For Davidson Guo, the numerous foreclosure proceedings against his company, AimForce Development, may not be his biggest problem, as a collection of private shareholders that he personally recruited are now alleging that he lied to them.

As first reported by STOREYS in July, five foreclosure applications had been filed at the request of four lenders pertaining to three properties: the site of a planned 67-storey tower in Surrey, the site of a planned 21-storey tower in Coquitlam, and a used car dealership in Richmond.

Since then, a civil claim has been filed in the Supreme Court of British Columbia by Canada Zonda International Investment Group Corp, who says it is filing "on its own behalf and as representative of all other partners of 3771 No. 3 Road Properties Limited Partnership," referring to the limited partnership that owns the aforementioned Richmond property along with 3771 No. 3 Road Properties GP Ltd, the general partner that is controlled by Davidson Guo.

In real estate, properties are often owned through a company that consists of a general partner that has full management control and limited partners comprised of passive investors with no control. AimForce Development itself is not listed as a defendant.

In its civil claim dated August 16, Canada Zonda International says the GP Ltd. — whose only listed director is Davidson Guo — breached its fiduciary duties by mortgaging the lands — 3771 No. 3 Road and 3791 No. 3 Road — on five separate occasions between December 2018 and March 2024 to four different lenders: Romspen Investment Corporation, Lanyard Investments, City Mortgage Investment Corporation, and Amber Mortgage Investment Corp.

Critically, the plaintiff notes that the partnership had already acquired the properties in September 2018, paying for it in cash, and that with all five mortgages, "the mortgage proceeds were not used for the partnership."

"The General Partnership fraudulently and dishonestly breached its fiduciary duty towards the Partnership by repeatedly mortgaging the Lands and diverted the mortgage proceeds for purposes other than for the Partnership," the plaintiff claimed. "Guo knowingly breached his fiduciary duty towards the General Partnership, or in the alternative, Guo knowingly assisted the General Partnership breaching its fiduciary duty."

Lanyard, City Mortgage, and Amber are also listed as defendants in the case, with the plaintiffs alleging that they acted "recklessly or with willful blindness" by assisting the GP/Guo in obtaining a mortgage for purposes other than the partnership. Romspen, however, whose mortgage was the earliest of the five, is not listed as a defendant.

Canada Zonda International is asking the Supreme Court to declare the various mortgages and assignments of rent in favour of the lenders to be declared void, which could throw a wrench into the ongoing foreclosure proceedings.

When reached for comment, Amber's VP of Mortgage Lending Roy Ho provided STOREYS with the following statement: "Our mortgage was extended to the borrower in 2023 while there were multiple mortgages and refinancing extended against the property as early as 2018 since the property was purchased. Our loan documents and mortgage registration along with title insurance are prepared and completed by reputable law office at Lawson Lundell which provided warranty over the validity and enforceability of our mortgage as a part of our standard loan procedure."

Ho also added that if the allegations in the civil claim are proven to be true, it would also mean Guo breached his loan commitment letter with Amber, which explicitly stated that the purpose of the $2.5M loan was "to provide working capital to support development expenses" of 3771 and 3791 No. 3 Road, according to a snippet of the letter shown to STOREYS.

Lanyard Principal Brian Chelin declined to provide additional comment and City Mortgage President Rick Maysenhoelder has not responded to an inquiry STOREYS made on August 18. STOREYS also reached out to Davidson Guo's legal representative on August 18, but has also not received a response.

The Investors

In early-August, a woman who asked to be identified only as Judie M reached out to STOREYS, saying that she is one of the limited partners of 3771 No. 3 Road. She holds one unit in the partnership, with each unit having been issued at a price of $200,000, according to a Certificate of Limited Partnership she provided.

"In 2018, around March, I invested in [No. 3 Road]," she said. "At that time, Davidson advertised trying to get people to invest in the partnership to purchase a property that had a good price and then sell it within three months, or later, and profit from the difference. He said very clearly that we are not doing any development or rebuilding anything, we are just collecting the rent from the tenant and keeping the land until it sells for a good price. He said it won't be a risky investment because in real estate, if you don't sell at a lower price, then you don't lose. That's exactly what he said. And I believed in real estate and the investment. He never mentioned that he would use the property to borrow."

Judie adds that although Guo said he would host events for all the shareholders to meet one another, that never happened and the shareholders had no way of identifying or contacting one another, other than by the numbered corporations they each used to purchase and hold their shares.

A list of all the limited partners was provided to STOREYS, indicating that 48 units have been issued. With each unit having a price of $200,000, that suggests Guo was able to secure a total of $9,600,000. BC Assessment values 3771 No. 3 Road at $8,242,600 and 3791 No. 3 Road at $3,709,300, for a total valuation of $11,951,900. This valuation is as of July 1, 2023, however, while the property was purchased in cash in September 2018.

