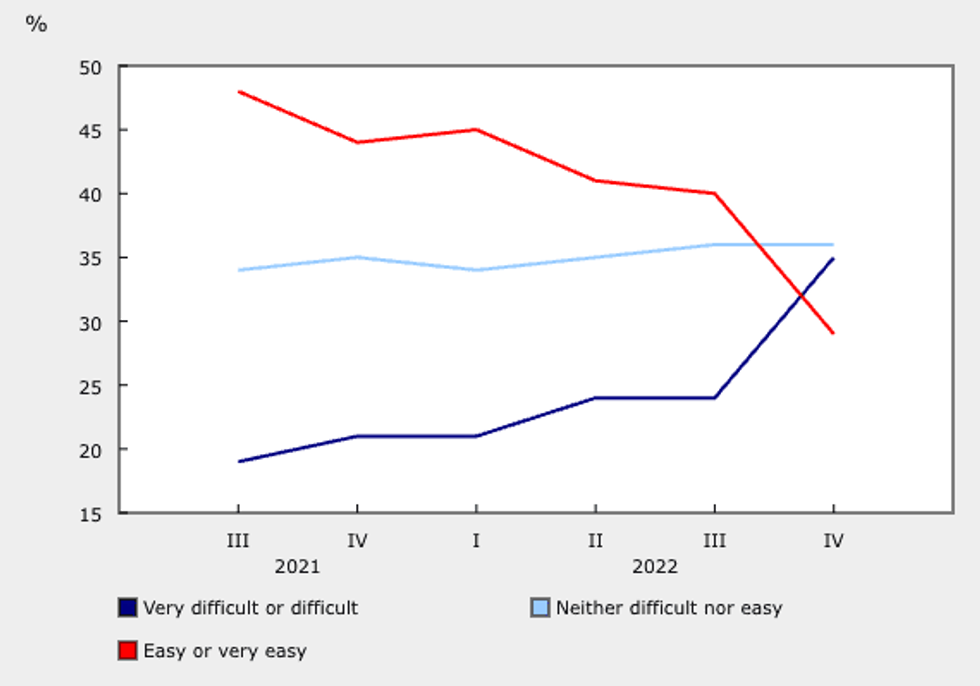

Canadian inflation hit a 40-year-high in 2022, and new data shows that consumers have been hit hard by the rising cost of food, shelter, and other essential expenses. In fact, the share of consumers reporting difficulties affording necessary expenses has edged up from 19% in the summer of 2021 to 35% at the end of 2022.

This is according to new data from the Canadian Social Survey (CSS), Statistics Canada's latest data collection project. Surveys are conducted every three months.

The latest CSS also reveals that “some segments of the population remained more likely to experience a higher degree of financial challenges.” Renters, recent immigrants, people living with children, and those looking for work were anywhere from 42% to 50% more likely to face financial hardship.

With Canada’s Consumer Price Index (CPI) clocking in at a lofty 6.8% in 2022 -- and prices of transportation, food, and shelter, rising 10.6%, 8.9%, and 6.9%, respectively -- it paints a pretty dismal picture.

“It's not unusual to have some goods experiencing above average inflation, but they’re normally not these major headline figures all happening at the same time,” says Moshe Lander, Senior Economics Lecturer at Concordia University. “I think that, unfortunately, it's kind of a perfect storm.”

Stunted wage growth, he adds, is compounding the affordability challenges at play.

“Wages haven’t kept pace with the average increase in prices, and that’s a worry for Canadians. Purchasing power has been eroded, and where it's been eroded most is on the goods and services that matter most. As inflation comes down, there's going to be this period where wages are going to need to grow faster than inflation numbers to re-establish some of that purchasing power that's been lost.”

"A Promising Sign"

It’s worth noting that inflation has slowed slightly so far in 2023, dipping to 5.9% in January. This is reason to be hopeful.

“The fact that inflation has come from above 8% to now below 6% is a promising sign. It means that those interest rate increases in 2022 are having the desired effect," says Lander. "And hopefully, it's indicative that the full impact of those interest rate increases -- when they're ultimately felt -- will bring inflation back to where it should be, where it has been for the last 30 years.”

He adds that something like CPI is indicative of a “big picture story.” What really matters is how consumers are being affected in real-time. Interest rates take around 12 to 18 months to work through the economy, and by that measure, Canadians should start to see inflation-related price pressures easing soon -- “and that would be a good sign.”

Still, when talking about bringing down inflation and restoring affordability, it comes down to managing exceptions.

“I think the misconception a lot of Canadians have is that when these interest rate increases have done their work, prices are going to go back to where they were in 2019, 2020. And that’s very unlikely to happen,” said Lander in an interview from January. “Where prices have gone up, they’re going to stay up. Inflation is the rate at which those prices are increasing.”

Home prices, for example, have been steadily increasing for most of history.

“Housing is more expensive now than it was 10 years ago, than it was 20 years ago, than it was 50 years ago,” Lander continued, adding that even if the Bank of Canada manages to get inflation down to a healthier level, home prices will likely continue to trend upwards. “I think the outcome we’re going to see is that, inevitably, prices are going to go back to increasing, on average, by only 2% a year, not by 6%.”