As the City of Burnaby continues its work on Burnaby 2050, a new official community plan (OCP) that will guide the city's growth across the next 25 years, a big component of the project is economic development.

Accordingly, last fall, the City retained Urban Systems to conduct an employment land needs assessment as part of the City's OCP Economic Development and Industrial Lands Policy Review, whose findings were presented to the City in late-June.

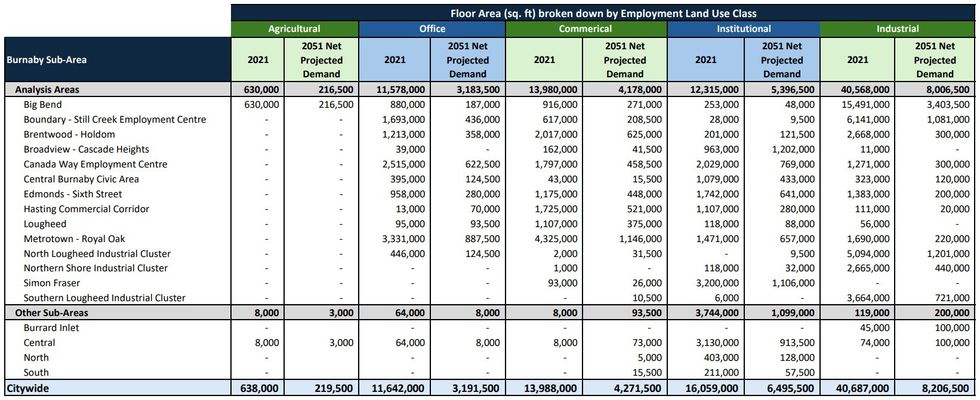

For the purposes of the assessment, Burnaby was divided into 19 sub-areas, which do not cover the entire city but capture the majority of existing employment lands. (A map of the sub-areas can be viewed here.)

After conducting an inventory of existing employment land, local employment data was used to estimate the average amount of floor area currently needed for workers in different employment land use classes — agricultural, office, commercial, institutional, and industrial.

Using employment growth projections for 2051, Urban Systems was then able to anticipate the amount of additional floor area that would be needed, and concluded that Burnaby will need an additional 22,384,500 sq. ft of employment land, which represents a 26.9% increase from the existing inventory of 83,014,000 sq. ft (as of 2021) and consists of:

- 8,206,500 sq. ft of industrial space,

- 6,495,000 sq. ft of institutional space,

- 4,271,500 sq. ft of commercial retail space,

- 3,191,500 sq. ft of office space, and

- 219,500 sq. ft of agricultural space.

Burnaby Industrial Real Estate

Currently, industrial space accounts for nearly 50% of all employment space in Burnaby, with the Big Bend sub-area near the Fraser River accounting for much of it, but while industrial space has the highest projected space demand by volume, at 8,206,500 sq. ft, this represents only a 20.2% increase, which is the lowest of all employment land categories.

As part of the assessment, Urban Systems also interviewed various organizations about the development trends they expect to see in Burnaby. Regarding industrial land, those interviewed stated that single-use industrial areas are becoming less prevalent and that industrial land can be more efficiently used by allowing office, retail, and mixed-commercial uses on the upper levels — also known as stacked industrial buildings.

Respondents, which included developers Beedie and Oxford Properties, also noted that there will be a greater demand for logistics and distributions facilities, as well as large warehouses used by the film industry.

Burnaby Institutional Space

While industrial space is the employment land category that needs the most additional space by volume, institutional space — schools, healthcare, municipal — is the category that needs the biggest increase by proportion, at 40.4% (6,495,500 sq. ft).

Currently, institutional space is fairly evenly spread out across the city, but the Broadview-Cascade Heights sub-area in the northwest corner of Burnaby is expected to need the highest amount of new institutional space in the coming years.

In terms of development trends, respondents — which included Simon Fraser University and Fraser Health — said that Burnaby will continue to be an education hub and that land for education and healthcare will continue to be in demand. Staff housing will be key in attracting quality talent to institutional uses, respondents said.

Burnaby Commercial Retail Space

The amount of new commercial space that's needed ranks third by both volume (4,271,500 sq. ft) and proportion (30.5%).

The Metrotown-Royal Oak sub-area accounts for over twice as much of the existing inventory of commercial retail space — thanks in large part to being the home of Metropolis at Metrotown, one of the largest malls in Canada. Nonetheless, the Metrotown-Royal Oak sub-area is still projected to need the largest amount of new retail space.

Respondents, including the Burnaby Board of Trade, stated that big box retail is dying and that there will be more demand for smaller retail spaces and that the demand will follow mixed-use development and office development because of the foot traffic those projects bring.

Burnaby Office Space

When it comes to office space, Burnaby is expected to need an additional 3,191,500 sq. ft of space, which represents a 27.4% increase. Again, the Metrotown-Royal Oak sub-area accounts for the highest amount of the existing office space — thanks in large part to the three Metrotower office buildings next to Metropolis — and is also projected to have the highest demand in the coming years.

In terms of development trends, respondents included WPJ McCarthy and Company — owners of several office buildings around Kingsway and Nelson Avenue in the Metrotown area — and they stated greater demand for office space near public transit and amenities will emerge and that Burnaby will see a shift towards office and retail mixed developments.

Of note, however, is the continued uncertainty around the need for office space in general, which has resulted in developers reconsidering planned office space. Earlier this year, Thind Properties opted to convert 10 floors of office space in its 48-storey Highline Metrotown tower into hotel space. Anthem Properties is also exploring the same thing for the seven-level podium in its 66-storey Citizen.

Burnaby Agricultural Space

In Burnaby, a vast majority of the existing agricultural space is located in the Big Bend sub-area, where most of the additional new agricultural space is also expected to be located. The assessment found that there will be a need of 219,500 sq. ft, which represents a 34.4% increase from the existing 638,000 sq. ft.

Perhaps because it represents the smallest employment land category in Burnaby, agricultural job growth is also expected to be minimal, with 120 new workers expected in the next 25 years.

Respondents made no comments regarding development trends for agricultural space.

Development Barriers

As part of the assessment, Urban Systems also interviewed the respondents about barriers they face in Burnaby when it comes to developing projects with employment space.

Respondents said that the rezoning process in Burnaby is complex and time-consuming, whether for new projects or even small things such as tenant improvements. Additionally, the need for a CD (Comprehensive Development) zone for industrial and commercial developments prolongs the development process further, because they require Council approval.

Respondents also said that land use designations and zones need to be more specific in order to provide clarity, pointed to high development costs, and said that the City's employment requirements are not always realistic. Furthermore, the lack of affordable housing — Burnaby continues to be one of the top-3 cities in all of Canada in terms of average rent — is also a barrier, respondents said, because it makes it difficult to attract talent.

In terms of what the City can do to help, reducing minimum parking requirements and reducing property taxes were the two most popular responses, along with creating a 50-year business plan and redesignating municipal land for employment use.