Toronto-based real estate investment and asset management firm Starlight Investments is continuing to grow its portfolio in British Columbia, buying a multi-family property out of distress, according to filings in the Supreme Court of British Columbia.

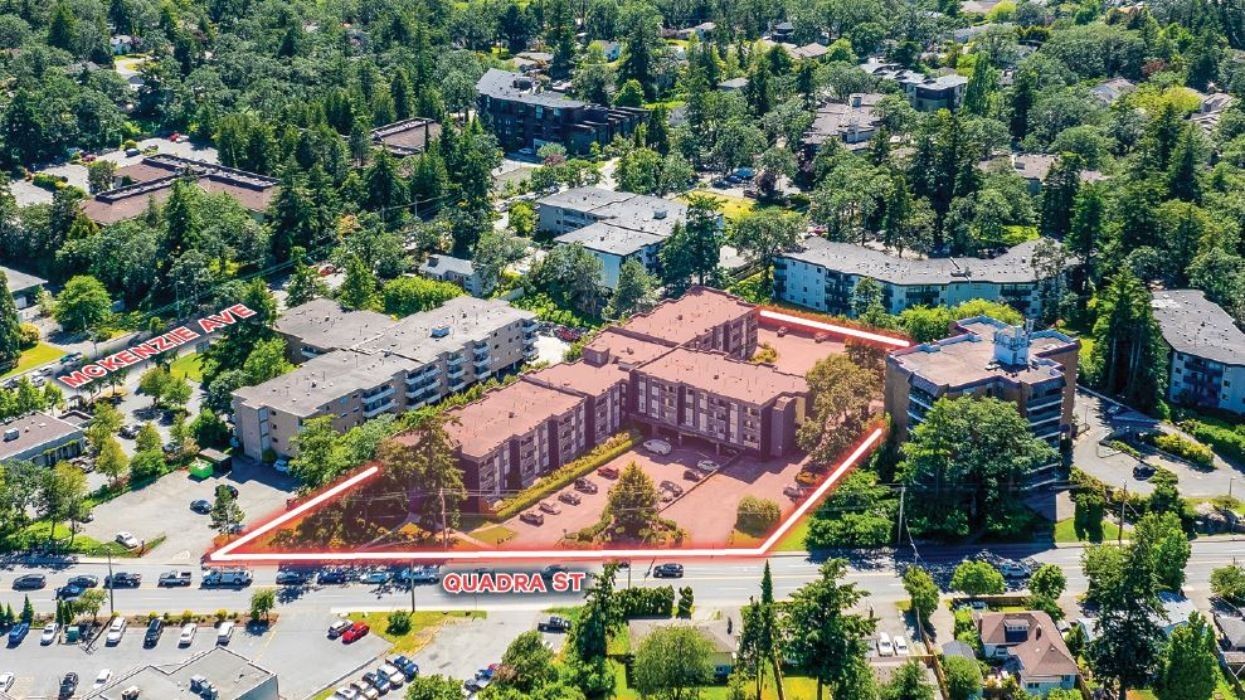

The property is the 87-unit rental building located at 4026 Quadra Street, near McKenzie Avenue, in Victoria. The four-storey building was originally constructed in 1977, according to BC Assessment, which values the property (as of July 1, 2023) at $28,931,000.

The property was previously owned by Asfar Holdings Ltd. and Irene Asfar when it was placed under receivership on March 26, 2024 at the request of RBC Investor Services Trust, the asset management firm of the Royal Bank of Canada. According to court documents, RBC Investor Services Trust was owed $11.7 million, while First Island Financial Services Ltd. held a second-ranking mortgage of $6.6 million, and two individuals held the third mortgage.

The court-appointed Receiver, MNP Ltd., subsequently retained CBRE in June to list the property. The listing team consisted of Ross Marshall and Chris Rust of the Investment Properties Group in Victoria along with Cartner Kerzner and Tony Quattrin of the National Investment Team in Vancouver.

In its sales brochure, CBRE noted that the property carries high-density redevelopment potential and had 10 vacancies as of June.

During the sales process, an appraisal of $24,150,000 dated July 4 was received from Victoria-based D.R. Coell & Associates.

A total of 30 parties showed interest, with 23 progressing to the point of signing confidentiality agreements, and four ultimately touring the property. CBRE then returned in August with three bids with varying conditions: a $21 million bid, a $21.6 million bid, and the $21.75 million bid from Starlight Investments.

According to the Receiver, the bid from Starlight Investments was chosen because it had both the highest purchase price and least amount of time required for closing. The $21.75 million bid was enough to fully pay off all three mortgages, with a surplus of $2.6 million.

Just prior to the court hearing on September 24, however, a sealed bid was submitted by Upfield Capital Acquisitions, co-founded by Edgar Development's Peter Edgar, which prompted a sealed bid from Starlight in response. Those bids were ultimately unsealed and revealed to be $22.5 million and $22.75 million.

Because of the small margin between the bids, the Receiver ordered another round of sealed bids, with Upfield Capital coming in at $23.05 million and Starlight Investments coming in at $23.53 million.

According to the Receiver, a third party called Altair EQ Properties Ltd. submitted a bid of $24.1 million, but the offer included no initial deposit, was subject to financing, and had a subject removal deadline of October 31.

Against the various objections of Asfar, the owner, the Supreme Court approved the sale to Starlight Investments and the transaction has since closed, with Starlight now owning the property under 4026 Quadra Apartments Ltd. according to BC's Land Owner Transparency Registry. The 4026 Quadra Street Apartments is now being managed by Devon Properties, which Starlight has retained on several past occasions to manage its properties in Victoria.

- Starlight Selling 40-Storey Aqua Tower In New West Just 4 Years After Acquisition ›

- The Lauren, Developed By Westbank And Peterson, Sold To Starlight ›

- City of Victoria Approves Starlight's 1,500-Unit Harris Green Village Project ›

- Starlight & BGO Buy Pickering Rental For $127M In Largest Q4 Multi-Family Deal ›