With the one-year anniversary of COVID-19 lockdowns just weeks away, it appears that the pandemic's overall impact on Canada's housing market wasn't as detrimental as what was initially expected.

Unprecedented government aid, supportive actions from financial institutions, and rock-bottom interest rates helped contribute to keep property values on track, in addition to fueling housing markets in a number of major Canadian cities.

To paint a clearer picture of the pandemic's impact on the national housing market, RBC released a Canadian Housing Health Check, an analysis of national and provincial trends in housing affordability and developments in major metropolitan housing markets.

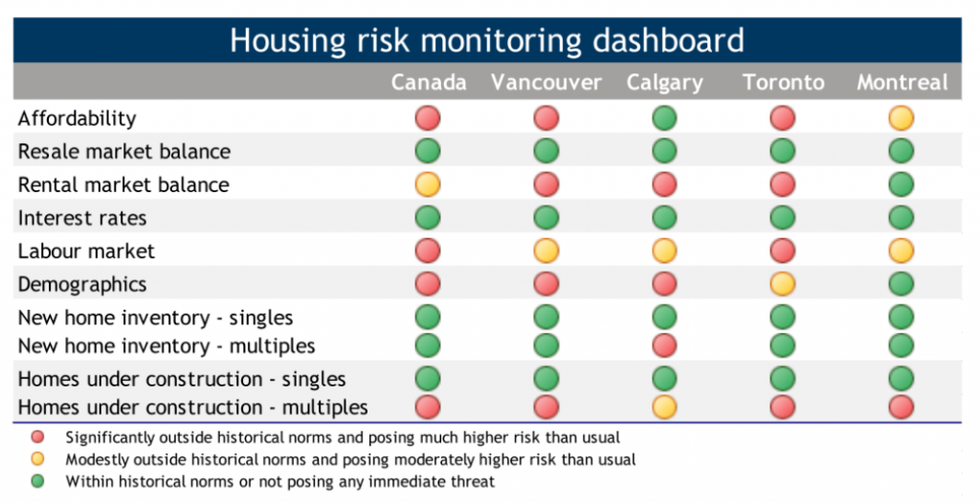

And while Canada currently has a "super-strong" housing market, RBC says it's far from risk-free.

READ: CMHC Changes Course, No Longer Predicts Grim Market Outcome

According to the health check, the country is facing a near-term risk of overheating, and not a price collapse, as strong demand is quickly depleting inventories across the country.

Competition between buyers is extremely fierce in many markets (including smaller ones), and a ‘fear of missing out’ is taking hold. Such dynamics often lead to self-reinforcing price trends.

Because of this, poor affordability remains a major issue in major markets. The high cost of homeownership in Vancouver, Toronto and, to a lesser extent, Montreal is a top vulnerability in these markets.

However, RBC says the hotter the market gets, the odd of policy intervention also increases. Events in British Columbia (2016) and Ontario (2017) have shown that policymakers come under intense pressure to stabilize markets and contain household leverage risks when prices spiral upward.

Subsequently, RBC says the interest rate risk could rise if the economy outperforms expectations. "Exceptionally low rates provide a powerful tailwind for the market. This wind could change direction if a quick economic recovery stokes inflation fears, causing interest rates to rise," reads the report.

Though there are other factors that could put the breaks on housing demand, including a fall in immigration, prolonged labour market weakness, and the outcome of the pandemic, as it still represents a threat to the housing market, especially if new variants emerge that could destabilize the economy, according to RBC.

According to the health check, here in Toronto, the market has rallied to record-high levels since last summer. Housing demand is "supercharged" and buyers are now acting with a sense of urgency on a fear of missing out.

