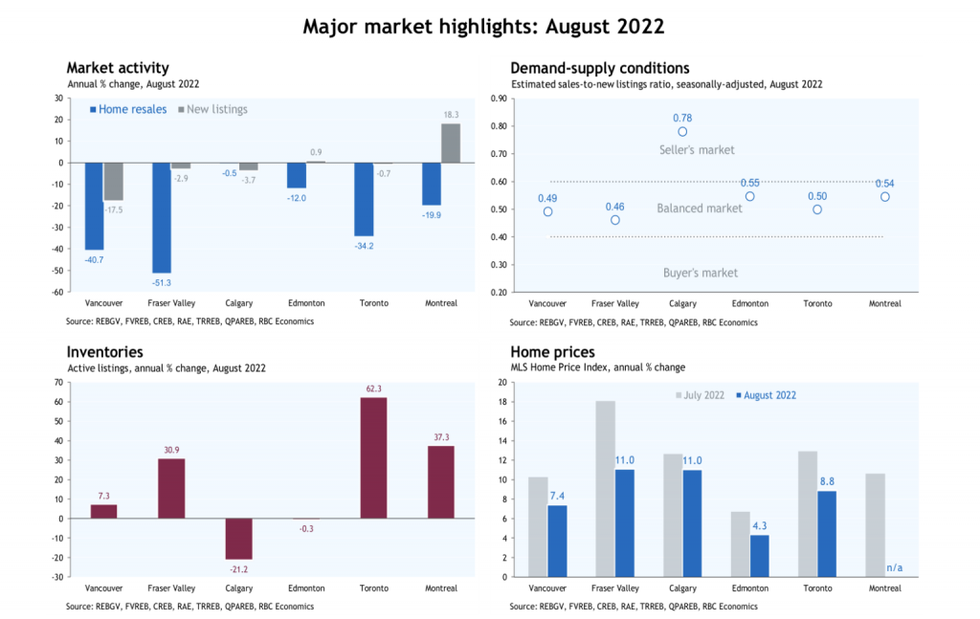

While fall typically sees an uptick in sales activity, markets across Canada are continuing to cool off. This is according to a report from RBC Economics released this morning.

“The cooling trends that emerged this spring are still firmly in place across Canada’s housing markets,” it reads. “Early reports from local real estate boards for the most part showed both resale activity and prices continuing to soften in August.”

The report goes on to say that the majority of markets in Ontario, British Columbia, and Quebec are seeing price corrections. Generally speaking, these markets are currently operating well below pre-pandemic levels. Toronto and Hamilton were the only outliers, seeing a a modest monthly resales increase. RBC chalks this up to “nothing more than volatility around the (clearly downward) trend.”

“Easing demand-supply conditions and souring sentiment are fueling the price correction. They provide buyers with a stronger hand in negotiations, helping them to reverse some of the enormous appreciation that occurred during the pandemic. This process is most visible in the suburbs and exurbs of Toronto and Vancouver where price drops have been most significant to date.”

While bargaining power has shifted in the buyers’ favour, today’s interest rate decision, in combination with the June and July hikes, is largely hindering the desire to purchase.

“Rising interest rates are pushing many buyers to the sidelines and reducing the purchasing budget of others. Our expectations for the Bank of Canada to hike its policy rate to 3.5% by the fall will keep chilling markets in the months ahead. We see the downturn intensifying and spreading as buyers take a wait-and-see approach while ascertaining the impact of higher lending rates. Canada’s least affordable markets Vancouver and Toronto, and their surrounding regions, are most at risk in light of their excessively stretched affordability and outsized price gains during the pandemic.”

