Believe it or not, Toronto is not the most expensive housing market in Ontario.

READ: Toronto Luxury Home Sales Are Booming, Vancouver’s Are Toppling [REPORT]

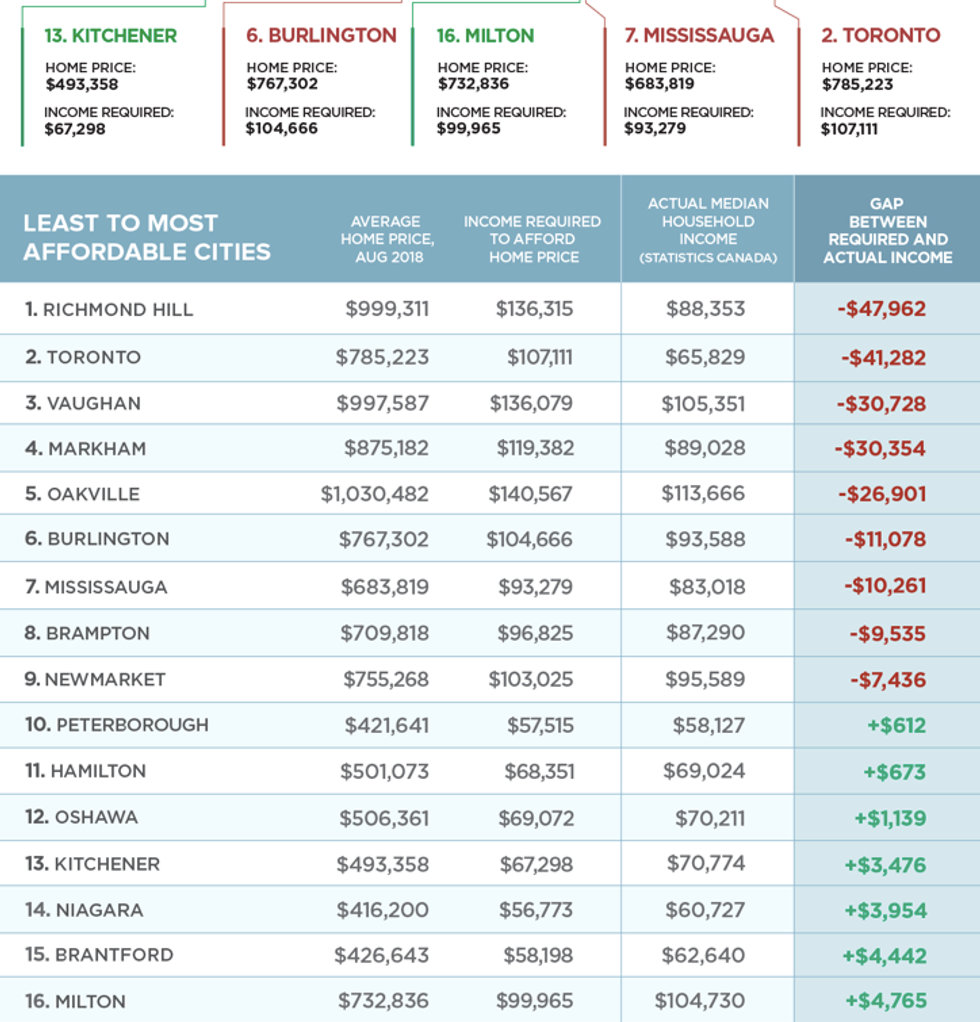

According to a new report by Zoocasa, Ontario's most expensive housing market is actually Richmond Hill. In that suburb, residents earning the median household income of $88,535 would still be $47,962 short to purchase a home at the average price of $999,311.

In comparison, a Torontonian earning the city’s median household income of $65,829, would be $41,282 short of the average home price of $785,223.

READ: Canada’s Most Expensive Home Is For Sale. Prepare To Have Your Mind Blown.

