Mortgage Insurance

Explore mortgage insurance in Canadian real estate — how it works, who it protects, and what homebuyers need to know when putting less than 20% down.

May 22, 2025

What is Mortgage Insurance?

Mortgage insurance protects the lender—not the borrower—in case the borrower defaults on a high-ratio mortgage with a down payment under 20%.

Why Mortgage Broker Fees Matter in Real Estate

In Canada, mortgage insurance is mandatory for insured mortgages. It is typically provided through the Canada Mortgage and Housing Corporation (CMHC), Sagen, or Canada Guaranty.

Key characteristics include:- Required for down payments between 5% and 19.99%

- Premiums are based on the loan-to-value (LTV) ratio

- Cost is often added to the mortgage principal

Although it protects the lender, it enables buyers to enter the housing market with less capital. Premiums are non-refundable and do not reduce mortgage interest.

Understanding mortgage insurance helps buyers plan for total costs and choose between insured and conventional mortgages.

Example of Mortgage Insurance in Action

A buyer with a 10% down payment pays a 3.1% CMHC insurance premium, which is added to their mortgage balance.

Key Takeaways

- Required for down payments under 20%.

- Protects lenders, not borrowers.

- Premium varies with LTV ratio.

- Enables lower entry costs for buyers.

- Offered through approved insurers.

Related Terms

- CMHC Insurance

- Loan-to-Value Ratio (LTV)

- Down Payment

- Government Incentive

- Pre-Approval

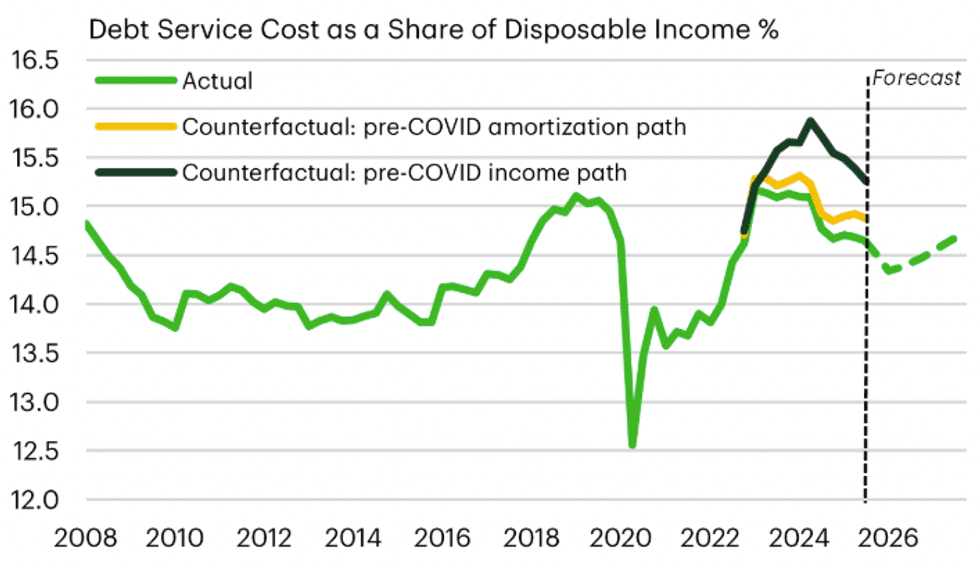

Income growth and longer amortizations are blunting mortgage shock/Statistics Canada, TD Economics

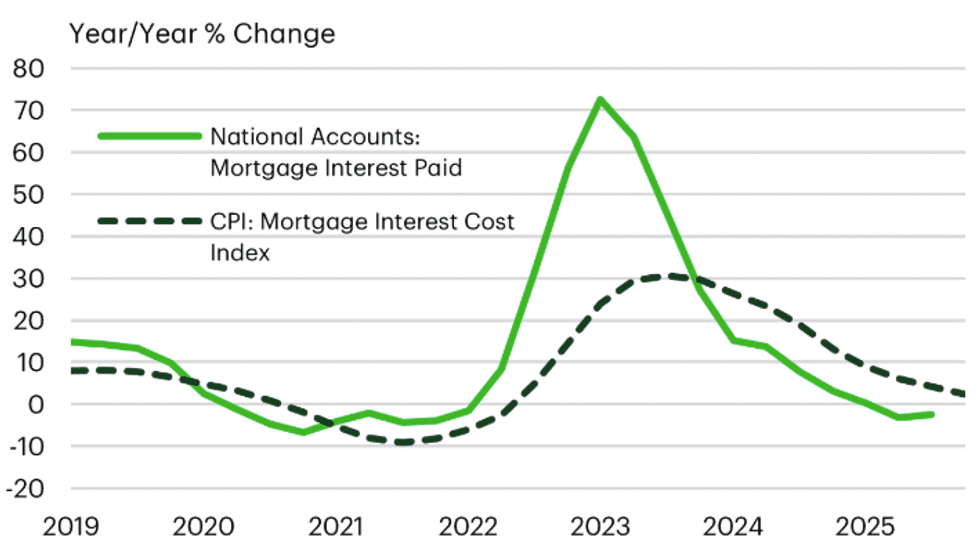

Income growth and longer amortizations are blunting mortgage shock/Statistics Canada, TD Economics Canada's mortgage interest cost index is nearing deflation/Statistics Canada, TD Economics

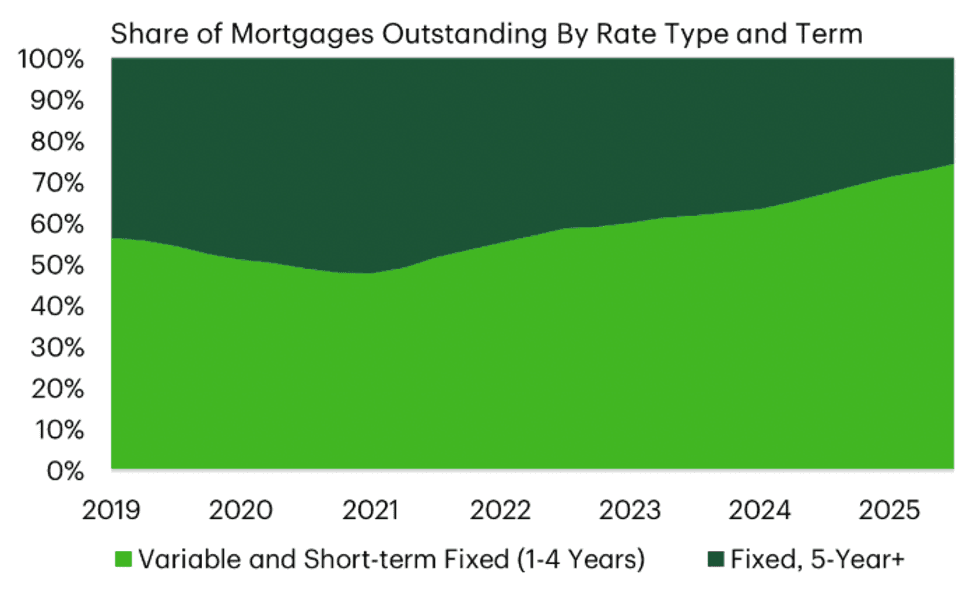

Canada's mortgage interest cost index is nearing deflation/Statistics Canada, TD Economics Canada's mortgage stock is more rate-sensitive today/Bank of Canada, TD Economics

Canada's mortgage stock is more rate-sensitive today/Bank of Canada, TD Economics

Manuela Preis/Instagram

Manuela Preis/Instagram