Different generations tend to have varying views on things, but it appears they have similarly sunny outlooks on the state of Canada’s real estate market.

Sotheby’s International Realty Canada and The Mustel Group surveyed 2,000 Canadians from the Vancouver, Calgary, Toronto, and Montreal Census Metropolitan Areas (CMAs) to gauge their views on the state of Canada’s real estate market. The first-of-its-kind report reveals confidence in the market by generation.

The 2023 Canadian Real Estate Market Sentiment: Generational Trends Report compared the relative confidence levels of baby boomers (ages 58–77), Generation X (ages 43–57), millennials (ages 27–42) and Generation Z adults (ages 18–26) as it relates to the current housing market, examining changes in consumer sentiment and housing mobility aspirations since January 2020.

Overall, Canadians seem optimistic, despite the current climate of sky-high interest rates and largely unattainable home prices. According to Sotheby’s experts, the appeal of primary home ownership has only increased with the stock market’s tumultuous volatility as Canadians seek alternatives for protecting their financial security.

“Results from the Mustel Group/Sotheby’s International Realty Canada survey reinforce the fact that confidence in the country’s real estate market remains resilient despite recent shifts in market conditions,” says Josh O’Neill, General Manager of Mustel Group.

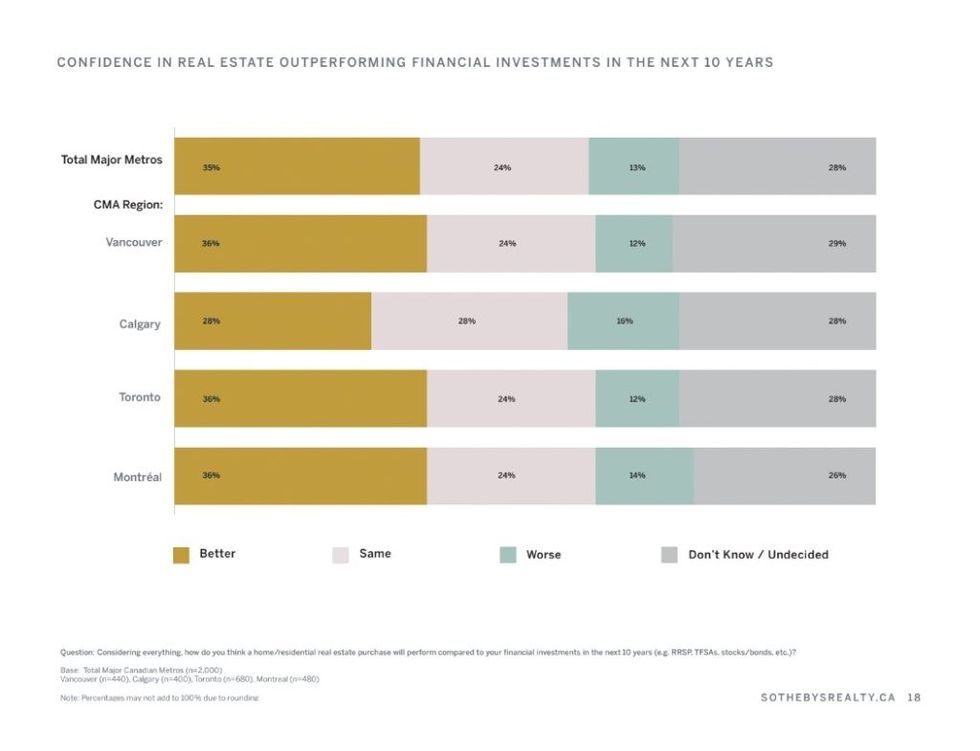

According to the report, confidence in the performance of real estate over the next 10 years is high across all major metropolitan areas, with six in 10 (60%) urban Canadians between the ages of 18-77 years believing that a home or residential real estate purchase will perform the same or better than their other financial investments in the next decade. One in three (35%) believe real estate will perform better.

