[Editor's Note: On February 13, the Supreme Court granted thereceivership application as described in this article. The 5508-5585 Oak Street property was then listed for sale by Colliers in early-April.]

A large-scale redevelopment plan for a site near Oakridge Park that has been in the works for several years is set to be delayed even further as the developer is now facing receivership proceedings, according to court filings in the Supreme Court of British Columbia obtained by STOREYS.

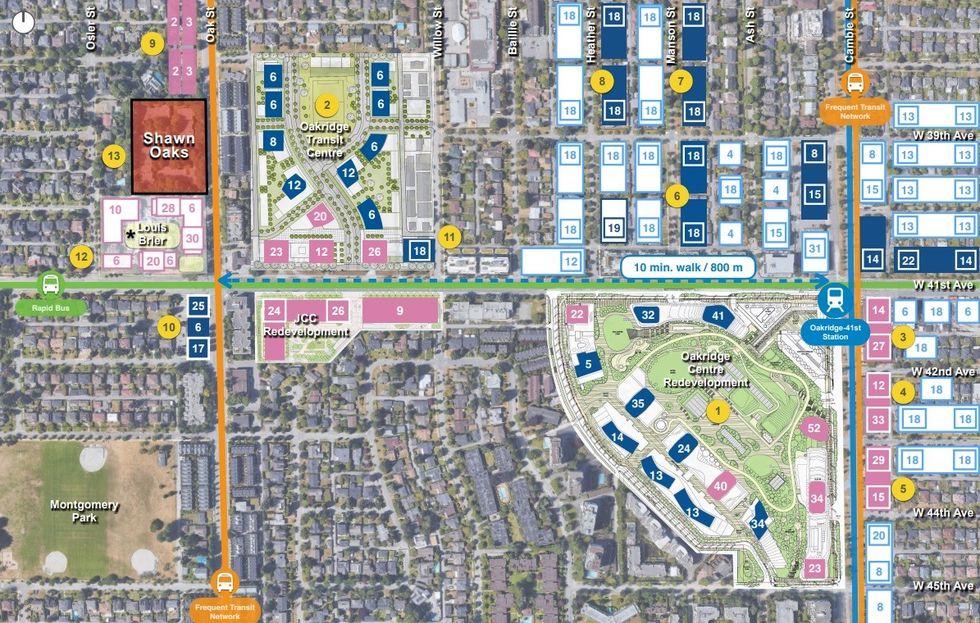

The project was being undertaken by Landmark Premiere Properties and was set for 5505-5585 Oak Street in Vancouver, which is located directly west of Grosvenor's Mayfair West project (formerly known as the Oakridge Transit Centre) and a few blocks away from Oakridge Park.

The 3.2-acre property is currently occupied by the 72-unit Shawn Oaks townhouse complex that Landmark Premiere Properties acquired in phases between 2016 and 2021, all of which are now owned by Shawn Oaks Holdings Ltd. and beneficially owned by Landmark Shawn Oaks Development Ltd., both of which are listed as respondents alongside Landmark Premiere Properties Ltd. and Helen Chan Sun, the two guarantors.

In July 2024, the City of Vancouver published the rezoning proposal — a pre-application proposal, not a formal rezoning application — for the site, which must go through an "enhanced rezoning process" because it is designated as a "Unique Site" in the Cambie Corridor due to its size and complexity.

For the site, Landmark has proposed a 31-storey strata tower, a 33-storey strata tower, and a six-storey social housing building, for over 600 total residential units, in addition to a one-storey childcare facility with 37 spaces.

The Mortgages

In December 2019, Landmark Premiere Properties secured a first-ranking mortgage from Trez Capital — as TCC Mortgage Holdings Inc. — for the principal amount of $67,661,000.

Then, in December 2021, the developer secured a second-ranking mortgage from Peterson Group for the principal amount of $25,000,000.

The loan between Landmark and Trez Capital matured on September 1, with the developer only making partial payments since August. According to Trez, the Shawn Oaks townhouses are currently being rented out and generate about $155,000 in rental income per month, but Landmark has "kept the rents and used the monies for their own purposes" and "the rents have not been remitted for application to the indebtness under the loan."

As of December 16, Trez says it is owed $71,756,515.48, with interest accruing at a daily rate of $29,204.90.

