Construction intentions slowed across Canada in November as costs soared, the economy slowed, and labour shortages persisted.

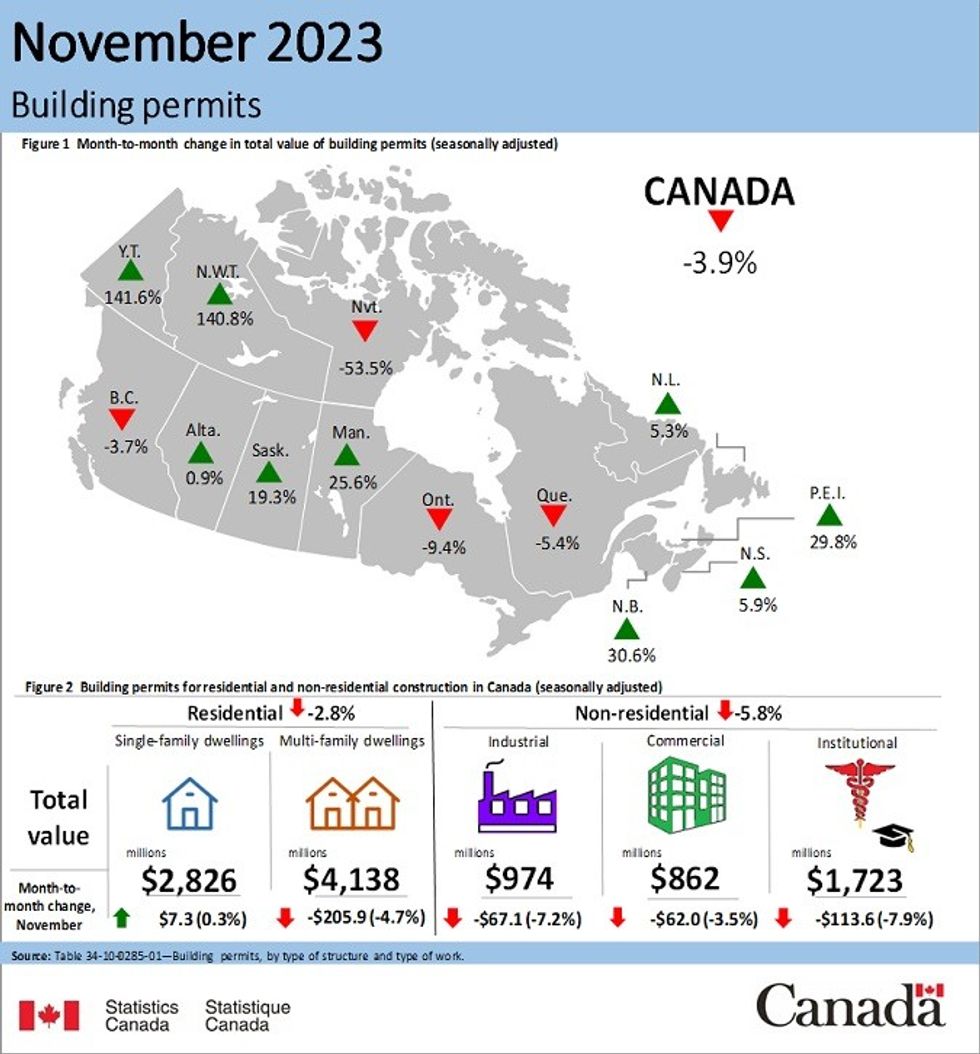

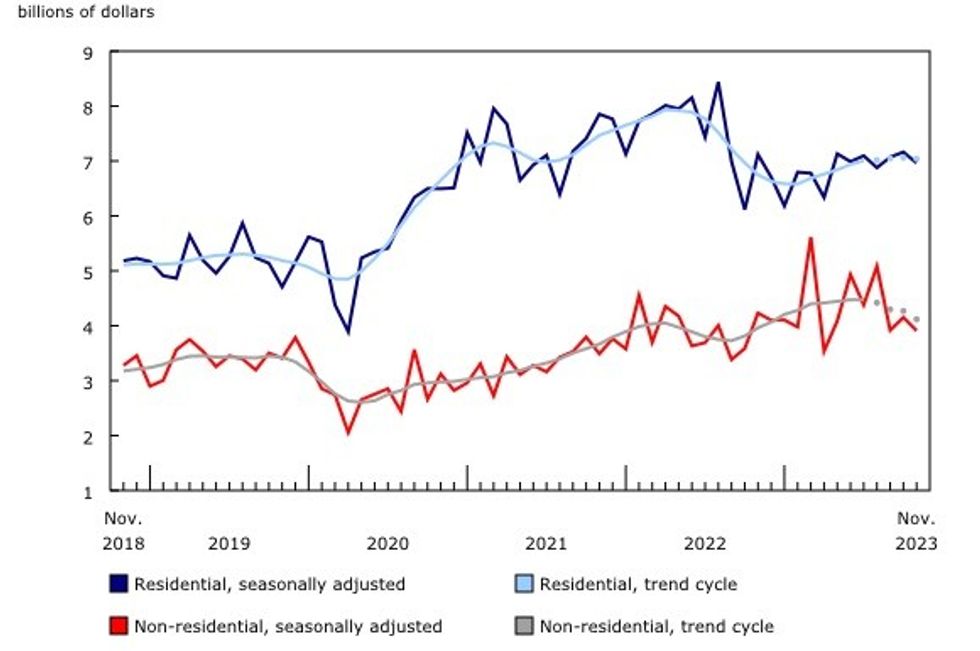

According to new data from Statistics Canada, the total value of building permits issued in November fell 3.9% on a monthly basis to $10.9B, the lowest level since April.

