More than three million Canadians have lost their jobs since the outbreak of the COVID-19 pandemic; stay-at-home orders have brought much of the economy to a halt and there's already been a decline in GDP. In turn, many Canadian industries are at a standstill, including much of the country's real estate market.

Though, while many housing markets across the country remain in a slump, one city is about to enter into a "boom," according to Real Estate Investment Network’s (REIN) latest COVID-19 Special Edition: Real Estate Cycle Update report.

"We released this report because we wanted to create something that was timely, important, and relevant so that investors and homebuyers alike are armed with Canada’s most trusted source of real estate investment information, especially during the coronavirus pandemic,” explained Jennifer Hunt, Vice President Research for REIN.

According to the report, all major real estate markets in British Columbia, Alberta, and Ontario are on a steady decline due to the economic impact of the pandemic shutdown and restriction measures – except for one: Ottawa.

READ: 34% of Torontonians Still Say They Want to Buy a Home in the Next 12 Months

These findings are based on two REIN research methodologies including the company's Long-Term Real Estate Success Formula and Real Estate Cycle Scorecard, both of which look at rapidly-evolving changes of economic fundamentals that directly affect the real estate market. While REIN looks at 16 different indicators during each cycle, the driving market influencers are GDP, jobs, and population.

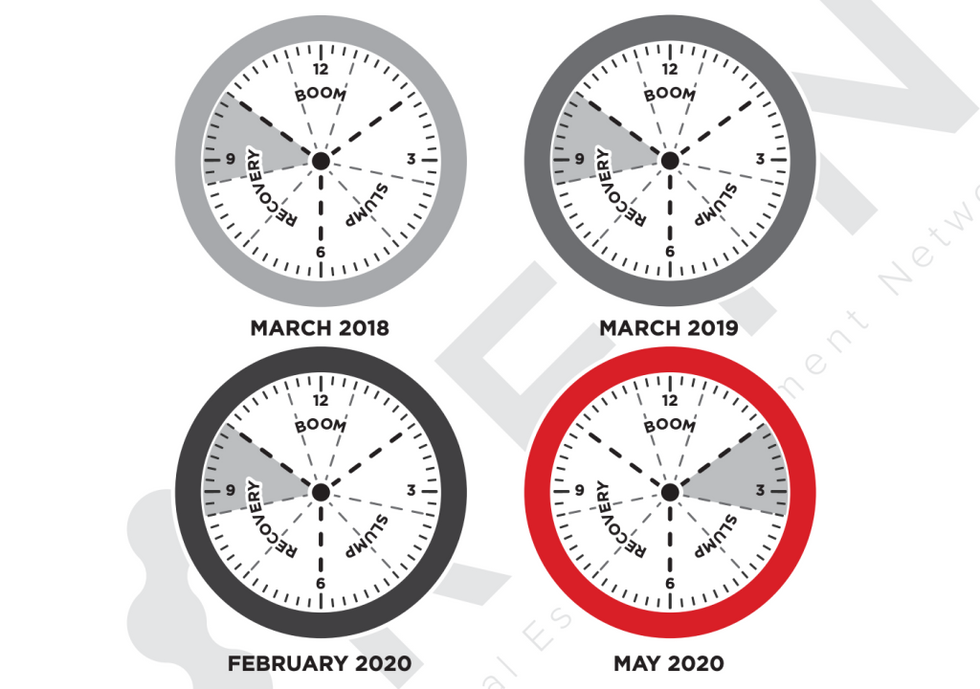

Hunt says the real estate cycle serves as a predictive tool that can help determine which phase a specific market is currently in based on driving indicators and market influencers. The report shows where specific markets are in the real estate cycle, so that those looking to buy, sell, or rent have a better idea of what to do and what to avoid doing.

[yop_poll id="3"]

The report suggests the impacts of COVID on these driving indicators will move most markets further into the "slump phase" in the coming months despite provinces gradually re-opening their economies.

According to REIN, a "slump" is generally characterized as a market slowdown; however, it can also be a great time for "uniquely positioned investors" to take advantage of the "opportunities that are bound to hit the market sooner or later."

In its latest report, REIN analyzed the real estate markets in three provinces and five cities, including Vancouver, Calgary, Edmonton, Toronto, and Ottawa, and found that Canada's capital city is the only one that's in a "boom" phase.

“Ottawa emerges as an outlier in the current pandemic landscape partly because, as the seat of Canada’s federal government, it’s insulated to some extent from the massive pandemic-related joblessness impacting the country,” explained Hunt.

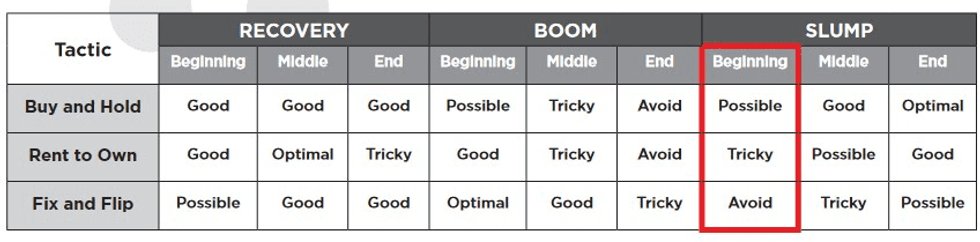

Based on REIN’s Real Estate Cycle Scorecard and Clock, the economic fundamentals and market influencers indicate Toronto’s real estate market is at the beginning of the slump phase. According to the scorecard, this position in the cycle makes buying and holding possible, renting-to-own tricky, and fixing and flipping best left avoided.

"What’s unique about Toronto and the GTA is that while borders have closed, permanent residency applications are still being processed to the degree that they can. Behind the scenes, immigration policies have not changed. Once it’s safe to do so, the borders will reopen and when they do, immigration will have a big impact on Toronto’s real estate market," said Hunt.

"What this means is that while Toronto might be entering into a slump cycle, as soon as there’s a drop to a market influencer, such as GDP, population, or job numbers, it will cause a shift to the cycle."

As for how long a cycle might last, it's not as short-lived as you might think and Hunt says it really depends on the city, especially given that we're living in the height of the coronavirus, which is having a direct (and drastic) impact on the Canadian economy.

“We may not be able to direct these market forces, but we can control how we respond – employing exactly the kind of ‘pandemic pivot’ we need to protect our property during these turbulent times," said Hunt. "The key will be in watching for indications of recovery, such as economic activity, employment, immigration, and new rental demand."