Last month, economists at the Bank of Montreal released a report on Canada’s “affordability conundrum” that delivered some sobering news for anyone paying attention.

Despite “a significant price correction” across most of Canada, affordability remains elusive -- and is unlikely to gain traction any time soon. The authors also underscored their long-held position that more housing supply will not be the fix we need to address the housing crisis.

So instead of asking when we might see market housing become affordable again, is it time to ask -- at least in certain urban markets -- if it’s time to accept high prices as the new normal? If we accept that reality, say some experts, then we can have an honest discussion about the need for subsidized housing and alternative forms of ownership, and acknowledge that any additional market supply will not reduce prices.

After all, even when we do see price drops in Vancouver and Toronto, they are negligible, not near enough to resume the affordability of a decade ago.

The general rule is that housing is affordable when it accounts for no more than one-third of one’s gross income. On June 1, the National Bank of Canada released its quarterly affordability monitor, which showed mortgage payments as a percentage of one’s income had reached nearly 61% nationwide in the first quarter. That’s a drop of 3.2% from the previous quarter, which doesn’t seem like much. And it comes after having reached the most unaffordable level in more than 30 years.

Mortgage payments as a percentage of income in Vancouver are at 95% and 83% in Toronto, far above the historic average for those cities. In Vancouver, where the median home price is $1,192,356, that’s a down payment of $238,471 and 340.8 months of saving for it. The annual income required is $242,045 and the monthly mortgage payments are $6,643.

In Toronto, the median home price is $1,137,570 and a down payment of $227,514 takes 297 months to save. That requires an annual income of $230,923 in order to cover the mortgage payments of $6,338.

“I think unfortunately we are always going to have a situation now where even people of average income are going to really struggle, and people of lower income will only be able to be housed through government subsidies and assistance,” says Vancouver developer and real estate consultant Michael Geller.

“The more I read about people working in restaurants and people earning minimum wage, I wonder how they manage. It really is quite disturbing.”

Clay Jarvis, mortgage and real estate expert for personal finance company NerdWallet, says the country has painted itself into a corner where home prices are concerned.

“We’re dependent on real estate for driving both GDP and personal wealth in this country, so if some silver bullet policy magically brought home values back to where they were in 2013, we’d be looking at pure economic carnage,” he says.

The BMO report explains unaffordability as a conundrum, which is why supply can’t fix it. Any time prices actually do drop and profit margins get narrower, developers have less incentive to build (that scenario is playing out in Vancouver). Meanwhile, the development industry can’t keep up with increased domestic demand and record-level immigration, so it’s seemingly impossible for the industry to keep pace.

“While most argue for a supply-side fix, our longstanding view has been that it’s wishful thinking to believe that an industry, already running at full capacity, can double output in short order, flood the market with new units and bring prices and rents down,” say the report’s economist authors.

“They are basically suggesting this booming population meant to ease labour markets is putting pressure on the housing market because supply can’t keep up,” Realosophy President John Pasalis told his audience at his monthly live talk on Thursday. “They [BMO] had this fantastic chart that looked at price growth -- the real house price appreciation relative to the population growth across different countries and they found a clear pattern. Canada, Australia, New Zealand and countries that have the most booming populations are also seeing the most rapid appreciation in house prices. And countries where population growth is slow -- Japan and Italy are at the lowest end -- are not seeing much growth in home prices. So there’s definitely a relationship. And they argue a 1% increase in population growth leads to a 3% increase in house prices. If we are at 2% in population growth, that’s 6% growth, and the reason it’s very hard for the construction sector to keep up with the boom.”

Pasalis said afterward that high home prices and rents are a trend that’s difficult to reverse, and politicians likely don’t have much interest in trying.

