Words matter. And real estate is no exception -- especially in conversations with investors.

According to a new year-long study titled, Building Opportunities: The Compelling Language of Real Estate Investment Trusts from global investment management firm Invesco Ltd. and research-driven language strategy firm Maslansky + Partners, language can complicate real estate deals.

The study found that many commonplace words and phrases used in today’s real estate conversations fall may short when used in discussions with investors. One reason why may be that, while most financial professionals understand the importance of including potential benefits in communications with clients, many do not know how to articulate them using words that fully resonate with investors (or the rest of us, for that matter).

"It is important for financial professionals to effectively communicate with their clients the potential benefits of real estate investing so they can understand their investment choices, and the research upheld our longstanding belief that word choice matters when introducing real estate investment trusts (REITs)," said Paul Brunswick, Head of Invesco Global Consulting. "Although most of the investors surveyed had favourable views on real estate investing, their views shifted depending on how certain concepts were presented."

Based on the extensive research using instant dial response technology, Invesco Global Consulting found that 60% of investors believe that it is a good time to invest in real estate, but only 46% said they were likely to do so. This gap can be attributed to investors not understanding the role real estate can play within a portfolio, says Invesco. "Given this, it is crucial for financial professionals to clearly articulate the potential benefits of REITs to clients," reads an Invesco-issued press release.

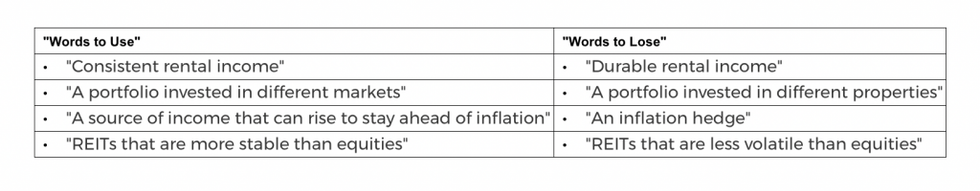

So, Invesco Global Consulting researched how to best articulate core benefits of real estate investment trusts in a study with 500 accredited investors. The research proved that word choice can impact the importance of potential benefits to clients. The following list of phrases have been shown to help financial professionals highlight the right potential benefits of REITs when talking to clients:

As it turns out, investors like plainspoken language when describing real estate potential benefits.

With interest rates rising, financial professionals can explain to clients that REITs are one way to potentially play defence in the face of inflation. When asked what they would rather add to their portfolio for inflation protection, 24% selected "an inflation hedge," while 76% liked "a source of income that can rise to stay ahead of inflation." The phrase "hedge" is not a plainspoken potential benefit and often investors think of the term in a negative light.

"We believe it is important for financial professionals to better understand investment communications from the client's point of view, and with that knowledge, they can better communicate real estate alternative investments to their clients," said Brunswick.

According to the study, there are portfolio misconceptions when it comes to diversification. Historically, retail investors have only allocated a very small portion of their portfolios to alternatives even though the asset class has potential diversification benefits. When talking about the diversification benefits of REITs, 44% of accredited investors believed "comprehensive" diversification worked best over "true" diversification (29%) and "enhanced" diversification (27%). Of the 500 accredited investors surveyed, only 16% felt that diversification was an investing priority, proving that most felt they already had a well-diversified portfolio. Given this, it is important to emphasize that a move into alternatives is about achieving potentially better diversification, says Invesco.

"Helping retail investors understand the potential benefits of REITs is the first step toward bridging the knowledge gap that presently exists and democratizing alternative investments for the masses," said R. Scott Dennis, Invesco Real Estate CEO. "Through effective communication and education, investors will be informed about how alternatives like real estate can potentially broaden exposure to different asset classes within their portfolios and potentially achieve better risk-adjusted returns."

The study found that not all real estate is perceived equally by investors. The majority of investors felt it was a good time to invest in technology projects, apartments/suburban housing, and storage but were less comfortable investing in retail, commercial, and office space. When it comes to the office sector, most accredited investors immediately thought of empty office buildings (a reality in today's hybrid work culture) as a risk, not an opportunity. Given this, it is important for financial professionals to cite specific opportunities in real estate when articulating the potential benefits of investing in the asset class, such as technology projects, medical offices, and senior housing, says Invesco.

Other key findings from the Building Opportunities study include:

- Maintain "portion control." A majority (70%) of accredited investors find it more appealing to have a "portion" of their income needs allocated to real estate. If the "portion" is not explicitly said, investors may assume their financial professional is suggesting a change to their entire portfolio.

- Emphasizing the potential benefits of consistent, stable and reliable income resonates with investors. 57% of accredited investors surveyed preferred "consistent" rental income over "durable" and "alternative" rental income as the most valuable potential benefit a real estate investment could provide as he/she looks ahead to retirement.

- Using the language of "more" over the language of "less." 67% of accredited investors preferred the phrase "increasing efficiencies" over "reducing inefficiencies." Similarly, 61% of investors found that there was a bigger advantage in investing in real estate assets when it was described as "more stable than equities" over "less volatile than equities."

So, if you have an upcoming meeting with potential investors, you may want to bookmark this page (just sayin').