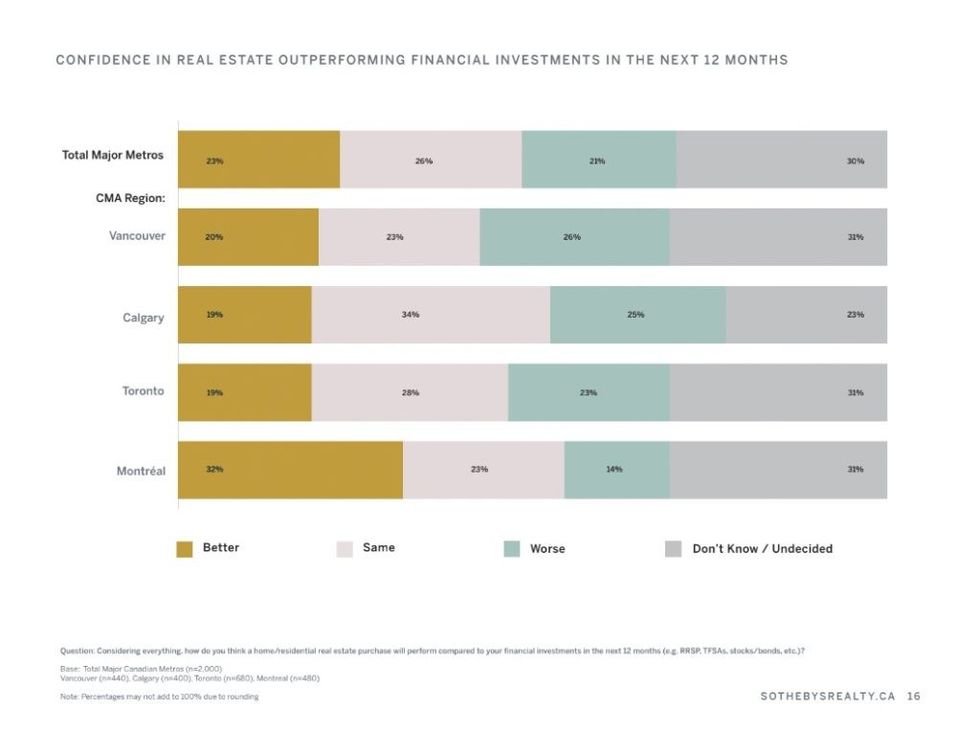

Nearly half (49%) believe that a home or residential real estate purchase will perform the same or better than their financial investments in the next 12 months, including 1 in 4 (23%) who believe that real estate will perform better.

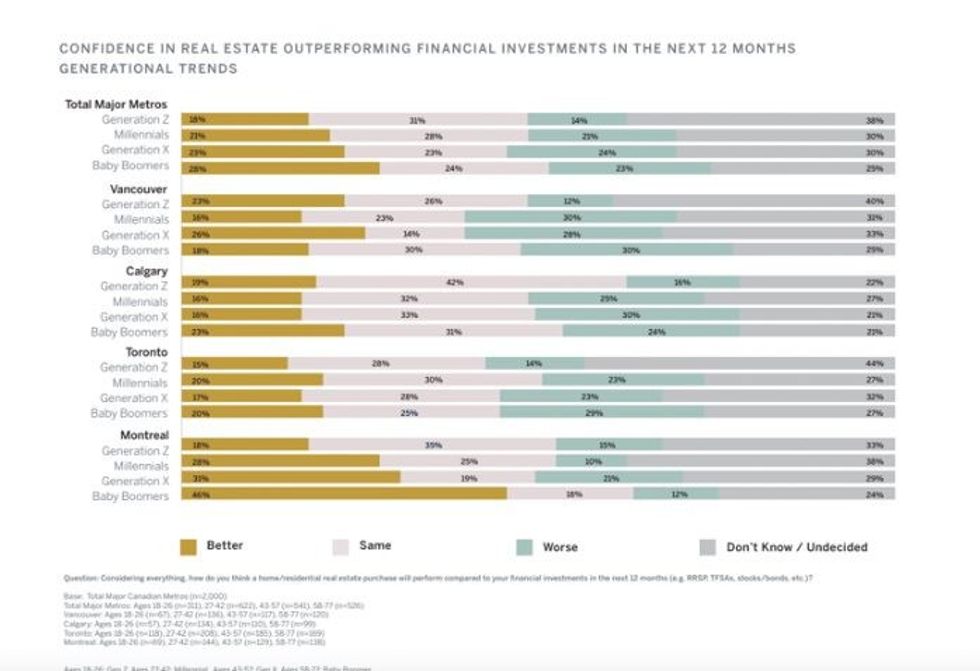

Overall, across all markets, baby boomers are the most likely generation to believe real estate will outperform their financial investments within one year, as well as within 10 years, with 28% and 44% doing so, respectively. Meanwhile, 34% of Generation X respondents believe that real estate performance will surpass their financial investments’ performance in this time frame, while 26% believe performance will be on par. Similarly, 32% of urban millennials expect a home or real estate purchase to outperform other financial investments, while 27% believe performance will be the same. Finally, 30% of urban Generation Z adults expect real estate to outperform their financial investments in the next 10 years, while 25% expect performance to be the same.

Somewhat surprisingly, one in three (35%) urban Canadians between the ages of 18-77 are now more likely to buy a home in the next five years as compared to their intentions in January 2020 before the COVID-19 pandemic -- something that served as a catalyst for soaring home prices from coast to coast. This finding is relatively consistent across all metropolitan areas and generations surveyed, highlights the report. This includes 12% who are “much more likely” to buy.

“One of the most transformative and enduring social and economic outcomes of the pandemic is that Canadians now place a heightened importance on primary home ownership, not only as an investment in their lifestyle and personal security, but as an investment in their financial future,” says Don Kottick, President and CEO of Sotheby’s International Realty Canada.

“Even though Canadians are now confronting the challenges of steep interest rate hikes, rising inflation, mounting economic uncertainty and significant housing affordability concerns, the results of the Mustel Group and Sotheby’s International Realty Canada survey reveal that confidence in our real estate market remains high, and that demand for housing and housing mobility across every generation is more pressing than ever.”

One in three (35%) of urban Canadian primary homeowners between the ages of 18-77 are more likely to sell a home within the next five years compared to their intentions in January 2020, including 14% who are now “much more likely” to sell.

Tellingly, the pandemic has had the least influence on Generation X and baby boomers’ likelihood to buy or sell, with more than four in 10 (41% and 44%, respectively) reporting no change in their propensity to buy compared to January 2020 and another four in 10 (43% and 42%, respectively) reporting no change in their propensity to sell.

As it turns out, millennials are staying put. Urban millennials are now less likely than Generation X and baby boomers to sell their primary residence in the next five years compared to pre-pandemic, with 32% reporting a reduced propensity to sell, compared to 21% and 23% amongst Generation X and baby boomers, respectively.