The non-residential sector led the decline, as construction intentions contracted across the institutional, industrial, and commercial components. Total permit values in the sector shrunk 5.8% to $3.9B in November.

Following a relatively active October, the institutional component saw construction intentions fall 7.9% to $1.7B in November, while the industrial component experienced a 7.2% monthly decline, to $974M.

Permit values in the commercial component dropped 3.5% to $862M in November, marking the third-straight month of decline and coming in 16.2% below November 2022 levels.

The decline comes as the price to build rises, particularly so in Toronto — according to a recent study, construction costs in the city jumped 40.5% between January 2020 and August 2023. Nationally, Canada's Residential Construction Price Index climbed 51% from Q1 2020 to Q1 2023.

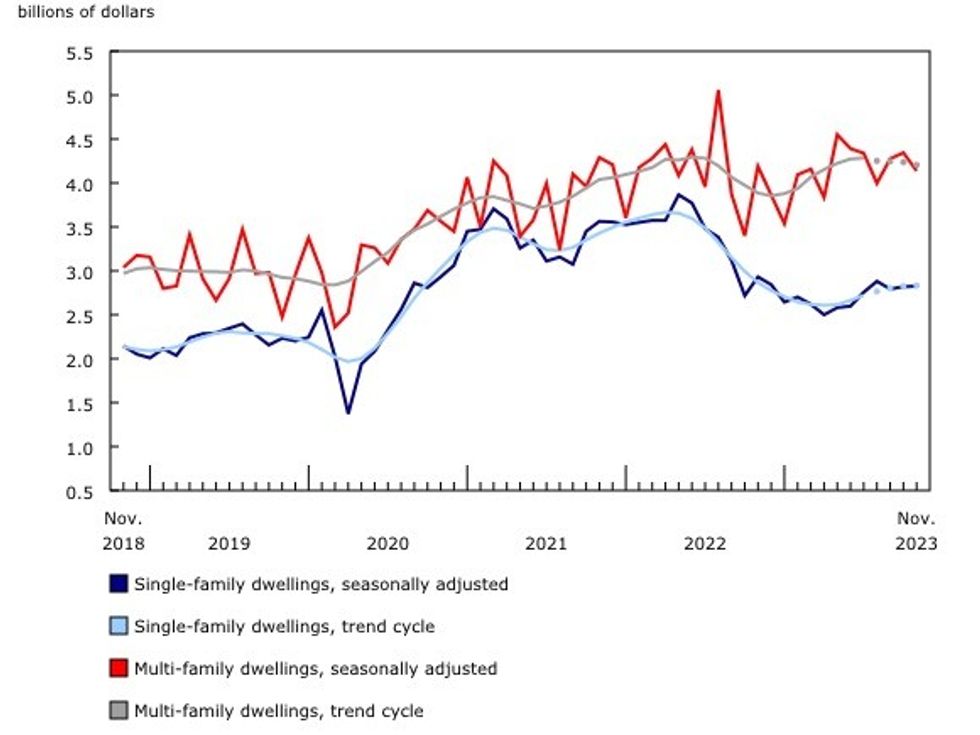

However, declines in the residential sector were relatively more modest, with the total value of building permits issued in November dipping 2.8% month over month to $7B. Construction intentions in the multi-family component declined 4.7% to $4.1B, while permit values in the single-family component inched up 0.3% to $2.8B.

On a local level, residential permit values increased in eight provinces, but the national figure was pulled down by declines in the multi-family component in Quebec and British Columbia. The provinces reported monthly declines of 17.3%, or $231M, and 19.4%, or $249.3M, respectively.

Meanwhile, the Atlantic provinces collectively saw construction intentions increase 30.0% to $421.8M while the Prairie provinces experienced a 9.8% jump to $1.4B.

In Ontario, residential permit values edged up 2.1% to $3B in November. But despite the uptick, Richard Lyall, President of the Residential Construction Council of Ontario, said it’s not enough given the provincial government’s push to build more housing.

"We’re already in a housing crisis, and with our demographic projections, a 2.1% increase is not good. We’re way underperforming. It’s actually quite scary to me," Lyall told STOREYS.

"In Ontario, our sales are way down. Our starts will continue to fall too. And just because someone gets a building permit doesn’t necessarily mean something will get built. People are waiting for interest rates to come down in the spring, but they’re not going to fall as rapidly as they went up."

Lyall noted that current building permit data relates to projects sold in the past; with sales and starts slowing in Ontario, he expects residential permits issued in the province will begin to decline, too.