December saw "record-breaking" low sales for new homes in the Greater Toronto Area (GTA), finds the Building Industry and Land Development Association's (BILD) latest monthly stats report, closing out one of the new home market's worst years on record with a foreboding thud.

“2024 will go down as a historic year, with December’s new home sales hitting their lowest point in nearly 40 years and the whole year producing the lowest annual total since 1990,” said Edward Jegg, Research Manager at Altus Group. “As 2025 begins, new home buyers remain unwilling to re-enter the market despite lower mortgage rates, falling prices, and elevated inventories.”

Over the course of the entire year, BILD recorded 9,816 new homes sales in the GTA, representing a 47% year-over-year decrease and landing us 69% below the 10-year average. In the month of December there were a meagre 319 sales, down 46% from December 2023 and 80% below the 10-year average.

In December, total sales were roughly split between condominium apartments and single-family homes, with 150 and 160 sales, respectively. For condos, which faced historically low demand in 2024, this meant a 63% year-over-year drop in sales, putting numbers 86% below the 10-year average. Single-family homes faired better on an annual basis, posting a 1% decrease from December 2023, but still remaining 62% below the 10-year average.

“We are literally watching the foundation of the next housing crisis being laid today," said Justin Sherwood, Senior Vice President of Communications, Research, and Stakeholder Relations at BILD. "December’s new home sales and the low new home sales seen throughout 2024 in the GTA illustrate the problem the region is facing adding new housing supply."

Over the course of 2024, BILD has made repeated pleas for government action to make home building more affordable in order to both reduce costs for end users and ensure the GTA delivers enough homes to meet current and future housing needs.

“While the resale market has shown some signs of life thanks to lower rates, new builds are continuing to face a ‘cost to build’ challenge. Skyrocketing construction costs, soaring financing rates, and increasingly high municipal fees over the last five years have made it financially impossible to build homes that the market can, and is willing to, absorb at present prices," says Sherwood. "Sales have plummeted and housing starts are sliding - and will continue to follow the sales trajectory. Without immediate action from governments to reduce development charges and municipal fees, the future housing supply of the GTA is in peril.”

Despite the lack of sales, total new home remaining inventory ticked down month over month, from 21,97 units in November to 21,787 units, comprised of 16,967 condos and 4,820 single-family homes. This brings the combined inventory level from 14.1 months down to 14 months, more or less consistent with what we've seen throughout 2024.

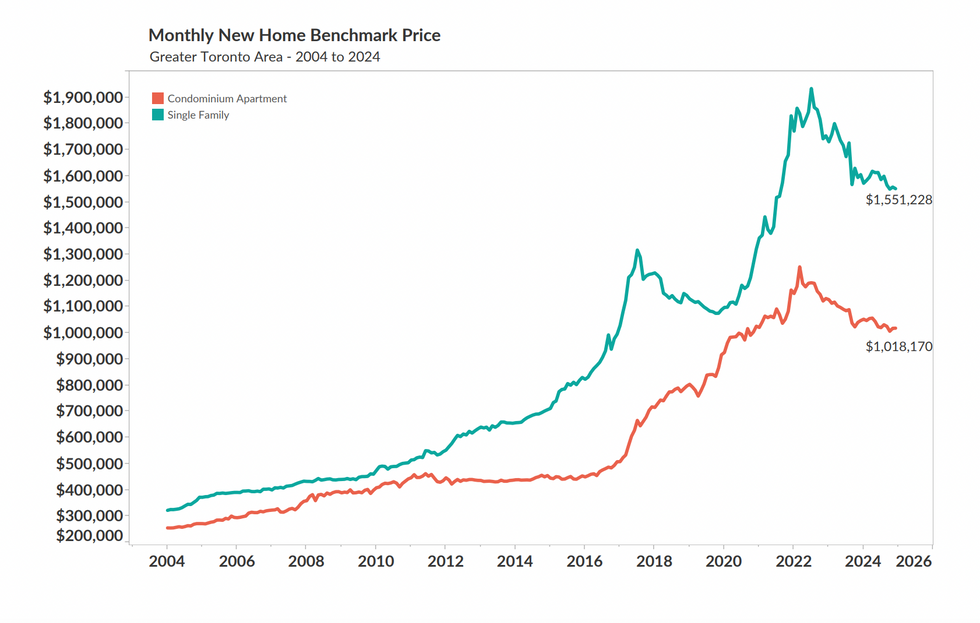

On the price front, the benchmark home price is on the decline in the GTA. The benchmark price for new condominium apartments was $1,018,170, down 2.8% over the last 12 months and single-family home prices are sitting at $1,551,228, down 3.4% over the last 12 months.

- New Home Construction In Trouble As Prices See Biggest Drop Since 2009 ›

- November Was A "Historically Busy" Month For Housing Starts, And It's Still Not Enough ›

- GTA New Home Sales "Continued To Languish" In November ›

- 'Prime Time For Buyers': GTA New Home Prices Down 20% From Peak ›

- "Rock Bottom": GTA New Home Sales See Worst February On Record ›

- GTA New Home Sales Hit "Rock Bottom" (Again) In March ›