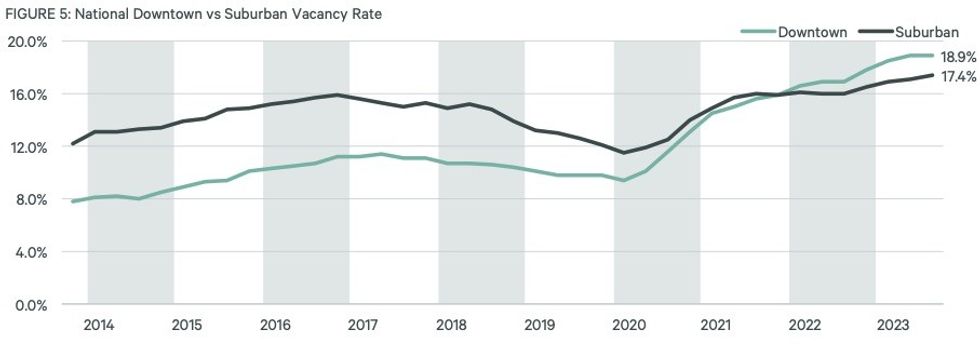

Despite a renewed interest in downtown Class A buildings, Canada’s overall office vacancy rate edged up in the third quarter of 2023 as demand continued to falter.

According to new data from CBRE, the overall national office vacancy rate rose to 18.2% in Q3, a 10-basis-point (bps) increase from Q2, largely due to a disinterest in sub-par and suburban spaces, with the vacancy rate for the latter segment rising 30 bps to 17.4%.

Although the national downtown Class A vacancy rate fell 20 bps to 16.3%, the overall vacancy rate for the downtown segment remained at its 30-year high of 18.9% in Q3. Meanwhile, the downtown Class B vacancy rate rose 30 basis points to 23.6%.

Shekhar Bhardwaj, CBRE’s Downtown Toronto Research Manager, attributed the outlying trend seen in downtown Class A buildings as a "flight to quality" on the part of tenants.

"When the market is slow, as is the case right now, you’re going to see the higher quality stuff leave first, before transaction volume shifts into the B and C asset classes," Bhardwaj told STOREYS.

Despite elevated vacancy rates, rents for Class A and B buildings in both the downtown and suburban segments were above Q1 2020 levels.

"The different prospects for Class A and Class B office buildings reflects the fact that businesses are prioritizing high-quality, well-amenitized office buildings in nodes that minimize commute times," said CBRE Canada Chairman Paul Morassutti.

"Converting office buildings to other uses has become an increasingly attractive option for landlords with older, less competitive buildings. However, while there is a lot of hype around conversions to residential uses, the economic viability of conversions is still challenging absent incentives and conversions will not be a silver bullet to solving for elevated office vacancy."

Since the start of 2022, conversions have led to the removal of 2.8 million sq. ft of office space from the national inventory. Equal to 0.6% of the total inventory, the majority has been located in Calgary and Ottawa.

The trend has yet to take off significantly in downtown Toronto, Bhardwaj explains, as conversions are costly and time-consuming. And, not every building is a suitable candidate for residential conversions.

"In recessionary times, banks are not as friendly, especially towards office buildings. So it’s a little bit tougher to convert these buildings right now," Bhardwaj told STOREYS.

"But I do think as time goes on the inventory in downtown Toronto will decrease. Whether or not that is material will depend on the economy, but we will see more and more conversions later on."

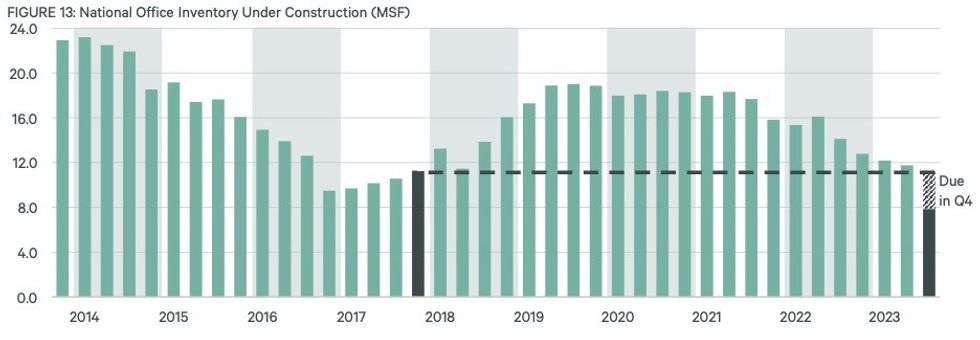

With demand for space dwindling, national new office construction has slowed to its lowest level in over six years — work got underway on just 89,000 sq. ft of space in Q3. New offices themselves are shrinking, too. The average size of projects that started in 2018 was 168,000 sq. ft; in 2023, the average is 75,000 sq. ft.

Just over 600,000 sq. ft of new supply was delivered in Q3, which was spread across three properties in Toronto and the Waterloo Region. In total, 1.8 million sq. ft of space has come online in 2023.