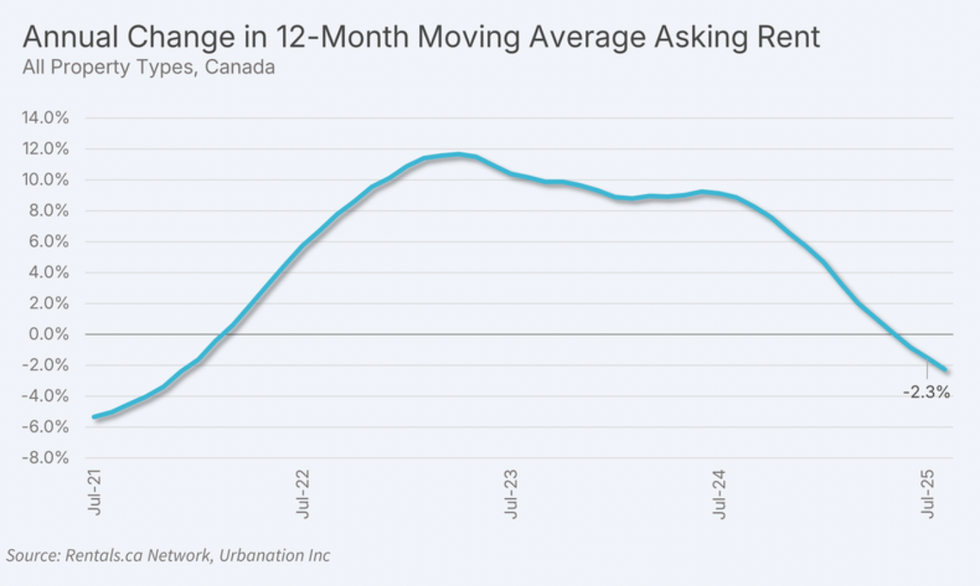

Midway through what Rentals.ca is calling an "uneventful summer," the latest national rent report from the real estate listings and data platform reveals rents continued to fall in July. While dipping a nominal $4 from June, national average rent fell 3.6% year over year from $2,201 to $2,121, marking the 10th consecutive month of annual rent decline.

The $80 difference represents a continued cooling trend that took hold last fall and that has meant improved affordability for renters who were already facing extremely high rents (as well as a less fruitful times for many investors). Behind the reversal of rent growth is a record level of new supply coming online as immigration levels have been dramatically reduced, lifting vacancy rates and forcing landlords to lower rents.

But while rents have been on the decline in recent months, the report points out that the amount coming out of Canadians' pockets each month is still 11.1% higher than it was three years ago, and 2% higher than two years ago.

Looking ahead, the report suggests rent decline is "compounding," as rents fell annually by a greater amount in July than in June, when they slid 2.7%, and as we head into the quieter second half of the year.

“Canada’s rental market is experiencing a prolonged softening phase, with price declines accelerating across most provinces and unit types,” said David Aizikov, Manager of Data Services at Rentals.ca. “With the seasonal peak now behind us, we expect continued downward pressure on rents heading into the fall.”

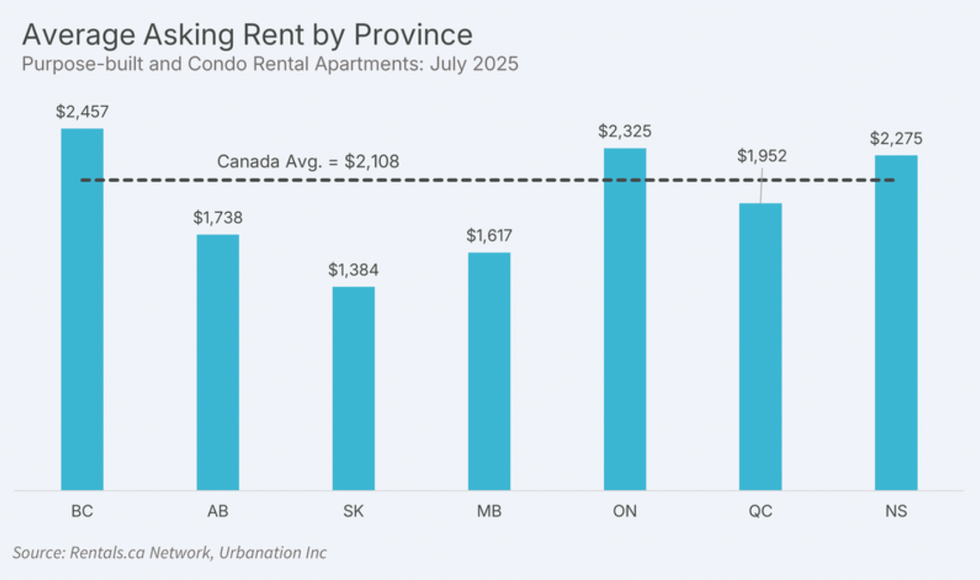

But depending on where you live in the country, current and future trends may deviate from the national narrative. If you're a rental investor in Saskatchewan, Alberta, or Manitoba, for example, you've benefitted from rents skyrocketing by 32%, 27%, and 21% since 2022, respectively. But despite the impressive rent growth, apartments in the Prairies remained some of the most affordable in July, home to seven of the ten most affordable markets in the country. This includes Lloydminster, Alberta ($1,203), Regina, Saskatchewan ($1,408), and Winnipeg, Manitoba ($1,619), as of July.

In comparison, July saw BC and Nova Scotia post some of the largest annual declines, with average rent in Nova Scotia falling 5.0% to $2,275 and 4.4% to $2,475 in British Columbia. In third place was Ontario, where rents fell 3% year over year to $2,325. Municipally, North Vancouver maintained its spot as the most expensive rental market in the country ($3,043), but rents in Vancouver fell 7.0% to $2,830, second only to Calgary, which saw rents decline 7.9% to $1,927.

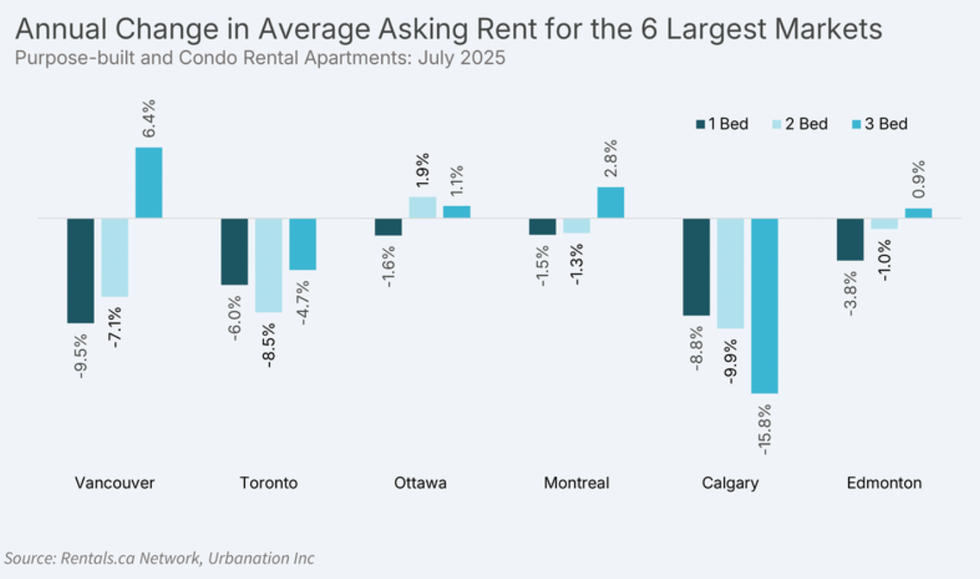

Looking at unit types, one bedrooms continued to struggle in much of BC, Alberta, and Ontario, where they fell 5.7%, 5.3%, and 5.1%, respectively, on an annual basis in July. Even in Saskatchewan, Manitoba, and Nova Scotia, where one bedrooms enjoyed some growth in previous months, in Saskatchewan specifically, that growth slowed to 1.8%, to 0.4% in Manitoba, and dipped by 0.8% in Nova Scotia.

On the other hand, three-bedroom units have shown continued "resilience and growth," reads the report. The larger unit type either led growth or saw the smallest declines in four of the country's six largest markets, only lagging in Ottawa, where two-bedrooms were stronger by 0.8% and in Calgary, where they fell 15.8%. But over the longer term, studios have performed the best over the last three years with an 11.4% growth in rents over two years and 19.7% over three years.

Finally, zooming out by product type, rents for purpose-built rental units slid 1.7% to an average of $2,095 in July, condo apartments fell 5.7% to $2,202, and houses/townhouses dropped 8.2% to $2,170. But where condos and houses/townhouses have seen relatively flat rents over the last three years, purpose-built rents have increased 23% since 2022.

Still, rents in primary markets remain lower than secondary market rentals (about $26 below the national average), and that's without factoring in incentives offered to fill units — a lever that landlords are increasingly using in cities like Toronto and Vancouver.

- Rent Control In Ontario: 'Destroyer Of A City' Or Necessary Protection? ›

- Ontario Lowers 2026 Rent Cap To 2.1%, Tightest In Four Years ›

- Low Immigration, High Supply Pull Rents Down For Ninth Straight Month ›

- Rental Market Drives Canadian Housing Starts To Multi-Year High ›

- August Marks 11th Consecutive Month Of National Rent Decline ›

- Housing Starts Fall 16% In August, Pointing To Construction Slowdown ›