Real Estate Investment Trust (REIT)

Explore how Real Estate Investment Trusts (REITs) work in Canada, and how they offer accessible, diversified, and income-generating exposure to real estate markets.

May 22, 2025

What is a Real Estate Investment Trust (REIT)?

A Real Estate Investment Trust (REIT) is a company that owns, manages, or finances income-producing real estate and allows investors to buy shares in its portfolio.

Why Do Real Estate Investment Trusts (REITs) Matter in Real Estate

In Canada, REITs are traded on major stock exchanges and provide investors with a way to earn income from real estate without owning property directly.

Key features of REITs include:

- Diversification across properties and sectors (residential, commercial, industrial)

- Regular income via dividends

- Liquidity through publicly traded shares

- Passive real estate exposure without landlord duties

REITs are attractive to investors seeking steady income and portfolio diversification. They must distribute a significant portion of their taxable income as dividends, making them popular among income-focused investors.

Understanding REITs is essential for those looking to invest in real estate markets indirectly, whether for long-term growth or cash flow.

Example of a Real Estate Investment Trust (REIT) in Action

An investor purchases shares in a Canadian REIT that owns shopping centers and receives quarterly dividend payments based on rental income.

Key Takeaways

- Own shares in income-generating real estate.

- Offers diversification and liquidity.

- Generates income through dividends.

- Good for passive investors.

- Traded on stock exchanges like TSX.

Related Terms

- Real Estate Investing

- Dividend Stocks

- Publicly Traded Funds

- Passive Income

- Property Portfolio

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps)

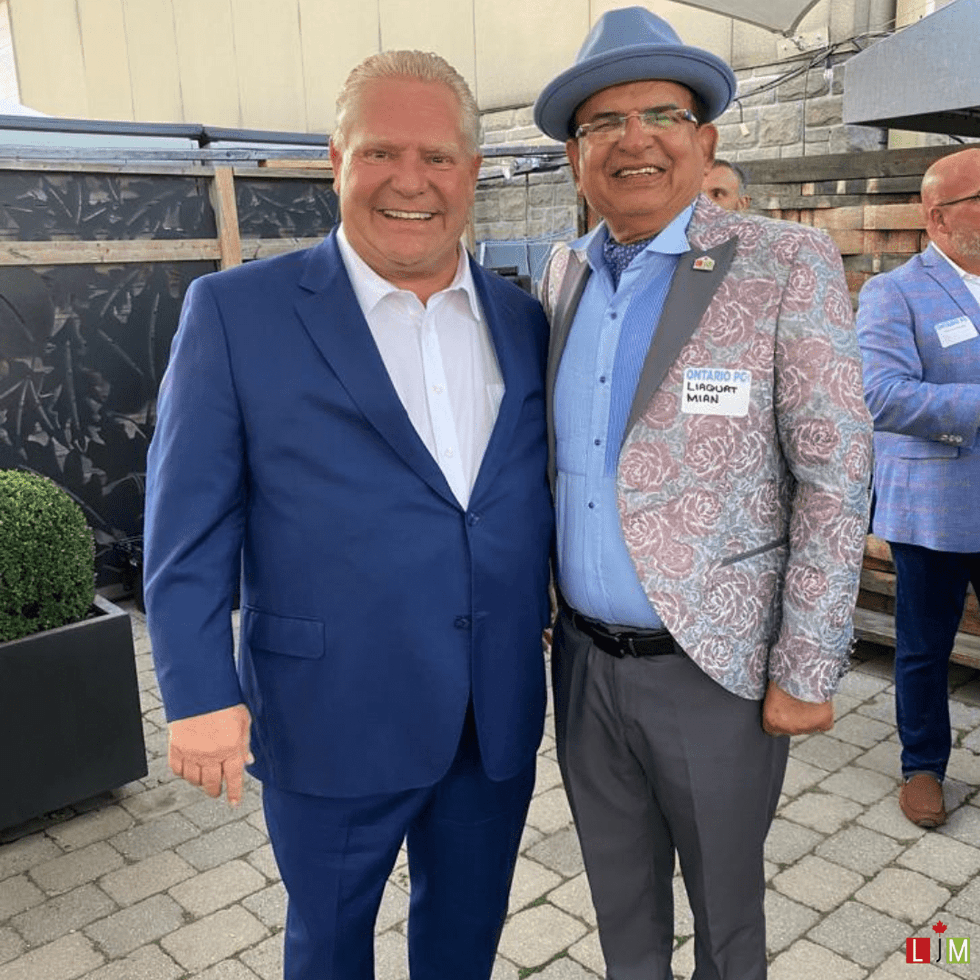

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps) Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)