There are three main factors that drive housing bubbles: rampant speculation, limited housing, and lowering rates. So, it's no surprise that Toronto just ranked fifth in the world for being at risk of a housing bubble, according to the 2024 UBS Global Real Estate Bubble Index report.

Nestled in behind Miami, Tokyo, Zurich, and Los Angeles, Toronto is described as facing an "elevated" risk of experiencing a housing bubble. But, globally, the risks of housing bubbles are on the decline for the second year in a row.

In a housing bubble, homes are priced high above their actual value — and above incomes and rents — creating a situation where most people cannot afford the average home and, ultimately, the bubble bursts. In Toronto, though home prices remain "far from sustainable at prevailing interest rate levels," according to the report, they have declined by around 10% year-over-year, in real terms.

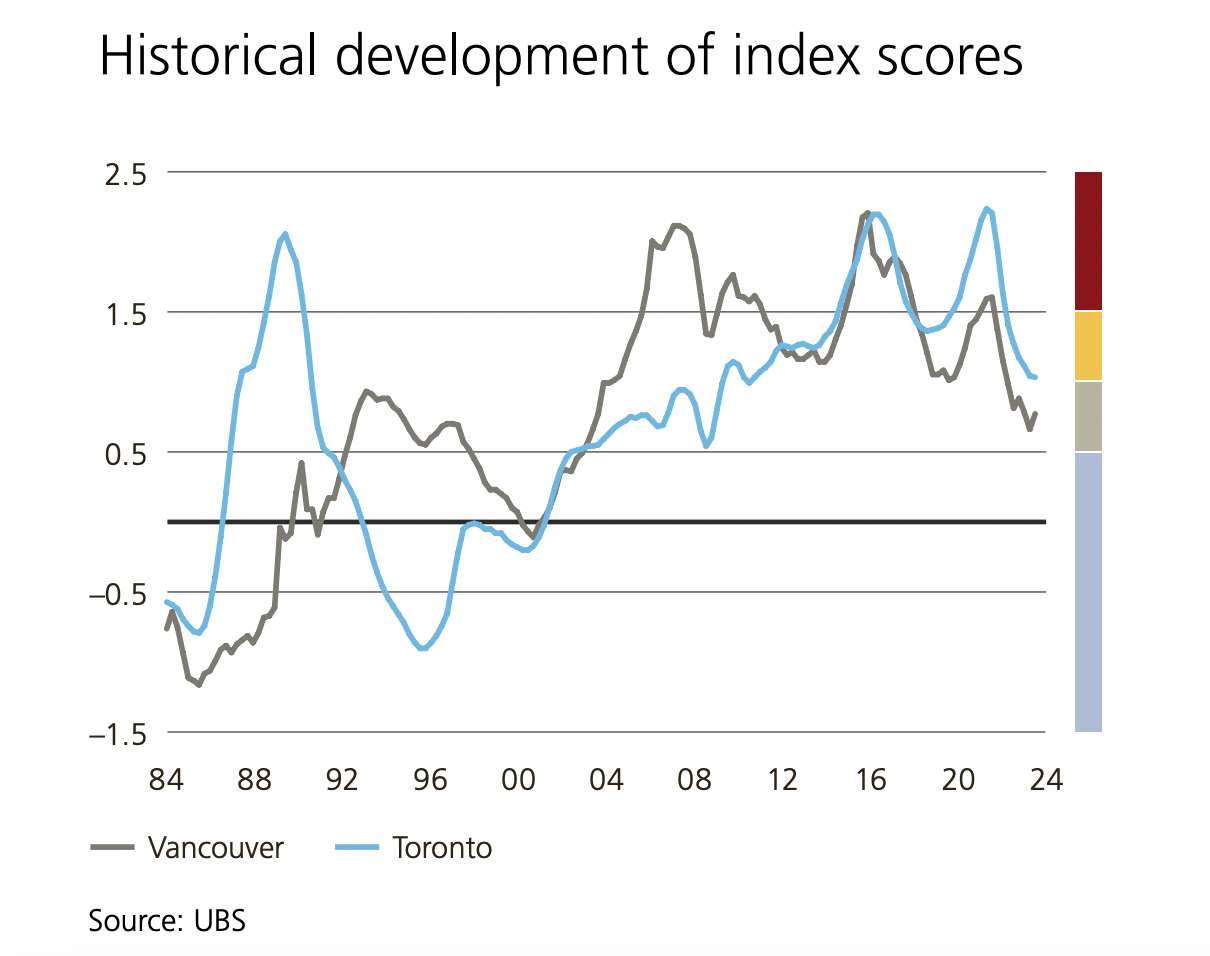

The decline follows a more than 20-year national trend of strong population growth, attractive financing conditions, high investment demand, and limited supply, which gradually drove Canadian home prices up to record highs between 2002 and 2022. But due to high inflation since 2022, imbalances in the national housing market have been reduced.

Toronto's housing bubble score ticked down from 1.21 in 2023 to 1.03 in 2024, though slower rent and income growth, compared to cities like Vancouver, have kept the city in "elevated" risk territory.

According to the report, it would take a skilled service worker in Toronto an average of six years to buy a 650 sq. ft apartment near the city centre, but it would take 25 years to pay for the apartment in rent payments. The report calls this phenomenon a high price-to-rent ratio — the result of "an excessive appreciation of housing prices in the wake of previously low interest rates." On a global scale, leading the pack is Zurich, where it would take you north of 40 years to pay for an apartment in rent payments.

And with interest rates on the decline again in Canada, the report predicts anticipated interest rate cuts are likely to accelerate price growth in both Toronto and Vancouver again, as "demand from particularly interest-sensitive first-home buyers increases." But interestingly, the report also predicts that the foreign buyers ban, increasing inventories, and a subdued economic outlook could dampen an otherwise abrupt real estate boom.

- Feds Introduce Two Substantial New Mortgage Reforms ›

- Inflation Cools To BoC Target, Igniting Calls For 50-Bps Rate Cut In October ›

- Toronto Now Has the Greatest Housing Bubble Risk of Anywhere Else in the World ›

- September Sees Slight Increase In GTA Home Sales ›

- Gord Perks On Toronto's Housing Affordability Crisis ›

- Gord Perks On Toronto's Housing Affordability Crisis ›

- Average 2-Bed Rent Could Hit $5,600/Month In Toronto By 2032 ›

- Toronto's 10-Year Economic Plan Targets Housing, Transit ›

- 85% Of Mortgages Up For Renewal In 2025 Face Higher Interest Rates ›