‘If it ain’t broke, don’t fix it’ is a maxim that represents the antithesis of Murtaza Haider’s feelings on Canadian homebuilding. The system is most certainly broken, and it’s high time we find new ways to fix it, expresses Haider, who was appointed Executive Director of the University of Alberta’s new Cities Institute earlier this year.

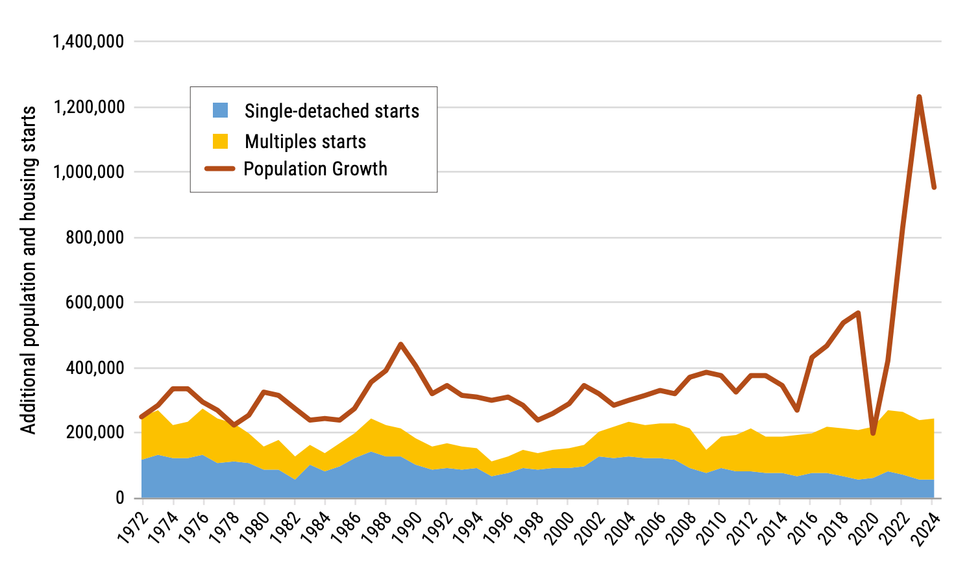

“The challenge we face is that, despite our best intentions since the 1970s, we have not been able to increase the rate, scale, scope, and frequency of housing construction in Canada,” he explains, also pointing out that Canada’s population has jumped from 20 million in the ‘70s to over 41 million now. “On a per-capita basis, we are producing far less housing despite our intent, all the incentives, the industry's desire. The only way to change that is to try something radically different from what we have done in the past.”

The Case for Prefab in Canada

Prefabricated housing is as ‘radically different’ as we have in the toolkit right now, and Mark Carney’s Liberals are vocally on board. The government has pledged to create a new entity known as Build Canada Homes (BCH), which would, among other things, provide $25 billion in debt financing and $1 billion in equity financing “to innovative Canadian prefabricated homebuilders.”

The Liberals have posited that prefabricated and modular homebuilding “can reduce construction times by up to 50%, costs by up to 20%, and emissions by up to 22% compared to traditional construction methods.” In addition, the government has specified that BCH “will issue bulk orders of units from manufacturers to create sustained demand,” and that “financing will leverage Canadian technologies and resources like mass timber and softwood lumber, as well as support more apprenticeship opportunities to grow our skilled trades workforce.”

The Feds reinforced their intention to support prefab, modular, and 3D-printed construction in a new Market Sounding Guide released earlier this month, and are currently seeking expertise and feedback on BCH on the whole from academics, research groups, institutional investors, and other potential sources of private capital until August 29.

Although the escalated emphasis on prefab has been met among industry stakeholders with a fair amount of scepticism — Canadian housing providers haven’t been able to make the method work at scale before — Haider is in full support. He cites a study he’s currently involved with that looks at 10 Western economies around the world, and shows that Japan is producing “almost 90,000 to 100,000 homes” every year using prefab methods.

“And they have been able to achieve a high level of customization, which means that these homes are not cookie-cutter homes where everything looks identical and looks like a hospital rather than a house because everything is so standardized,” he says. “We can learn from countries that have done better, like Japan and Sweden, and go about it in a better way, a more productive way.”

Industry Response: Stelumar and Assembly Corp.

This past June, The Globe and Mail reported that Mattamy Homes Founder Peter Gilgan is behind a new prefab business known as Stelumar, which is expected to begin its first phase of roll-out in 2026. Once operational, the company is looking to provide modular components for about 3,000 housing units a year. Gilgan also opened a prefab home factory in the late 1990s, it’s worth noting, but it ceased operations in 2009.

However, Peter Hass, General Manager for Stelumar emphasizes that ventures are different; the ‘90s business focussed on fully-detached, single-family homes, while the latest version will manufacture in favour of six-story buildings (the ‘missing middle’).