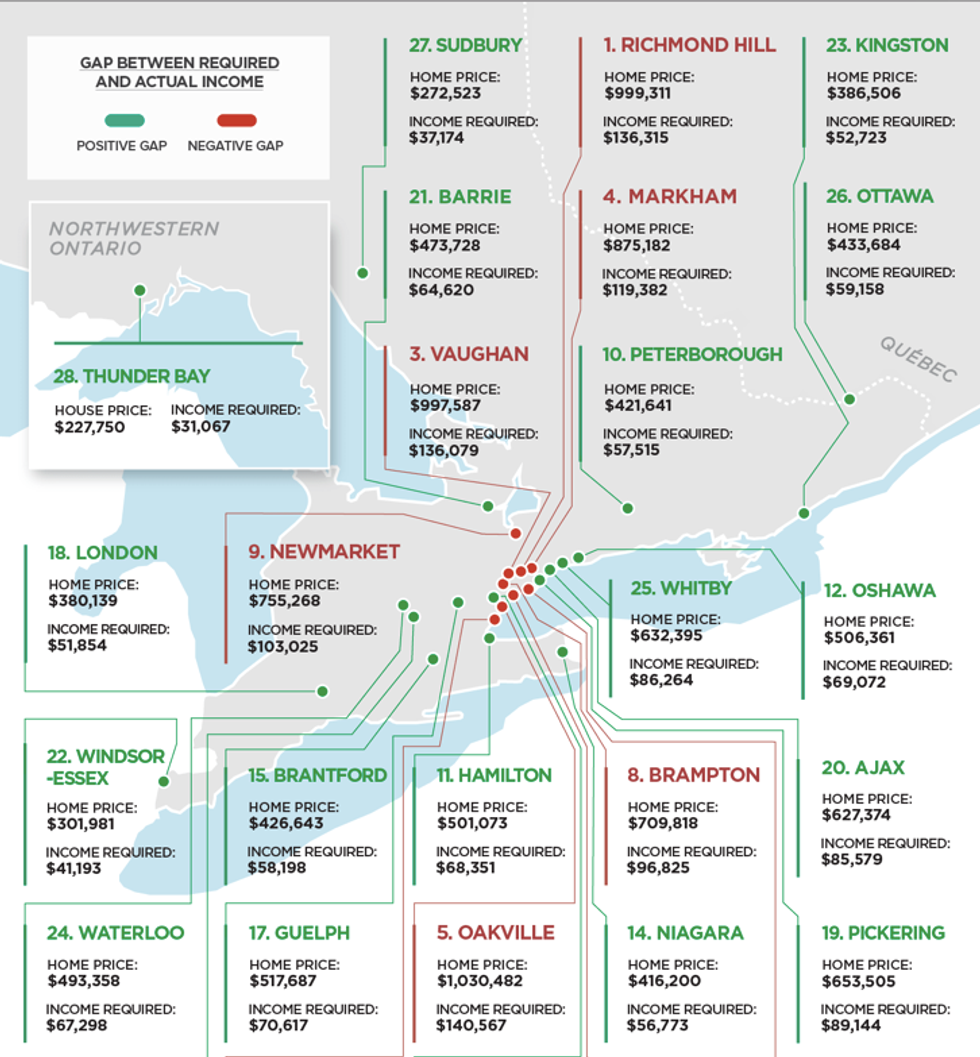

Zoocasa's report ranks 28 major housing markets in Ontario on affordability. The report highlights affordability gaps in each region by calculating the difference between the income required to afford the average home and actual median household incomes.

So what really determines affordability?

READ: Toronto Condo Prices Hit A New All-Time High — Again

A region’s home affordability is dependent upon more than just the average home price. Incomes must align with housing prices that allow homebuyers to afford, to purchase, and to carry local properties.

To determine which markets are most affordable, the report calculated the required income to purchase the average home in each of the 28 major markets across the province.

READ: Toronto Rent Is STILL The Most Expensive In Canada, GTA Dominates List

Calculations were made assuming a 20-per-cent down payment is made at a mortgage rate of 3.14 per cent and a 30-year amortization. This amount was then compared to the actual median household income in each region, to determine whether local home buyers face an income gap or surplus when attempting to enter the market.

Here's an infographic of what you'll need to earn in each of the 28 housing markets across Ontario in order to afford a home.

Below the graphic, you'll find a breakdown of the top 5 most expensive and the top 5 most affordable housing markets in Ontario.

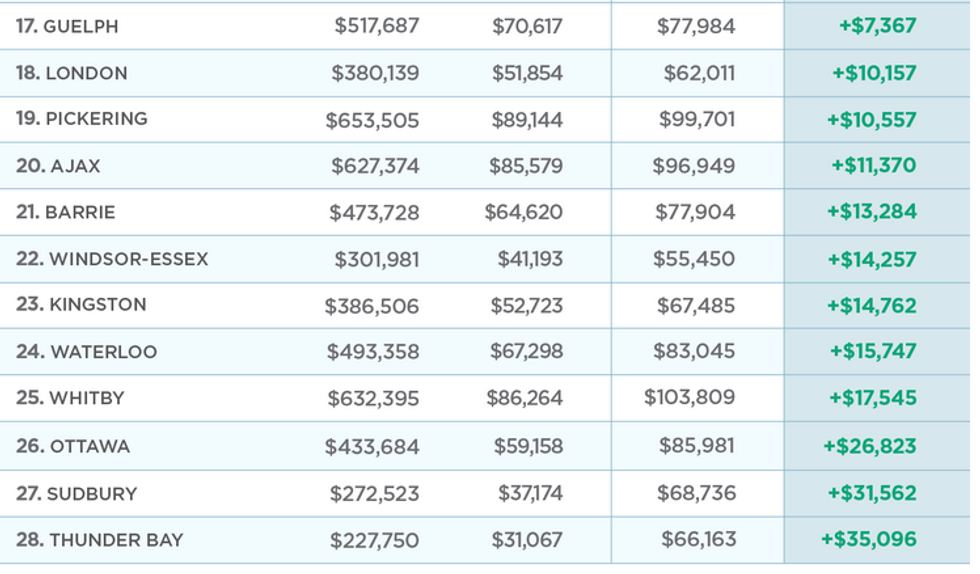

5 Most Affordable Housing Markets In Ontario

1. Thunder Bay

Average Home Price: $227,750

Required Income: $31,067

Median Income: $66,163

Surplus: $35,096

2.Sudbury

Average Home Price: $272,523

Required Income: $37,174

Median Income: $68,736

Surplus: $26,901

3 – Ottawa

Average Home Price: $433,684

Required Income: $59,158

Median Income: $85,981

Surplus: $26,823

4. Whitby

Average Home Price: $632,395

Required Income: $86,264

Median Income: $103,809

Surplus: $17,545

5. Waterloo

Average Home Price: $493,358

Required Income: $67,298

Median Income: $83,045

Surplus: $15,747

5 Least Affordable Housing Markets In Ontario

1. Richmond Hill

Average Home Price: $999,311

Required Income: $136,315

Median Income: $88,353

Income Gap: $47,962

2. Toronto

Average Home Price: $785,223

Required Income: $107,111

Median Income: $65,829

Income Gap: $41,282

3. Vaughan

Average Home Price: $997,587

Required Income: $136,079

Median Income: $105,351

Income Gap: $30,728

4. Markham

Average Home Price: $875,182

Required Income: $119,382

Median Income: $89,028

Income Gap: $30,354

5. Oakville

Average Home Price: $1,030,482

Required Income: $140,567

Median Income: $113,666

Income Gap: $26,901