Construction costs have risen dramatically in Toronto over the past couple of years, a new global ranking shows.

Australian price comparison service Compare the Market used data from construction tenders to calculate the cost of building materials in various global cities, and found that costs in Toronto spiked 40.5% between January 2020 and August 2023.

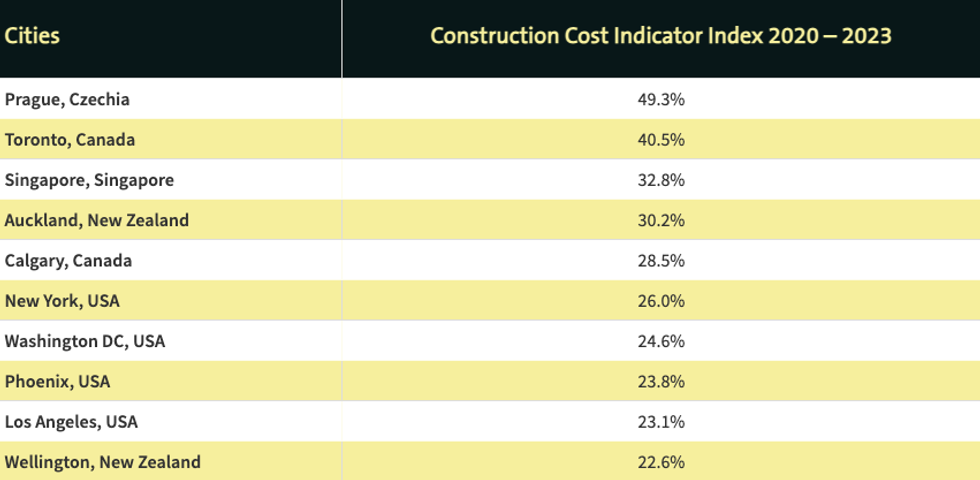

Toronto was second in the ranking of 25 cities only to Prague in the Czech Republic, where costs are up 49.3%. Singapore in the Republic of Singapore was third in the ranking, with building costs up 32.8%.

Globally speaking, Compare the Market writer James McCay attributes surging construction costs to supply chain challenges hatched during the COVID-19 pandemic. These challenges pose a barrier to getting new construction projects, including housing projects, off the ground in cities around the world.

Speaking specifically to Toronto, McCay says that building costs in the city have been “steadily increasing” since 2018. The rise of such costs is linked to higher borrowing costs and labour shortages.

“Construction issues in Toronto from 2020 to 2023 may also relate to how bidding works for construction projects. Toronto doesn’t allow open bidding to all constructors and only to a select few, meaning construction prices remain high,” McCay adds.

Calgary was the only other Canadian city to make the rankings. Construction costs in the westerly city are reportedly up 28.5%, putting it fifth in the rankings.

A Canada-Wide Concern

Although only Toronto and Calgary were featured in Compare the Market's rankings, the rising cost of raw materials, development fees, labour, and other building-related expenses is a Canada-wide concern.

RBC's Robert Hogue and Rachel Battaglia explain in a report from this summer that Canada's Residential Construction Price Index has climbed 51% since the start of the first quarter of 2020, and note that the index has been driven up by “dramatic jumps” in prices of concrete and structural steel (up 55% and 53% respectively since Q1 2020), and “soaring” lumber prices in 2021 and early 2022.

“This surge in raw material prices, together with a ballooning population, has also accelerated increases in the development fees and levies imposed by municipal governments,” they say, adding that such fees have surged “as much as 30% annually” in 2022 for single or semi-detached units.

Going forward, the expectation is that these types of costs will escalate further as the country ramps up homebuilding to meet updated supply targets.

“More housing starts are required to deliver a badly needed expansion in housing supply. But these will boost demand for materials, which will put upward pressure on costs once again,” the report says. “Continuing to focus on higher-density development in very tall structures, for example, will push up demand for cement, potentially straining production capacity limits.”

And while the launch of the express entry process for skilled trades newcomers could help to grow the construction labour force and bring down the cost of hiring, Hogue and Battaglia caution that “it remains to be seen” if this program, and other provincial programs designed to entice people into the construction trades, will curb costs in a meaningful way.