Personal Injury

Understand personal injury in Canadian real estate — what it includes, how to protect against liability, and the role of insurance in managing risks.

May 22, 2025

What is Personal Injury?

Personal injury in real estate refers to bodily harm sustained by a visitor, tenant, or service provider on or because of a property.

Why Personal Injury Matters in Real Estate

In Canadian real estate, personal injury claims can arise from unsafe conditions such as icy walkways, loose handrails, or poor lighting. Property owners may be held legally liable if negligence is proven.

Examples of personal injury incidents include:

- Slip and falls on unshoveled sidewalks

- Trips on broken steps or walkways

- Injuries from falling debris or unsecured fixtures

Liability coverage within home insurance helps protect homeowners against legal costs and damages from such claims. Landlords and property managers also carry liability insurance to protect against tenant or visitor injury lawsuits.

Understanding personal injury risks allows homeowners and landlords to mitigate liability and ensure safe living conditions.

Example of Personal Injury in Action

A tenant’s guest breaks their ankle after slipping on an icy stairwell. The property owner is found liable and the insurance policy covers the settlement.

Key Takeaways

- Involves injury occurring on property grounds.

- Can lead to lawsuits and financial liability.

- Covered by liability insurance.

- Landlords must maintain safe conditions.

- Risk increases with negligence.

Related Terms

- Liability Coverage

- Home Insurance

- Legal Liability

- Property Protection

- Risk Management

150 Slater Street in Ottawa. (Regional Group)

150 Slater Street in Ottawa. (Regional Group) 150 Slater Street in Ottawa. (Regional Group)

150 Slater Street in Ottawa. (Regional Group)

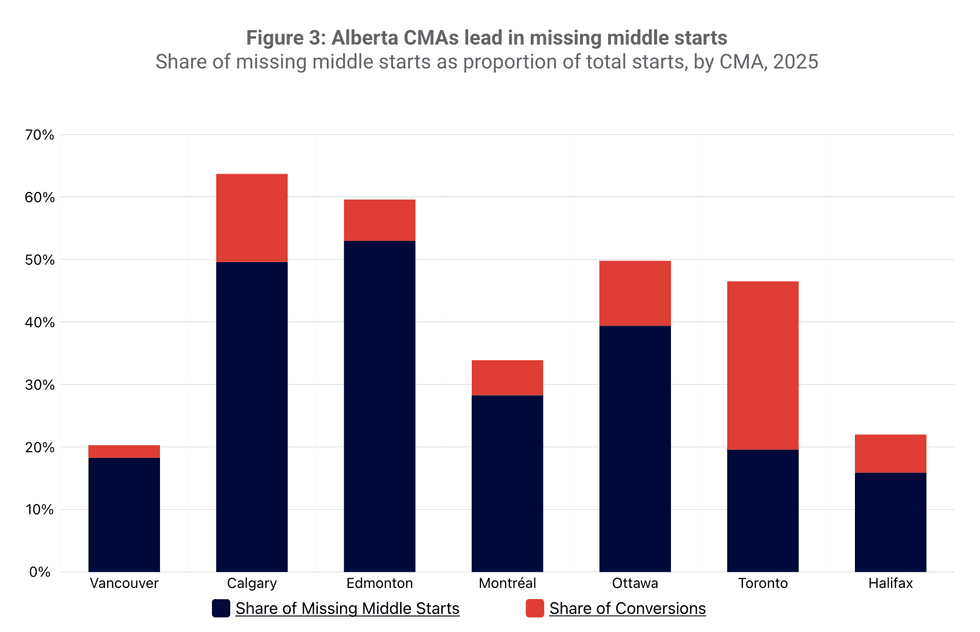

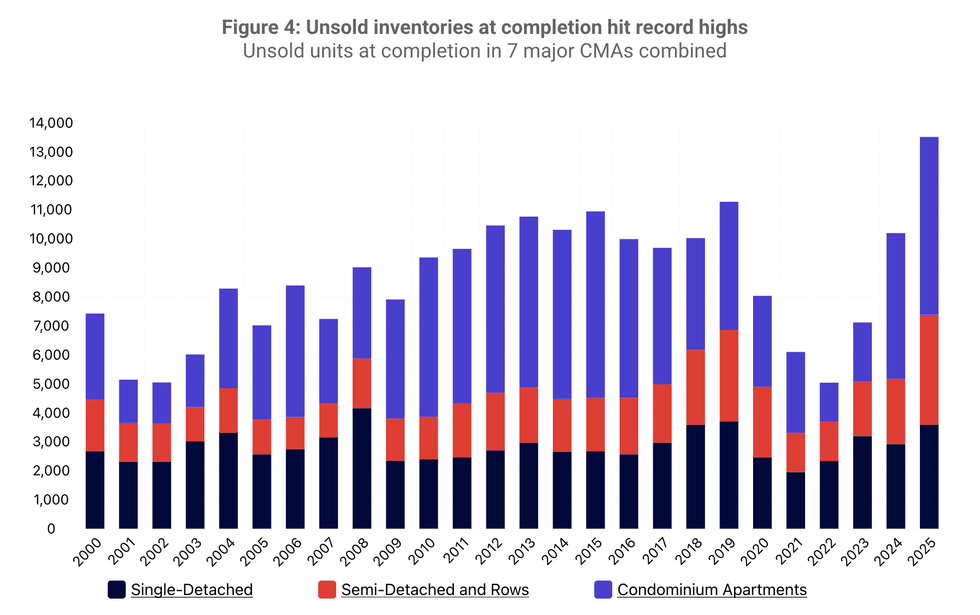

Spring 2026 Housing Supply Report/CMHC

Spring 2026 Housing Supply Report/CMHC Spring 2026 Housing Supply Report/CMHC

Spring 2026 Housing Supply Report/CMHC

Manuela Preis/Instagram

Manuela Preis/Instagram

Renderings of the 65-storey tower previously proposed for 145 Wellington Street West. (Partisans with Turner Fleischer / SKYGRiD)

Renderings of the 65-storey tower previously proposed for 145 Wellington Street West. (Partisans with Turner Fleischer / SKYGRiD)