The MNP Consumer Debt Index dropped to an all-time low in the last quarter of 2022, following a quarterly decline that the company is calling “unprecedented.”

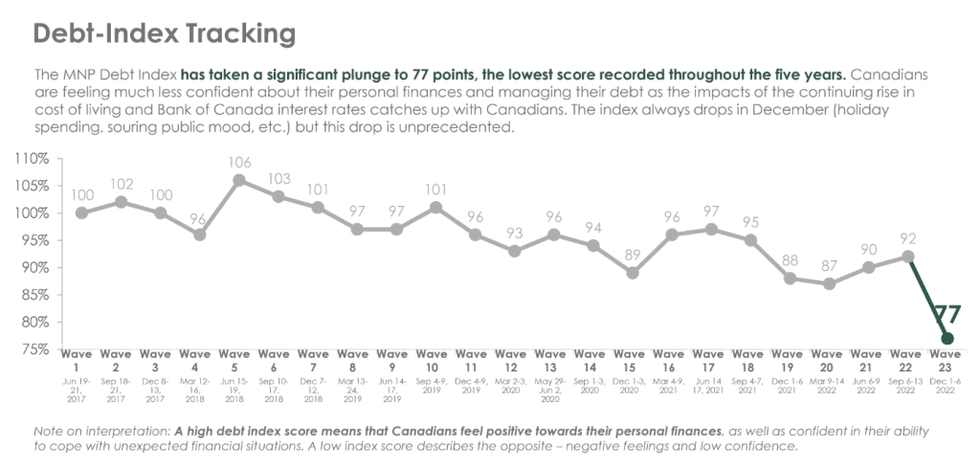

MNP LTD, Canada’s largest insolvency practice, reported that the index now sits at 77 points, down 15 points from Q3 2022, bringing it to its lowest point since the Index was created over five years ago.

Conducted quarterly by Ipsos, the index measures Canadians’ attitudes toward their consumer debt and gauges their ability to pay bills, endure unexpected expenses, and absorb interest-rate fluctuations without approaching insolvency. A lower score on the index suggests higher anxiety surrounding debt.

“The unprecedented quarterly decline underscores the anxiety Canadians feel about their debt situation amid rising interest rates, persistent inflation, and heightened affordability concerns,” says MNP.

READ: Canadian Insolvencies Reach Highest Number Since March 2020

The latest data collected by Ipsos shows that 47% -- a record high -- of Canadian respondents are concerned about their current level of debt, while 49% regret the amount of debt they’ve taken on. Both those measures are up seven points from the quarter prior. An additional 51% of Canadians are confident in their ability to cover all of their living and family expenses in the next year without going further into debt, which is down five points from the quarter prior.

“This major shift in Canadians’ attitudes towards their personal debt is a reflection of the rapidly rising interest rates and persistent inflation this past year,” says Grant Bazian, president of MNP LTD. “For many, this represents a double whammy, because inflation is eroding household budgets and, at the same time, financially fragile and overleveraged Canadians face sharply rising borrowing costs.”

The data also reveals that 68% of Canadians are already feeling the effects of interest rate increases (up 11 points since the quarter prior), with 26% saying their ability to absorb an interest rate increase of one percentage point has worsened (up nine points). A sizable 64% say that as interest rates rise they are more concerned about their ability to pay their debts (up nine points), and 59% say they will be in financial trouble if interest rates go up much more (up nine points).

Of course, the debt woes are felt differently across various demographics, with Canadians bringing in less than $40K in annual household income, and those ages 18-34 and 35-54, reportedly most concerned about the consequence of interest rate increases and their ability to repay their debts.

“Lower and some middle-income households typically spend nearly all their income each month, leaving very little wiggle room to accommodate an increase in expenses and debt carrying costs. These Canadians are struggling to maintain their standard of living, and often they resort to taking on more debt,” says Bazian.

And this reality is certainly already being realized among Canadian consumers, with 26% saying they have paid only the minimum balance on their credit card (up five points since December 2021), 18% saying they have borrowed money they can’t afford to pay back quickly (up seven points), and 17% saying they are paying the minimum balance on a line of credit (up six points).

Meanwhile, 21% say they will tap into savings to pay off bills, 14% say they will use credit cards to pay their bills, 13% say they will borrow from friends or family to pay their bills, and 36% say they plan on reducing their consumer expenses to make ends meet.

“More individuals are being forced to make tough financial decisions to try to stay afloat,” continues Bazian. “Unfortunately, taking on more debt can have lasting financial impacts and push some into a debt spiral. These kinds of financial struggles often trigger stress and anxiety which can have a significant impact on mental health.”

On a slightly less disparaging note, the number of Canadians reporting they are $200 away or less from not being able to meet all of their financial obligations held relatively steady since the quarter prior, at 45%. This includes 30% (also unchanged) that report not making enough to cover their bills and debt obligations.