[Editor's Note: On April 15, Vancouver City Council approved the new Hotel Development Policy and other recommended changes, with an amendment to exempt amenity and back-of-house space from CAC calculations.]

After several delays, the City of Vancouver has finally come up with a series of policy changes that it hopes will address Vancouver's well-documented shortage of hotel rooms.

The proposed changes come as the result of a motion introduced in Fall 2023 by Councillor Sarah Kirby-Yung — who worked in the hospitality sector prior to entering politics — entitled "Addressing the Hotel Supply Gap to Support Tourism Economy and Reduce Pressure on Local Housing." Staff were originally set to return with policy recommendations in Q1 2024, but that was delayed until Fall 2024, before finally being unveiled this week.

Although developers were perhaps hoping for incentives or financial assistance, the new Hotel Development Policy is looking to address the problem through zoning changes. Those changes are:

- Enabling consideration of mixed-use hotel and residential developments on key sites in the Central Business District;

- Enabling consideration of hotels on Broadway Plan sites with narrow frontages in non-residential areas;

- Enabling consideration of additional density for 100% hotel developments on sites zoned C-1, C-2, C-2B, C-2C, C-2C1, or adjacent CD-1s, with density up to 3.50 FSR and 3.70 FSR for corner sites;

- Enabling consideration of additional density on sites with existing hotels to expand room count; and

- Enabling consideration of additional density for hotel projects that advance the City's UNDRIP commitments and reconciliation goals.

"Industry has advised that the walkability of the downtown core is a major competitive advantage for Vancouver's hotel sector and that continued growth of hotels in the CBD is important for the city's long term economic development," staff noted in their recommendations report. "While there are examples of recent hotel developments in the CBD, industry has advised that these developments can be difficult to finance in the current environment due to limited direct sources of capital for hospitality projects. The inclusion of a residential component in a project can help to support financial viability, particularly with larger developments."

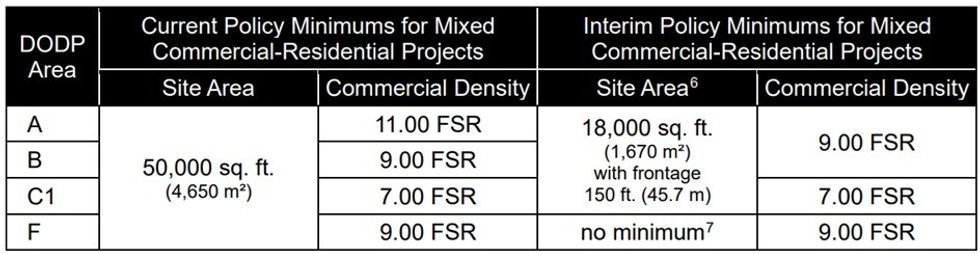

For the CBD, staff are recommending a temporary three-year period during which the minimum site size required for mixed-use developments is reduced or removed (depending on location), which they say will incentivize hotels on mid-sized development sites while preserving the ability for smaller sites to deliver 100% commercial developments.

Staff say they are recommending a period of three years because it allows developers to go through the entire process of a rezoning enquiry, site acquisition, rezoning approval, and development permit approval.

The other recommended changes are more minor and were not discussed in detail by staff in the report, but the new Hotel Development Policy also encourages conversions of existing office buildings or strata buildings into hotels, on any site where zoning currently permits hotel use. Partial conversions will also be allowed, as long as office/strata space is not located on the same floor as the new hotel space.

Office-to-residential conversions have been very successful in Calgary, but have not really taken off here in Vancouver. However, Vancouver has started seeing a few office-to-hotel conversions recently, including the recently-announced conversion of 1111 W Hastings by Reliance Properties and Germain Hotels.