Judie says she talked to Guo about the Richmond property in late-2022 and Guo stated that there was no mortgage or debt on the property. At one point a few years ago, after having her second child, she asked Guo to buy her out of her share, but Guo refused. She said she had no idea Guo had mortgaged the properties until she saw STOREYS' article about the foreclosure proceedings.

"I'm a single mom and I don't have that much money," she said. "I'm already in tears right now. I can't afford losing this much money. He knows that."

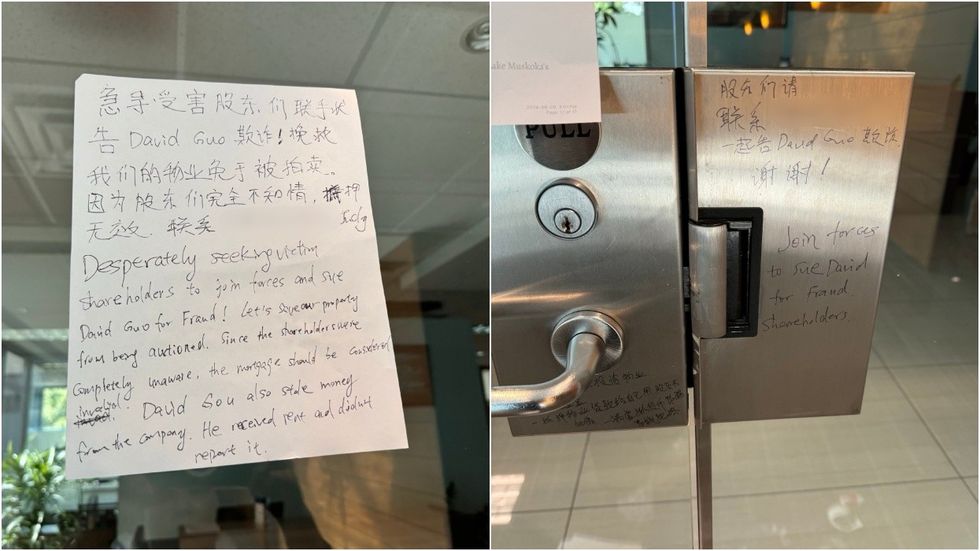

She is now planning to take legal action and visited AimForce Development's office at 311-13091 Vanier Place in early August to leave messages at their door in hopes that other investors would see it and reach out to her.

Her notes have been successful. She says she has since been in contact with seven other investors Guo recruited, all of whom had the same story: Davidson Guo sold them on investing with him to purchase and flip properties and were never aware of the mortgages at any point until the foreclosure proceedings were reported.

Judie and the seven other investors were not involved in the civil claim filed by Canada Zonda, but have since spoken to Canada Zonda's legal representative seeking to join the claim or potentially file their own claim. Aside from the aforementioned allegations, Judie claims that Guo also collected rent from the tenant of the No. 3 Road property, a used car dealership called Transparent Motorcars, that he did not report to the limited partners.

Judie says she visited Transparent Motorcars and spoke to one of their employees, who informed her that the company pays approximately $290,000 per year to lease the property and that the company also plans to seek out legal advice regarding how the foreclosure proceedings will affect them.

Critically, Judie says that not all seven of other investors she met with — they all recently met in person — were investors in the Richmond property and some were also investors in the Surrey property, suggesting that the allegations against Guo may not be limited to the Richmond property and that more trouble could be potentially looming.

Davidson Guo and Hui Meng

So, if the Richmond property was paid for in full with cash and Guo subsequently mortgaged the property, what did he do with the borrowed money?

According to the civil claim filed by Canada Zonda, Davidson Guo's wife, Hui Meng, is the registered owner of four properties. Addresses were not provided in the court filling, but STOREYS was able to identify the four properties using the Parcel ID numbers that were provided. Those four properties are:

- 302-538 Smithe Street, Vancouver

- 1205-977 Mainland Street, Vancouver

- 4182 W 11th Avenue, Vancouver

- 13805 27 Avenue, Surrey

According to BC Assessment records, the two condos in Vancouver most-recently transacted for $611,000 and $684,000, while the single-family home in Vancouver most-recently transacted for $3,150,000. All three transactions occurred in 2021.

The fourth property, 13805 27 Avenue in Surrey, is a single-family home that's also the registered address of Davidson Guo. As previously detailed by STOREYS, court servers seeking to serve Guo in the various foreclosure proceedings were unable to reach him and lenders had to apply to instead serve Guo's legal representative, Nerissa Yan of Yan Muirhead LLP. During that process, a court process server visited the Surrey home — which BC Assessment currently values at $6,068,000 — and met a woman who identified herself as Tracy and claimed that Guo had moved out of the property two years ago.

In its civil claim, Canada Zonda International claims that the mortgage proceeds "were used for the purchase, preservation, maintenance, and/or improvement of the Meng Properties" and Hui Meng is listed as a defendant.

