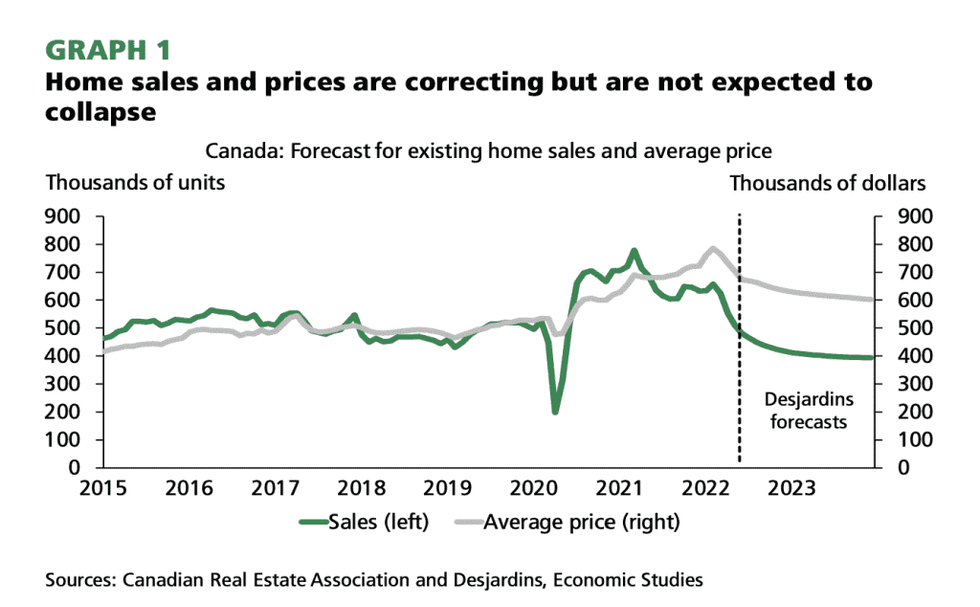

Lacklustre economic data, along with tumbling home sales and prices, have led a Canadian bank to release an even more bearish outlook on the housing market, calling for a 23% decline in the average home price between February 2022 and December 2023.

Written by Desjardins Principal Economists Hélène Bégin and Marc Desormeaux, and Senior Director of Canadian Economics Randall Bartlett, the updated residential real estate outlook calls for deeper price pain than the 15% decline the bank initially forecasted at the start of the summer.

“Canada’s housing market is correcting quickly, and faster than we anticipated in our downbeat June forecast,” reads the report.

“At the time, we expected the average home price to fall by 15% nationally from its February 2022 high to the end of 2023. But we’re almost there already. We now expect home prices to fall between 20% and 25% from peak to trough. On an annual basis, that would mean a price increase of 1.2% in 2022 followed by a 11.5% contraction in 2023.”

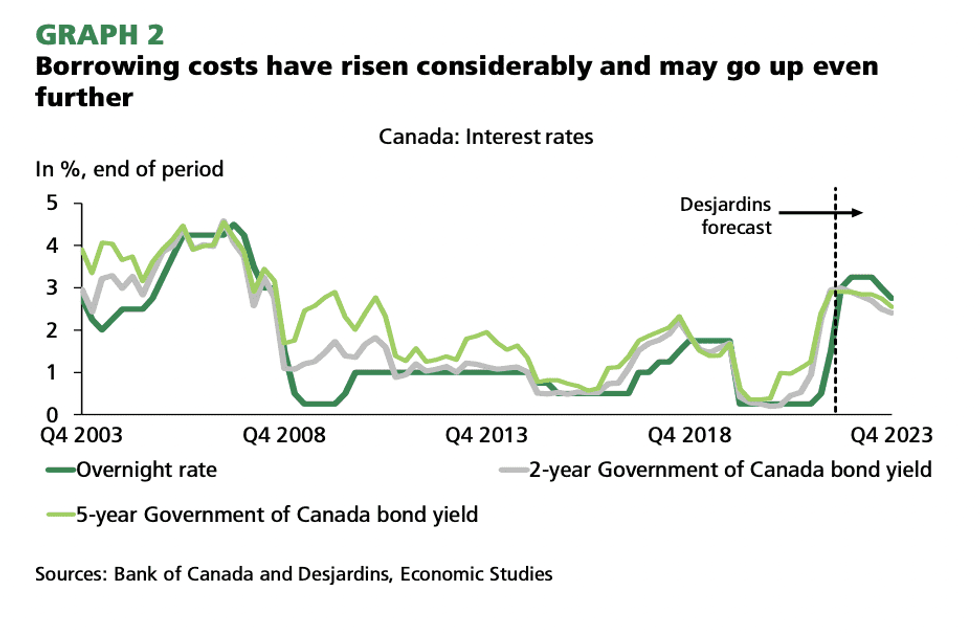

The bank points to weaker data and higher interest rates for its increasingly gloomy outlook. It now expects the Bank of Canada to increase its Overnight Lending Rate from the current 2.5% to 3.25% later this year, before pivoting to a rate-cutting strategy next year as the economy experiences a downturn.

“Markets seem to be predicting this already as bond yields have likely peaked,” reads the report.

Recent market reports, both at the local and national level, have revealed market price growth is stalling. The July numbers from the Toronto Regional Real Estate Board reported year-over-year aggregate price growth of just 1.2% in July following a 47% decline in sales -- the smallest annual price increase since April 2020. While prices have been stickier in Metro Vancouver, up 10.3% YoY, a 40% sales drop has pulled the benchmark down 2% from June.

However, says Desjardins, despite the fact that home prices have dropped more than 4% in each of the three months through June, they'll still end next year above pre-pandemic levels.

“After peaking in February at the national level, home prices continue to fall and have further to go before they find a bottom. That said, we still believe home prices will end 2023 above pre-pandemic levels nationally and in all 10 provinces,” reads the report.

Sales activity, meanwhile, “may not be so lucky,” with steep declines in Canada’s biggest provinces, with some smaller provinces hot on their heels. Just Quebec and the Prairies are set to outperform their provincial peers, given their greater overall affordability and less volatile market conditions. However, Desjarins points out, the pace of sales moderation has calmed since its initial plunge in April, and should continue to stabilize through to the end of next year.

READ: GTA Home Sales Haven’t Dropped This Drastically Since 1990

The bank says provinces that experienced the biggest gains during the pandemic have the farthest to fall, calling for the most substantial price declines in New Brunswick, Nova Scotia, and Prince Edward Island. These markets saw a considerable influx of migrating homebuyers during the pandemic, as remote work arrangements made it possible to relocate to cheaper markets. As more workplaces have rolled full-time telecommuting back to a hybrid work structure, though, that flow of buyers has dried up.

Ontario and BC are experiencing the most abrupt corrections, as affordability was already at an all-time low in these markets; it has only deteriorated more since, following price spikes in suburban and rural communities across those provinces. Those corrections will slow with time, says Desjardins, as international immigration picks back up and buyers return to the market, drawn by recent price softening and improved affordability.