The Current State of Hotel Development

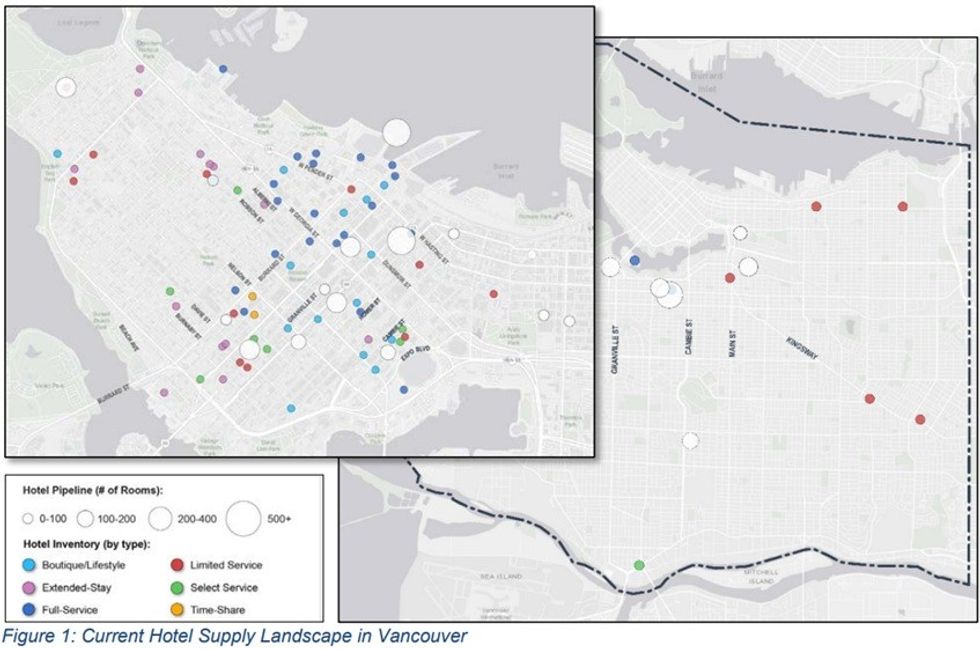

The new Hotel Development Policy comes in the same week where Destination Vancouver — formerly known as Tourism Vancouver — published a new report on the state of the hotel sector.

"Vancouver hotels are operating at near full capacity, with 80% average annual occupancy and up to 95% during peak seasons —well above rates in peer cities," said Destination Vancouver in a press release. "The lack of new capacity makes it increasingly difficult to attract major conferences and marquee events and meet visitor demand."

They also noted that Vancouver saw a net loss of hotel rooms between 2002 and 2022, as a result of hotel closures or conversions into supportive housing, and that only 12 new hotels have been built during that same period. To meet that goal, Destination Vancouver recommended that development cost charges (DCCs) be deferred, transit-oriented areas (TOAs) be pre-zoned for hotels, creative solutions for parking and loading to be allowed, residential developments to be paired with hotels, and strategic partnerships be built to reduce risk and boost demand.

Vancouver needs 10,000 hotel rooms by 2050 to keep up with growing demand. Reaching that target would bring 5,450 direct hospitality jobs, 8,000 indirect jobs to other sectors, $125 million in municipal tax revenue, and $78 million in provincial tax revenue, said Destination Vancouver.

Over the last three or so years, Vancouver has seen a handful of notable proposals for new hotels, with many developers citing the urgent need for hotel rooms ahead of the 2026 FIFA World Cup. However, almost none of those proposals have come to fruition yet and likely will not be available in time by then.

Hotel projects that are currently in the pipeline include: a 30-storey hotel at 848 Seymour Street by Paul Y. Construction (BC) Ltd., a 32-storey mixed-use hotel at 516-534 West Pender Street and 509 Richards Street by Marcon, a 33-storey hotel at 717 Davie Street by Deecorp, the Listel Hotel redevelopment at 1300 Robson Street by Bosa Properties, a two-tower hotel development at 888 W Broadway also by Bosa Properties, and a 29-storey hotel at 2030 Barclay Street again by Marcon, among others.

Although hotel development brings its own set of challenges, developers of commercial space have become more interested in hotels, as previously reported by STOREYS, now that the office market has seen a downturn that may last for several more years.

The new Hotel Development Policy and recommended policy changes will be considered by Council on Tuesday, April 15, after which the focus will be on whether those changes move the needle.