“There's also a lot of differences on the technology side this time around. On the equipment, things are a lot more automated, and within the automation, there's a bit more flexibility than what there was, so it enables us to obviously manufacture a lot more efficiently,” says Hass.

“And there are a lot of changes on the software side too,” he adds. “In the original Stelumar, there was over 40 people taking the 2D drawings of the homes and putting them into machine-readable drawings. And now you can model everything in 3D from the start. So, to translate that into the machine-readable drawings and do all the clash detection on your MEP and find out what your stud spacing is and what the framing is going to look like — we can use software to automatically do a lot of that… which allows the overhead of the company to be significantly less.”

Although Stelumar’s new Toronto-area facility is expected to cost “hundreds of millions of dollars” before it's operational, Hass notes that having one of the largest privately owned builders in North America on their side means that they will be able to scale quicker.

“Our main investor is Peter Gilgan and Mattamy Asset Management, and then we also have an agreement with Mattamy Homes to be the main customer,” he says. “So, having confidence in that pipeline makes a huge difference. It allows us to invest in further automation in the factory and take on more overhead than a typical company would be able to if they didn't have that pipeline of projects.”

Hass also notes that, to Haider’s point, the company is interested in drawing from what is being done overseas, pointing out that one idea they are looking into is having performance-based building codes.

“So instead of being prescriptive about how a building should be built in order to meet the code, it’s: here's the bar that you need to hit, prove that you can hit this bar. And that makes a big difference in a factory because you can do things differently than how you can do it on a job site — you can manufacture differently, you have a different level of quality and accuracy with machines in a consistent environment than you would have on a job site,” he says.

Haider goes on to say that the success of scalable prefab in Canada is going to rely on the participation of big players in homebuilding, Mattamy being a quintessential example.

“These big builders and developers have the financial means to put [toward] this initial investment into setting up these factories and [are] able to negotiate terms with the government,” he adds. “Canada’s large number of smaller builders, they don't have the money, expertise, scale, or even ambition to go modular… but once these [factory] setups are made, small builders can benefit, because they can be the implementers or assemblers of the products that these big factories make. I think it’s quite doable, the study of Japan clearly shows us that this is doable.”

Toronto-based builder Assembly Corp. has been immersed in the space since 2017, providing prefabricated all-wood residential buildings in Ontario. Like Stelumar, Assembly is focused on the missing middle, and they currently have 10 projects built and 11 in various stages of entitlement and construction. Though the company operates at more of a niche scale than Stelumar, Product Lead for the company Justin Spec says that federal government’s push for prefab is already resulting in an uptick in interest for their services.

Giving a bit of a crash-course in how Assembly’s services work, Spec explains that around 80% of each project’s design process is “predefined, coordinated across all design disciplines, and the other 20% is a site adaptation process where we incorporate unique conditions like ground-floor functions, facade design, and specific zoning requirements.”

“We primarily work in panelized modular, so building elements, like floor or wall panels, come stacked on trucks and are quickly lifted into place on site,” he adds.

In addition, Assembly’s Director of Sales and Marketing Francesca MacKinnon shares that the company has partnered with Swedish company and leader in wood industrial housing Lindbäcks and will be acquiring their factory equipment to outfit their forthcoming facilities.

“We are opening a manufacturing facility in 2026 in Toronto with a capacity of 1000+ units annually. We also have access to technologies and AI that we never had before, making Design for Manufacturing Assembly, costing, and building integrative design software easier than ever before,” MacKinnon says. “The government has vocalized their deep support, and the demand for housing is greater than ever before in Canada. Canadians are more motivated than ever to buy and build Canadian. All the ingredients for scaling are here.”

What's Next? Funding, Policy, and International Expertise

MacKinnon also highlights that Assembly, in partnership with EY-Parthenon, has created the Canadian Industrialized Construction Coalition, “to unify industry voices and create a set of recommendations for the government to inform on ways to successfully scale the factory-built housing industry in Canada.” The Coalition is made up of over 80 members across the supply chain and is a reminder of the expanding enthusiasm to scale this method of homebuilding.

On a final note, one thing that both Hass and Haider make a point of emphasizing and remphasizing is that getting prefab off the ground in a meaningful way will need money — and not just from Canadian players. Capital is the ultimate way to create a “virtuous cycle,” says Hass, so that the companies that do end up riding the wave of prefab momentum can invest more in advancing in their technology and scaling up faster.

“We need to bring in builders from China, from Japan, to bring capital and technology and then start building it here. And governments can provide them with incentives,” adds Haider. “Remember when municipalities were going nuts offering tax relief to Amazon when Amazon decided [they were] going to open a second headquarters? Toronto and many Canadian cities put their bid and offered all sorts of crazy incentives to attract Amazon to their city. Well, do the same for prefab construction expertise and investments from abroad — give them incentives, bring them here.”