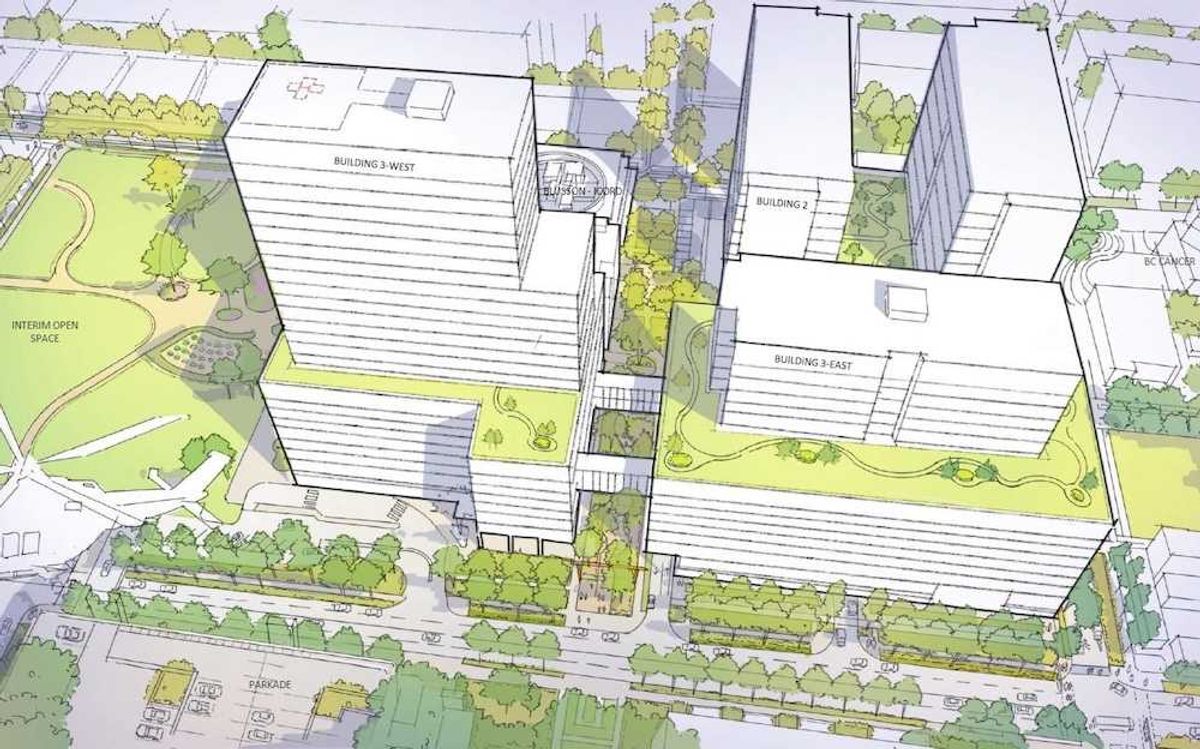

So instead of wondering when home prices might drop, it might be time to look for ways to negotiate the rough terrain. Geller believes that there will soon be a return to models that are in line with the sharing economy, popular with the tech industry.

We will look to the old-fashioned equity co-op, where residents own shares in a building and lease back the units. The model is a precursor to strata condos and is less pricey because there are restrictions, New York style. There’s also co-ownership, whereby separate parties own principal residences together.

Alex Hemingway, senior economist and policy analyst at Canadian Centre for Policy Alternatives, refuses to surrender to unaffordability as a way of life. He believes that we could follow Auckland, New Zealand’s model and densify low-density zones while adding significant public housing for low-incomes. He’s still a believer that more supply could at least cause rents to flat line until affordably priced housing gets built.

“Do we have to give up? No we don’t. Significant citywide upzoning has been a rarity and yet there is lots of theory and evidence it would be good idea -- but [we] haven’t seen it happen. Maybe we will soon.

“A striking example is Auckland. They did significant citywide upzoning back in 2016 and the results are quite impressive. They played out exactly how the theory would predict a significant increase in housing supply and as a result, and most importantly, rent growth slowed down substantially. If adjusted for inflation, rents in Auckland where upzoning happened are lower now than in 2016. Which is not the trajectory of other cities in New Zealand.”

Jarvis believes it will take a lot more than zoning changes to turn the affordability crisis around. He sees major disruption as the only way out, such as targeting investors who are buying up properties to take advantage of high rents. Investors compete with first-time buyers because they focus on entry-level condo units.

Earlier this year, a Statistics Canada report showed that nearly one in five properties was used as an investment in BC, Ontario, Manitoba, and Nova Scotia combined.

Jarvis suggests temporarily limiting the number of properties an individual can own or raising the down payment requirements for buyers with more than one secondary property.

“Either strategy would reduce competition and ensure housing wealth isn’t concentrated among people who already own homes. But what politician is going to suggest something that would be so unpopular with wealthy voters, developers, and real estate companies?” he asks.

“Our housing market is like a person who hasn’t gone to the dentist in 20 years. The time when a little fluoride and floss would have kept things healthy is long gone. The only way forward now is serious, potentially painful intervention. If we really want to provide housing that first-time buyers can afford, we’re going to have to fire up the drill.”