"At the time when Meng acquired the Meng Properties, Meng knowingly, acting recklessly or with willful blindness, assisted the General Partnership to transfer/dispose of the mortgage proceeds from the Lands of the Partnership with the intent to delay, hinder or defraud the other partners of the Partnership of their just and lawful remedies."

In addition to asking the Supreme Court to void the various mortgages, Canada Zonda International is also asking the Court to allow the limited partners to pursue actions against Meng, or declare the limited partners the beneficiaries of the four properties.

"The GP and Guo's disposition of the mortgage proceeds from the lenders was a fraudulent conveyance under the Fraudulent Conveyance Act," the plaintiff claimed. "Meng was unjustly enriched by receiving the Meng Properties, which caused a corresponding loss suffered by the Partnership."

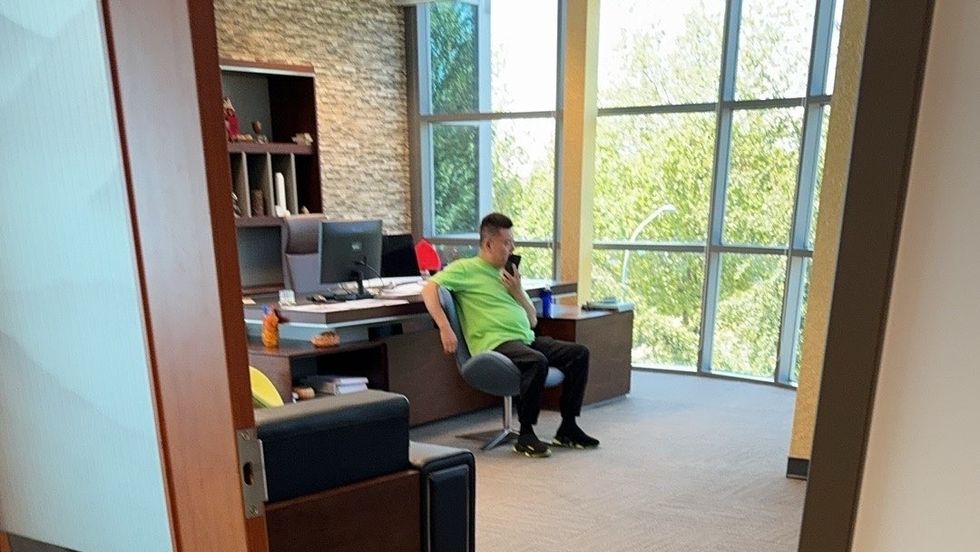

Judie says she and the other investors she met with are worried that Guo will flee the country, citing his documented attempts to evade court service. It's unclear whether or not Guo is still in British Columbia, but he was most recently seen on July 19, when Judie made an unannounced visit to AimForce's office and encountered Guo.

This is not the first time allegations have been levied against Guo.

In 2016, Sam Cooper of the Vancouver Sun reported that a company called Sun Commercial Real Estate (SunCom) owned approximately $500M in real estate in British Columbia and that the company was led by Founder Kevin Sun and CEO Davidson Guo — also known as De Xue Guo — who were both under investigation in China for their involvement in a banking scandal. It was also reported that year that Davidson Guo was listed as the director of Suncrowdfunding Holdings Ltd, a company that solicited offshore real estate investors that promised zero risk and high returns, which SunCom denied was a crowdfunding operation.

Two independent sources that have come into contact with Davidson Guo in the past, as well as several private investors in the AimForce properties, have confirmed to STOREYS that Sun Commercial Real Estate's Davidson Guo is the same Davidson Guo that went on to found AimForce.

These latest allegations also do not appear to be the last set of allegations against him.

According to Judie and the investors she met with, Guo has also been operating an app-based cryptocurrency investment scheme out of the AimForce office in Richmond that has also resulted in numerous investors losing money. Judie says she herself invested $100 USD, but was eventually paid back by Vera Pan, who is listed as AimForce's Assistant President on LinkedIn.

Judie says she distinctly remembers a conversation she had with Davidson Guo during which he made a remark she has never forgotten and has since become foreshadowing: "Vancouver is a paradise for economic crime."

If you are an investor who would like to share your experience, please email: howard@storeys.com.

- Site Of Foreclosed 67-Storey AimForce Project In Surrey Listed For $75M ›

- AimForce Development Hit By 3 Foreclosures, Including 67-Storey Surrey Project ›

- PwC Confirms BC Mortgage Broker Greg Martel Was Running $317M+ Ponzi Scheme ›

- Pusateri's Owes Creditors Over $37M, Court Documents Reveal ›

- iFortune Homes Subject Of 4 Foreclosures Across Metro Vancouver ›

- Burnaby 34-Storey Willingdon Rose Project Subject Of Foreclosure ›

- Difficulties In China Force Aoyuan To Sell Canadian Projects ›