Regarding the second-ranking mortgage, Peterson Group issued a formal demand for payment in November and has yet to receive payments. Peterson Group then initiated its own proceedings on January 23, claiming that they are owed $27,441,576.26 as of January 1, with interest accruing at a daily rate of $16,916.04.

This brings Landmark Premiere Properties' total debt on Shawn Oaks to $99,198,091, not including interest.

In its response to Trez Capital's application, Peterson said that it was also not receiving the rental income Landmark is collecting. Peterson also noted that Landmark "failed to properly disclose the majority investor of the Debtors."

In a statement provided to STOREYS, Landmark Premiere Properties said that it holds a 30% stake in the project and the two equity partners that hold the remaining 70% stopped making shareholder payments in 2018 and 2019, forcing Landmark to carry the full financial burden of the project. The company also said the insolvency is isolated to Shawn Oaks and does not impact their other projects, such as the Foster Martin project in White Rock.

Concurrently, Helen Chan Sun — CEO of Landmark Premiere Properties — has been involved in a separate foreclosure proceeding in which she claimed to be too "cash poor" to pay off debt. A decision published by the Supreme Court on December 30 found that her claim "lacks credibility" and ordered her to make monthly payments of $300,000 until the debt is paid off.

"I find that Ms. Sun leads a lavish lifestyle making regular purchases at luxury stores, which are indicative of someone whose income well exceeds the $60,000 to $70,000 she claims to make on an annual basis," the decision notes. "I found her testimony that many of the purchases were gifts or prizes for persons at her companies or investors lacks credibility and her inability to remember or identify specific major purchases (such as the $11,000 purchase at Holt Renfrew) defies credulity."

What Happens Next?

In its Petition to the Court, Trez Capital has requested that a Receiver be appointed over Shawn Oaks. As of January 23, the application has yet to be approved by the Supreme Court, but such applications are rarely denied.

Meanwhile, Peterson Group has only asked for the court to recognize the debt, but said in a response to Trez Capital's application that it would support a receivership in part because receivership proceedings allow for the use of reverse vesting orders — share sales — that are not possible in foreclosure proceedings.

If the receivership application is granted, the Receiver will likely retain a commercial real estate brokerage and the 5505-5585 Oak Street property would then go through a court-ordered sales process. Although the property is located in a development hotspot, a sale price that covers all or most of the debt on the property is usually sought, which could limit the potential buyer pool in this particular case.

In a response to Trez Capital's application, Landmark Premiere Properties and Helen Chan Sun said that it had received a $100,831,806 appraisal for the property in December 2019 and that it has received a higher appraisal since then.

As for the project, if a new developer is found, it may end up proceeding in a different form, considering a rezoning application has yet to be submitted.

Trez also notes that the current "burn rate" — the rate at which a company uses its cash — when factoring in both loans is approximately $1.37 million per month before compounding. Trez also notes that if a rezoning application is pursued, an additional $16 million on its loan and $8.92 million on Peterson's loan would accrue in interest, due to the rezoning process usually taking 12 to 18 months.

"It is apparent that the Debtors lack the financial wherewithal to move the rezoning application forward," said Trez Capital. "The Debtors have not provided substantive updates to Trez over the past six to eight weeks nor have they proposed any potential (much less viable) solution[s] for the liquidity issues. The rezoning process is thus stalled and there is no realistic prospect that the Debtors can complete the process in a timely manner or at all."

Elsewhere in Vancouver, Peterson — a developer that also acts as a lender on occasion — is also the lender in an ongoing foreclosure proceeding involving Coromandel Properties. In Burnaby, its joint venture with Create Properties was also placed under creditor protection in late-November as a result of an impasse between the two partners.

[Editor's Note: This article was updated on January 24 to include a statement from Landmark Premiere Properties.]

- Duck Island, Home Of Richmond Night Market, Subject Of $90M Foreclosure ›

- Grosvenor Unveils First Phase Of The Oakridge Transit Centre Redevelopment ›

- Landmark Premiere Properties Facing Second Insolvency In Vancouver ›

- Landmark Premiere And Cenyard Facing Foreclosure On Surrey Mall ›

- Cenyard Buys Out Embattled Landmark Premiere From Projects In Surrey, Coquitlam ›