increasingly eye Class A, well-amenitized buildings to entice workers back into the office.

"Admittedly, the demand for Class B office, especially in the downtown markets, is evaporating. Toronto has high commute times and trying to convince employees to come into lower quality space in the downtown core is really not a winning argument today," he added.

While Toronto struggled, that same flight to quality, as well as slowing construction, helped improve office market fundamentals in other major cities.

Calgary’s downtown office vacancy rate fell to 30.2% and Ottawa’s slipped to 14.2% in Q4 as the cities marked several successful office-to-residential conversions. In 2023, more than 2.5 million sq. ft of office space, or 0.5% of total national inventory, was converted to other uses.

Meehan noted, though, that residential conversions are not a feasible option for all office buildings. For older Class B and C spaces that don’t have strong sustainability profiles, there "aren’t that many obvious solutions," save for a land play.

Two quarters of positive net absorption in Edmonton and seven in Halifax pushed the cities’ downtown office vacancy rates down to 22.9% and 17.9%, respectively, in Q4. After two quarters with no new supply, Vancouver’s downtown office vacancy rate dropped to 11.0%.

Across Canada, just 10.9 million sq. ft of office space was under construction in Q4, 54.4% of which is pre-leased. Equal to 2.2% of total inventory, it’s the lowest construction total since Q3 2017. In 2023, ground broke on only 784,000 sq. ft. of new office space nationally, just over 10% of the amount seen in 2018.

"Effectively, we've had nearly no notable construction starts in 2023," Meehan told STOREYS. "While there are fewer and fewer projects breaking ground, there are still some significant ones in the pipeline, like Portland Commons and CIBC Square Phase 2 in Toronto. That new supply is going to have an upward impact on vacancy."

"From the occupier side, we are reasonably optimistic that there's going to be increased demand for office space as there’s increasing clarity around the interest rate environment and as more companies begin return to work mandates. That said, the new supply will more than offset the gains we’re expecting from occupiers. So I think vacancy rates are going to continue to increase for at least the year ahead."