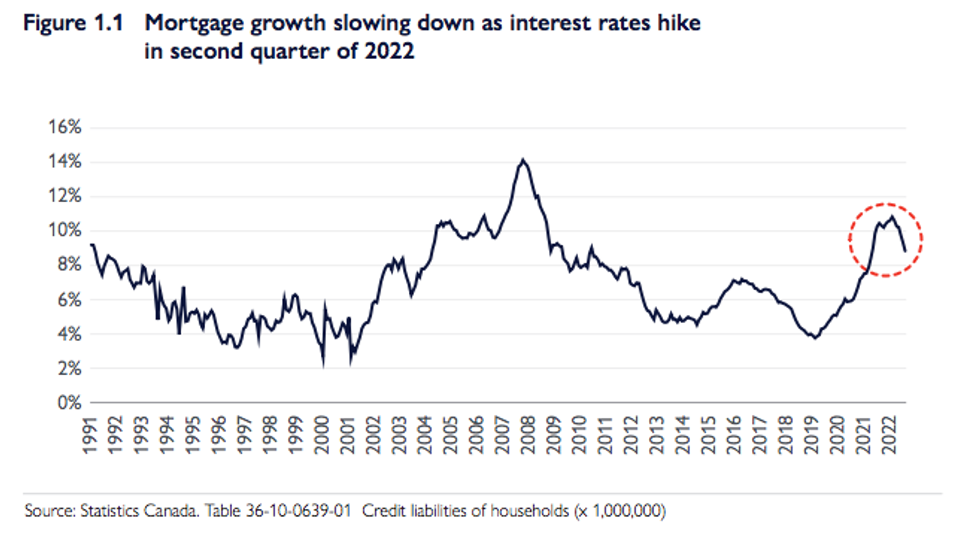

Canadian mortgage growth softened in the second quarter of 2022 -- an unmistakable indication of the interest rate environment -- but households are still facing record levels of real estate debt.

This is according to the latest Residential Mortgage Industry Report from the Canada Mortgage and Housing Corporation (CMHC), released Wednesday. The report examines the mortgage industry landscape and mortgage market trends as of Q2 and Q3 2022.

CMHC’s data shows that residential mortgage debt has observed sluggish growth since the first Bank of Canada interest rate hike in March 2022, reaching $2.05T in August 2022.

“An economic environment tinted by uncertainty, rising interest rates and inflationary pressure has contributed to the decrease in new mortgage originations in the first two quarters of 2022,” says the national housing agency. In that timeframe, chartered banks saw a 7.9% drop in originated mortgage loans, mortgage loans for property purchases dropped by 5.5%, and refinances fell by 13.3%. In addition, non-bank mortgage lending activity fell by more than 23% year over year.

That said, debt levels were still up YoY, climbing 8.8% between August 2021 and August 2022.

On another note, CMHC’s report finds that, since June, consumers are favouring fixed-rate mortgages with shorter-term commitments over mortgages with terms of five years or more. Meanwhile, ratios of mortgage loan approvals to applications declined in the first two quarters of the year, reflecting the “increasingly difficult” reality for borrowers when it comes to loan qualifications and the stress test.

Still, approval rates in 2022 remain above pre-pandemic levels.

Mortgages in arrears were also down across all lender types by the end of Q2, continuing on a months-long downward trend and indicating that “Canadian mortgage loan consumers were not only able to continue making their payments on time, but a larger share of were able to do so.”

Credit unions saw the lowest rate of mortgages in arrears, down to 0.10%, followed by mortgage finance companies trusts, and insurance companies, at 0.12%, chartered banks, at 0.14%, and mortgage investment entities, at 0.69%.