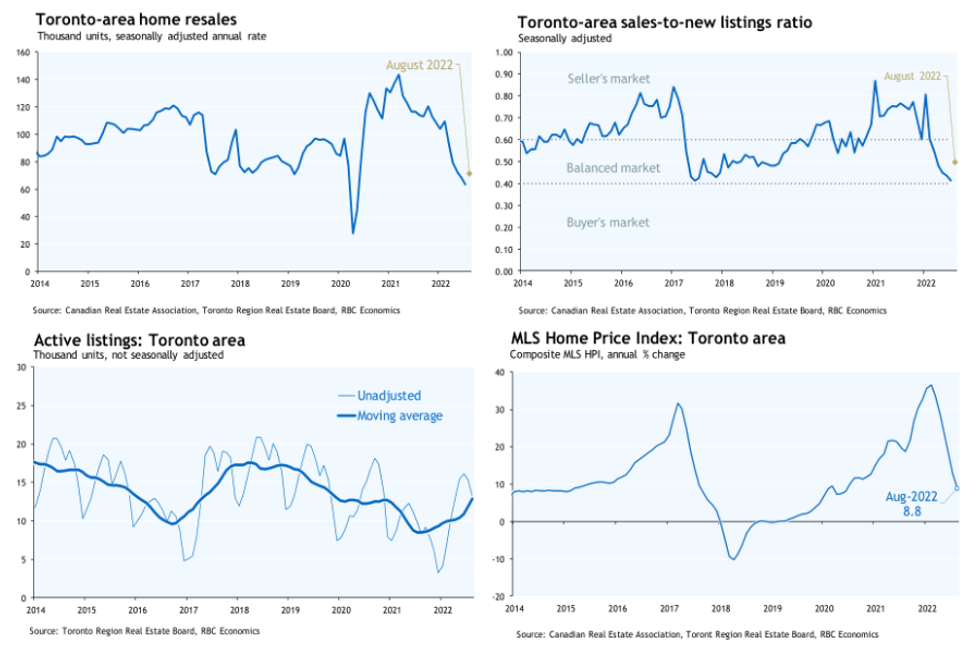

In contrast to other Canadian markets, Toronto’s market saw a slight increase in sales activity with home sales rising 11% between July and August on a seasonally-adjusted basis. Activity was still well below pre-pandemic levels.

“While it’s too early to call it a bottom, we view it as evidence buyers haven’t given up and are ready to pull the trigger on the right opportunity. Price corrections may provide more opportunities.”

Toronto’s composite MLS home price index (HPI) dropped to 2.8% to $1.12M, marking the fifth consecutive month of decline. Since reaching a peak in March, Toronto’s HPI has plummeted 16% in value or more than $210,000. Suburban single-detached home prices have declined the most drastically, particularly in the Halton and Durham regions. On the flip side, condo prices have shown resilience.

“We expect these diverging trends to persist near term as buyers focus on relatively more affordable options such as condos.”

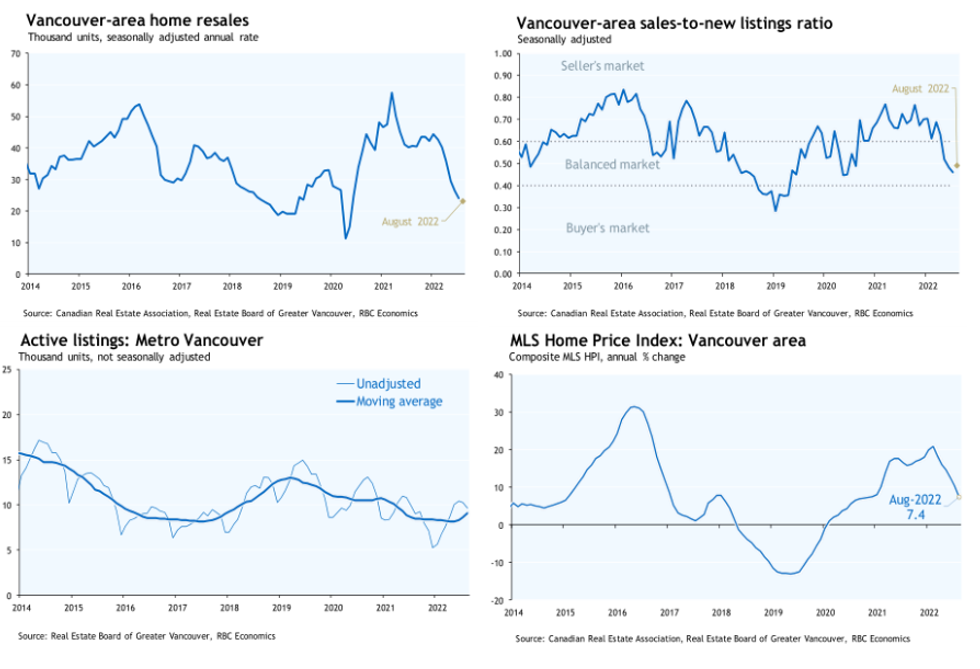

In the Vancouver area, both sales activity and prices are on a downward trajectory.

From July to August, home sales receded around 4% and the HPI fell 2.2%. Since reaching a peak in winter, home resales are down 46% and benchmark prices are down 6.7%.

The region’s suburban markets are seeing the steepest corrections, with prices in Pitt Meadows and Port Coquitlam down 11.3% and 10.4% respectively. Additionally, prices in Cloverdale and Mission are down 12.4% and 15.2% respectively. The latter is especially notable when you consider the fact that both Cloverdale and Mission saw hearty price appreciation in last year.

“There are no signs the market has reached the bottom yet… The sharp rise in interest rates and partial return to office are evidently causing buyers to more significantly reprice properties away from Vancouver’s urban core. We expect activity to stay quiet in the months ahead in the entire area as the market continues to adjust to the new realities. Higher interest rates are a big pill to swallow for buyers facing the some of the steepest home prices in Canada.”