As builders' confidence in residential construction falters in the face of high interest rates and worsening affordability, construction intentions in October were concentrated in the institutional and industrial components.

According to new data from Statistics Data, the total value of building permits issued in October rose 2.3% on a monthly basis to $11.2B, a significant portion of which was driven by the construction of a new hospital wing in Toronto.

Fittingly, the monthly growth was led by the institutional component, which saw construction intentions rise 29.2% to $1.4B. Permit values in the industrial component rose 11.9% to $973.8M, which helped to offset a 10.5% decline in the commercial component to to $1.8B.

Permit values in the latter have been trending downward since reaching a record-high of $2.9B in March. Year over year, they’ve fallen 11.9%.

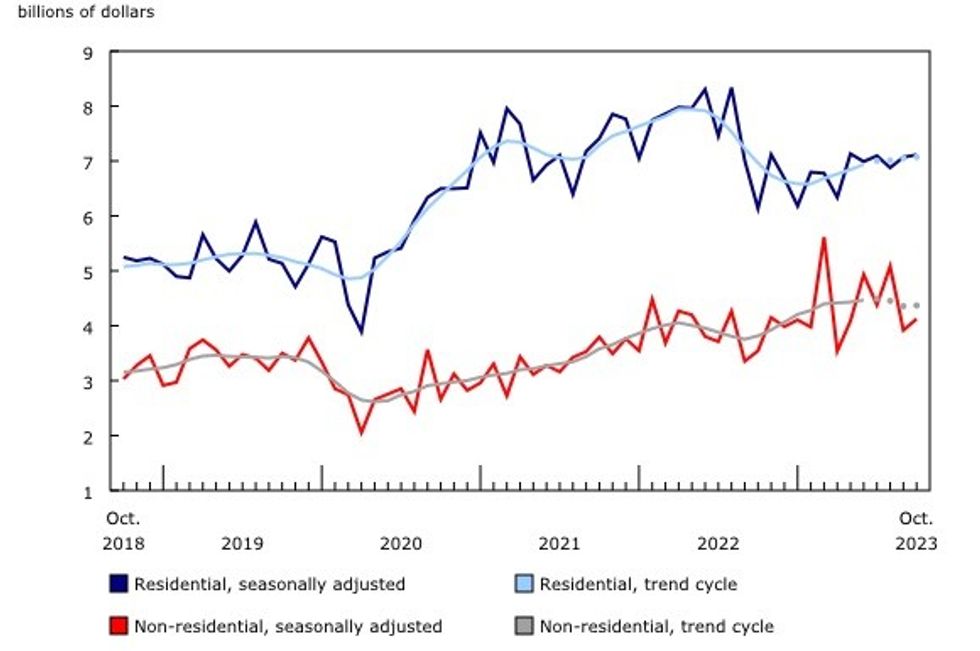

Overall, permit values in the non-residential sector increased 5.3% to $4.1B in October, a welcome reversal after the 21% monthly drop seen in September. October’s gains were concentrated in Ontario, with construction intentions in the province rising 16% to $2B.

Meanwhile, the residential sector experienced a relatively quiet October, with the total value of building permits rising just 0.6% to $7.1B, following a 2.8% jump in September. On an annual basis, residential construction intentions were up 16.1%.

Again, much of October’s gains occurred in Ontario, with permit values rising 7.4%, or $199.9M. Significant increases were also seen in Alberta, where construction intentions edged up 14.8% or $125.5M, and in Quebec, where they rose 7.0% to $89M.

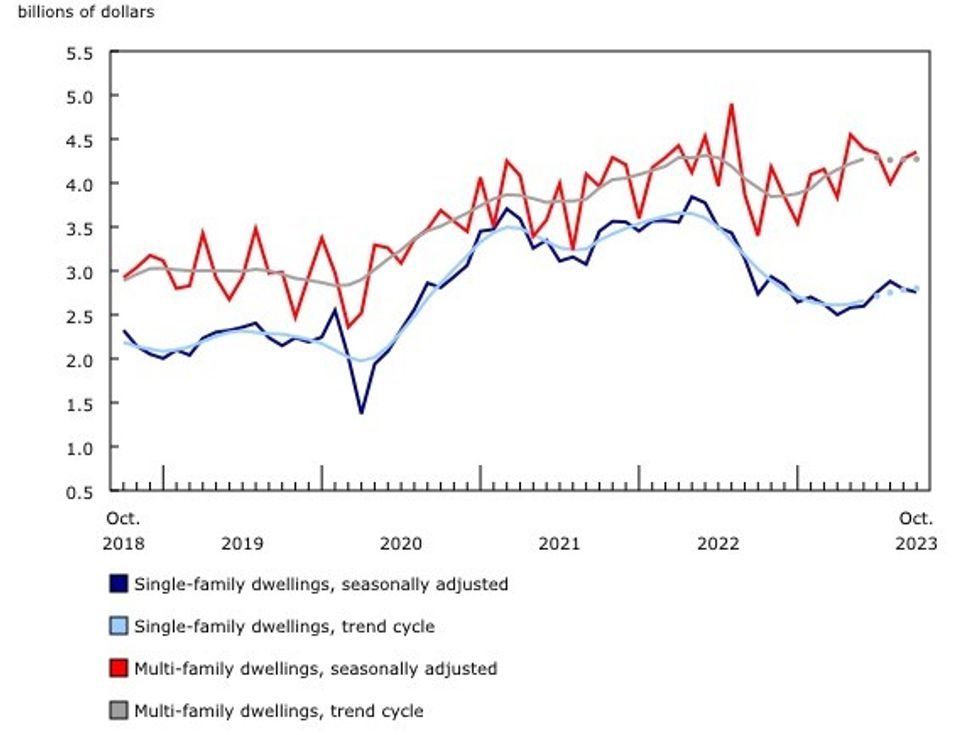

Across Canada, building permits were issued for 18,100 new multi-family units and 4,600 new single-family dwellings in October.

According to the Canadian Home Builders' Association (CHBA)'s latest Housing Market Index, builders feel increasingly pessimistic about current and future selling conditions as interest rates remain high. The indexes for both single-family and multi-family developments declined in the Q3 2023, which signals that "much less housing supply" is to come in forthcoming quarters.

"Builder sentiment will continue to be tied to the path of interest rates, as will depressed housing starts compared to housing supply need. The Bank of Canada merely holding its policy rate steady at its new higher level is unlikely to incentivize an increase in buyer interest or traffic like it did earlier in 2023, particularly as the fall/winter season—a traditionally slower time for new construction sales— is here," the CHBA said.

"Put simply, high borrowing costs for both homebuyers and builders is incompatible with making continued and sustained progress towards the government’s target of building 5.8 million new homes, and requires a concerted effort for new housing policies across all levels of government."