Thus far, Toronto’s spring housing market is looking much the same as last, with just one less home changing hands at 7,187 sales, compared to the 7,188 recorded last year. That’s kept the average GTA home price in a stable territory, rising just 0.5 per cent from the same month in 2018 to $788,335.

READ: Toronto Is One Of The Worst North American Cities For Affordable Housing

As is typical, activity and price growth differed between the City of Toronto proper – including North York, East York, Old City of Toronto, and Etobicoke homes for sale - and the surrounding 905 markets. Toronto home prices rose 1.5 per cent to an average of $830,043, though the pace of home sales was down more drastically by 8.5 per cent over the course of the month. In contrast, the 905 is actually enjoying a robust uptick in sales, following months of languishing activity; they’re up 5.3 per cent, with prices increasing 2.6 per cent to $765,469, indicating strengthening demand for segments such as Mississauga homes for sale.

Too Little Supply to Meet Demand

The Toronto Real Estate Board, however, continues to be concerned about the lack of inventory coming to market. As has been a growing long term trend, sellers have held off amid fears of a slowing market, in turn putting pressure on buyers. According to the March data, the number of new listings fell 5.1 per cent throughout the GTA, outpacing the decline of lacklustre sales. That’s pushed the sales-to-new-listings ratio, which measures the level of competition in the market, for the region to 51 per cent, signalling an overall balanced market.

READ: Spring Housing Market Predictions: What To Expect In Toronto

“Market conditions have remained tight enough to support a moderate pace of price growth. Despite sales being markedly lower than the record levels of 2016 and early 2017, the supply of listings has also receded,” said Jason Mercer, TREB’s chief market analyst. “This means that in many neighbourhoods throughout the GTA, we continue to see competition between buyers for available listings, which provides a level of support for home prices.”

The Stress Test Continues to Cramp Mortgage Borrowers

Slower home sales are largely due to a decline in qualified mortgage borrowers, as a result of the steeper stress test introduced last year by the national banking regulator. TREB, along with other real estate boards and policymakers, has been lobbying governments at all levels for this tougher criteria to be reviewed, arguing it has been too aggressive an approach.

“The OSFI stress test continues to impact homebuyers’ ability to qualify for a mortgage. TREB is still arguing that the stress test provisions and mortgage lending guidelines generally, including allowable amortization periods for insured mortgages, should be reviewed,” said TREB President Garry Bhaura.

READ: TREB Calls For A Review Of Mortgage Stress Test As Home Prices Rise

He adds that, in Toronto, restrictive zoning rules continue to limit the types of housing that can be built, which is further exacerbating the supply issue that has plagued the city in recent years.

“The supply of listings in the GTA also remains a problem. Bringing a greater diversity of ownership and rental housing online, including ‘missing middle’ home types, should be a priority of all levels of government,” he says.

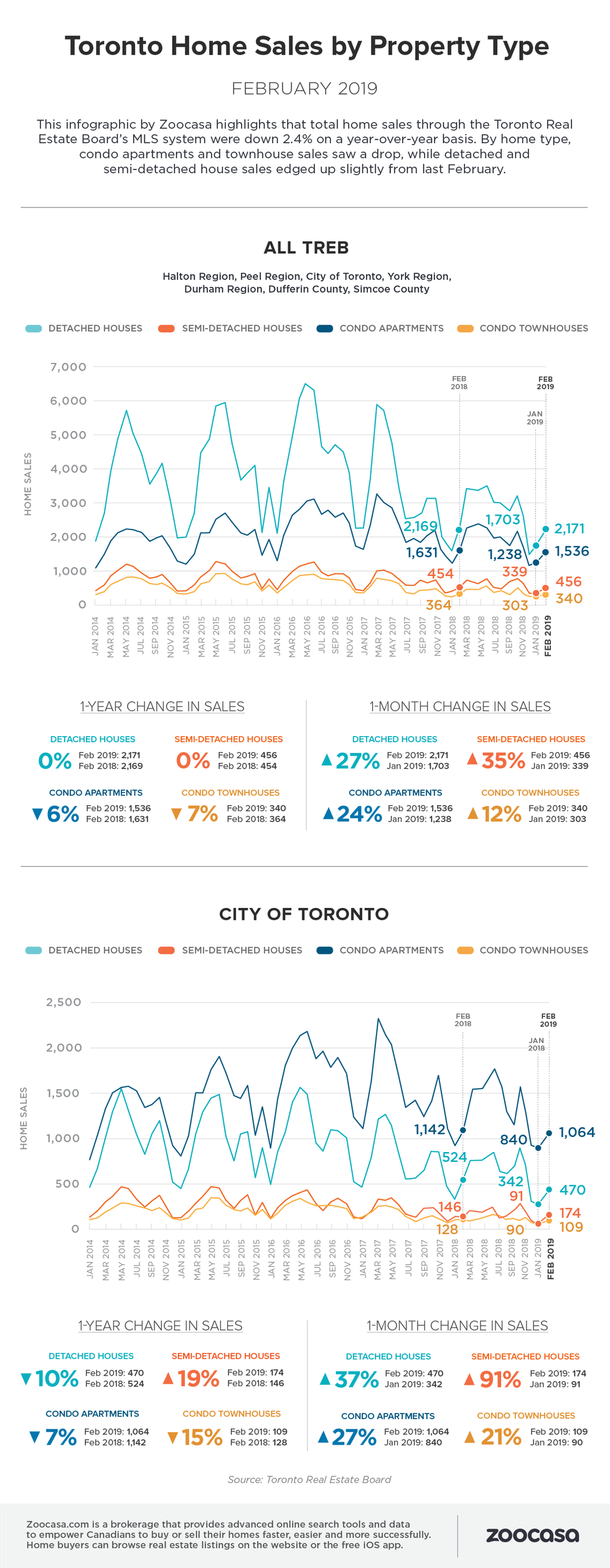

Check out how home prices have changed year over year in March in the 416 and GTA, in the infographic below: