As if taking cues from Mother Nature, real estate activity throughout the Muskoka region cooled in September, falling from last year's record to more "normal" levels.

According to recent data from the Canadian Real Estate Association (CREA), sales of both waterfront and non-waterfront properties were down from their respective records last September. However, it still managed to be a "solid" month.

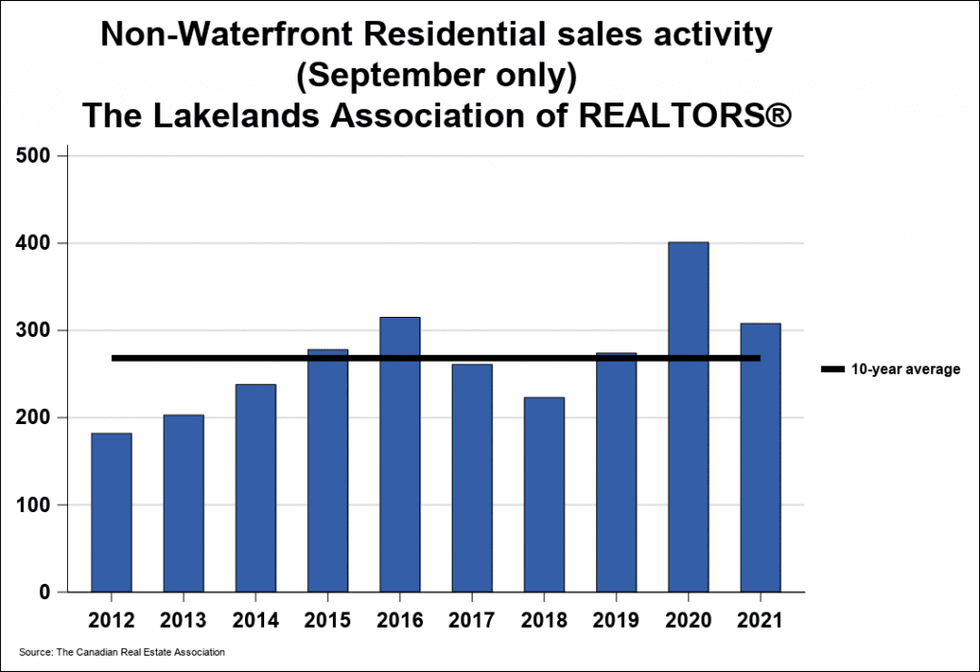

In September, residential non-waterfront sales activity recorded through the MLS system for the Lakelands region reached 308 units -- a decrease of 23.2% year-over-year. But, for greater context, that same sales category remained 5% over the five-year average and 14.8% above the 10-year average for September.

On a year-to-date basis, residential non-waterfront sales reached a record 2,939 units over the first nine months of the year, up 13.4% over the same period in 2020.

READ: Muskoka's August Realty Market Remained "Firmly in Sellers' Territory"

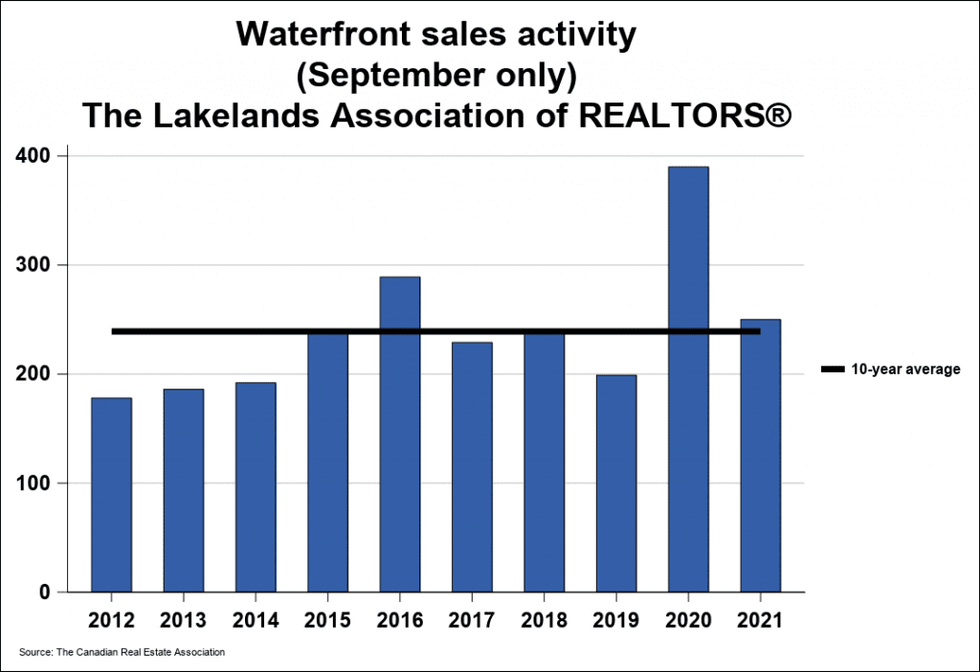

Sales of waterfront properties also slowed in September with 250 units sold, marking a decrease of 35.9% from the same period in 2020. Waterfront sales were 4.4% below the five-year average but 4.6% above the 10-year average for September.

On a year-to-date basis, waterfront sales totalled 2,002 units over the first nine months of the year, falling modestly by 2.5% from the same period in 2020, according to the national real estate association.

However, while last months' year-over-year decline in sales is notable, Ross Halloran of Halloran & Associates, Sotheby's International Realty Canada, says that when comparing September 2020 to 2021, the trends in Muskoka are directly linked to historically low inventory levels of waterfront properties over the past three years.

"Buyer demand still remains strong this fall, with many cottage properties continuing to receive multiple offers well into October," said Halloran. "In short, when it comes to attracting buyers to increase current fall sales trends in cottage country, the message is clear, 'List it, and they (the buyers) will come.'"

According to the MLS Home Prince Index -- which tracks price trends far more accurately than is possible using average or median price measures -- the overall MLS HPI single-family benchmark price was $628,500 in September, advancing 32.1% on a year-over-year basis.

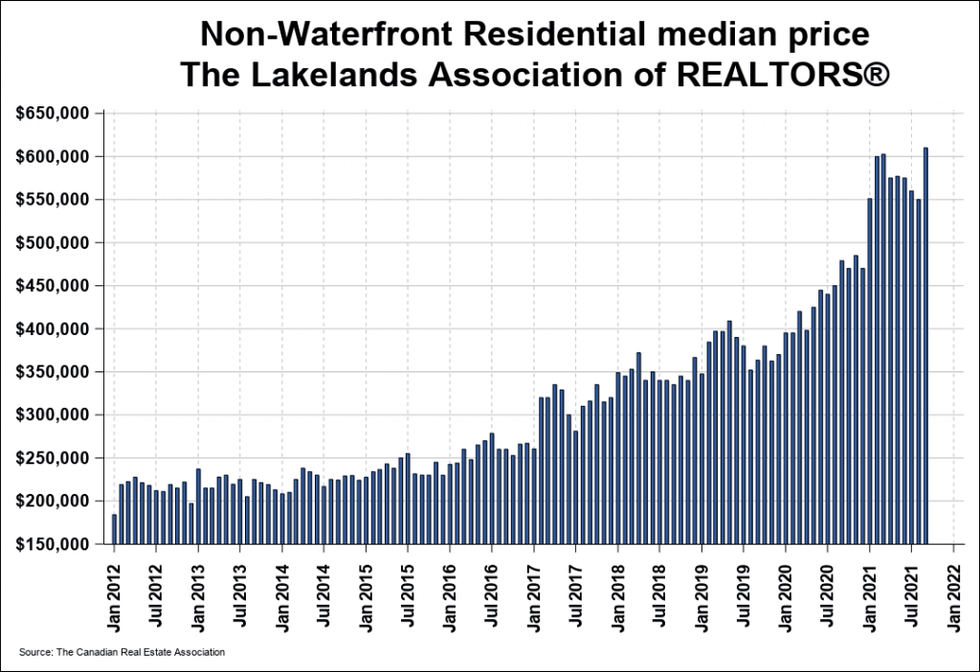

For residential non-waterfront property sales, the median price in September was a record $610,000 -- a 27.3% year-over-year gain. At the same time, CREA said the more comprehensive year-to-date residential non-waterfront median price was $576,000, a jump of 33.7% from the first nine months of 2020.

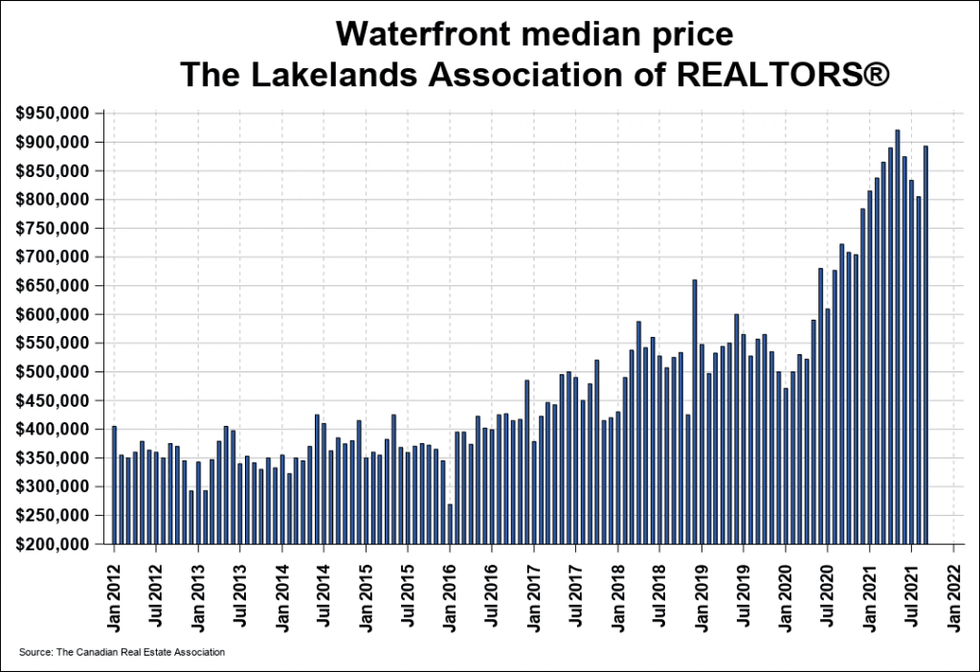

Meanwhile, in September, the median price for waterfront property sales was $893,000, up 23.6% year-over-year, while the total year-to-date median price for this property category was $872,000, climbing 36% from the first nine months of 2020.

CREA said the total dollar value of all residential non-waterfront sales in September was $202.4 million, falling by 2.3% from the same month in 2020. On the other hand, waterfront sales totalled $333.1 million, declining by 17.8% from the same month in 2020.

"Price gains for both property types are still going strong at more than 20% year-over-year but have cooled significantly from the more extreme jumps of over 40% seen earlier in the year," said Chuck Murney, President of the Lakelands Association of Realtors.

"Overall supply levels continue trending at record lows, so it's unlikely that the upward pressure on prices will subside in a meaningful way in the near future as long as these trends persist."