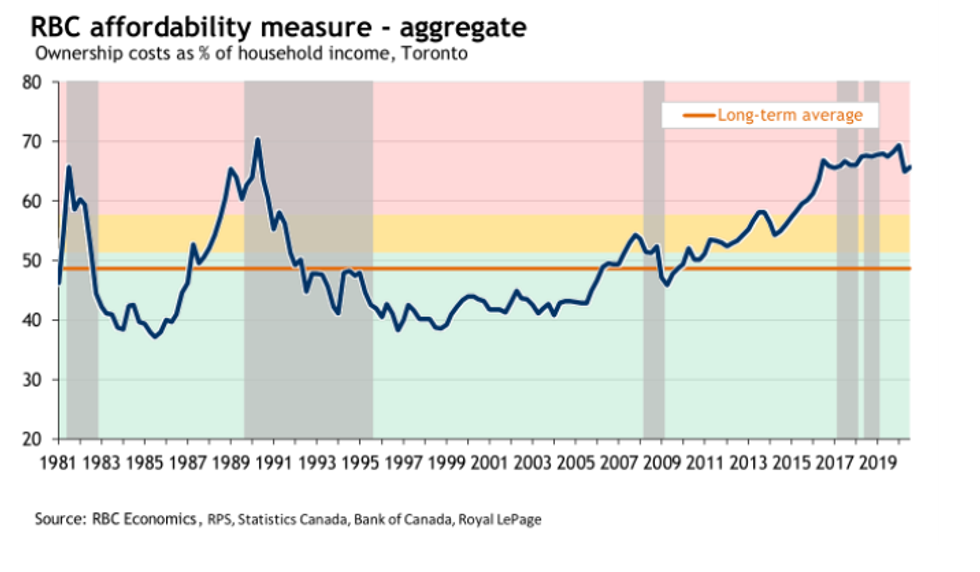

The big issue Toronto is facing is affordability, which, according to RBC, is significantly outside historical norms and poses a much higher risk than usual.

While the affordability issue has "slightly improved" since COVID-19, thanks to the drop in interest rates and a temporary spike in household income arising from massive government transfers, RBC says most of the affordability pressure is concentrated in the single-family home side of the market. However, some degree of stress is also present in the condo segment.

Unsurprisingly, RBC noted that for-sale inventories are very thin in Toronto, except for downtown condos. Though, this means there’s an "increased potential for overheating."

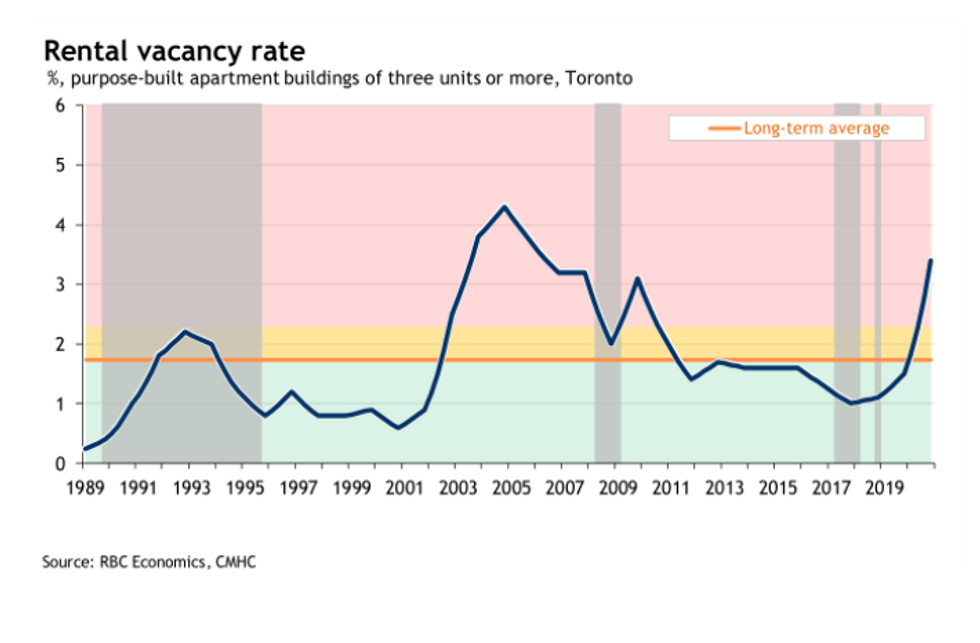

Additionally, single-family home prices are escalating at an accelerating pace, while condo prices are largely stagnant, which reflects the downturn in Toronto's rental market, which currently has a moderately-high vacancy rate. Subsequently, RBC says overstretched affordability remains a significant issue and top vulnerability.

RBC's report comes as the average price of a home in the GTA — including all types of houses and condos — rose 14.9% year-over-year to eclipse the $1-million mark for the first time in history last month.