Loan Origination

Learn what loan origination is in Canadian mortgage lending, what steps are involved, and how borrowers complete the approval and funding process.

May 30, 2025

What is Loan Origination?

Loan origination is the full process of creating, reviewing, and approving a new mortgage or loan, from initial application to final funding.

Why Does Loan Origination Matter in Real Estate?

In Canadian real estate, loan origination involves multiple steps and stakeholders, including the borrower, broker, lender, and underwriter.

Steps in loan origination include:

- Pre-approval or prequalification

- Mortgage application and documentation

- Credit review and underwriting

- Appraisal and title verification

- Loan approval and funding

Origination may involve fees, especially in private or complex lending scenarios. These fees should be disclosed up front in writing.

Understanding loan origination helps borrowers navigate the mortgage process and prepare documentation efficiently to avoid delays.

Example of Loan Origination in Action

The borrower completes the loan origination process, including credit review and appraisal, and receives funding two days before closing.

Key Takeaways

- Covers full mortgage processing from start to finish.

- Includes documentation, underwriting, and funding.

- May involve fees and third-party services.

- Critical to securing home financing.

- Must comply with regulatory timelines.

Related Terms

- Mortgage Application

- Underwriting

- Lender Disclosure

- Broker Disclosure

- Origination Fee

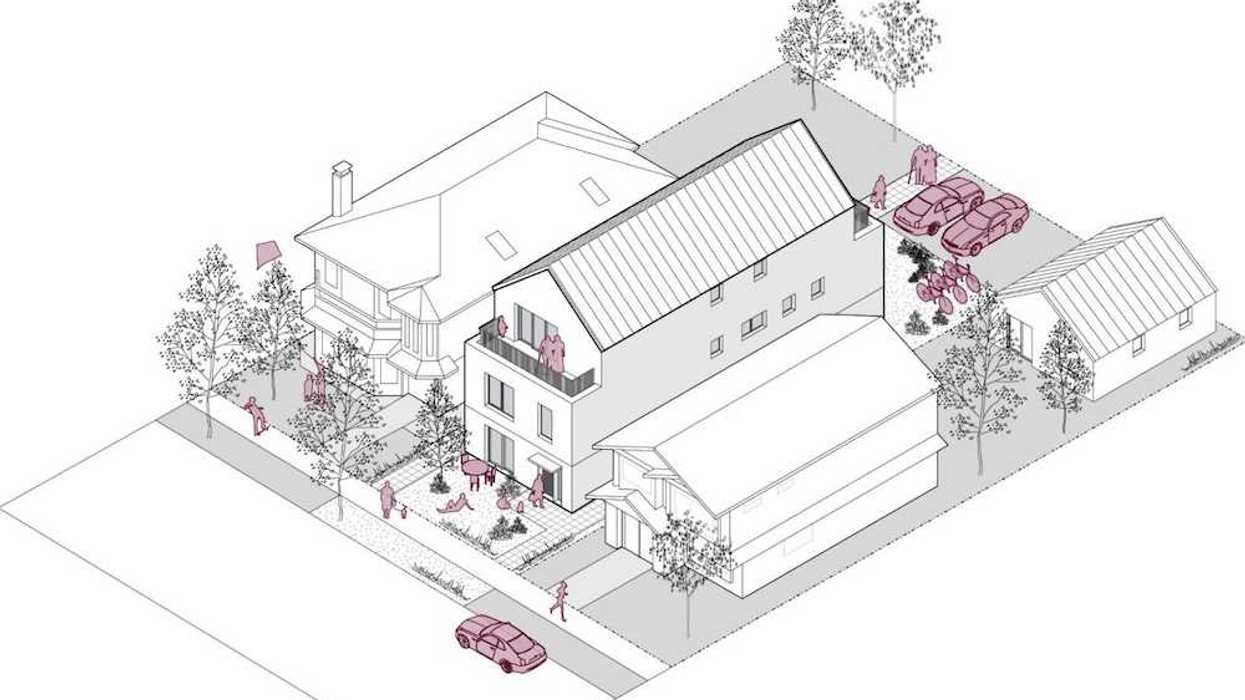

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

Rendering of 9 Shortt Street/CreateTO, Montgomery Sisam

Rendering of 9 Shortt Street/CreateTO, Montgomery Sisam Rendering of 1631 Queen Street/CreateTO, SVN Architects & Planners, Two Row Architect

Rendering of 1631 Queen Street/CreateTO, SVN Architects & Planners, Two Row Architect Rendering of 405 Sherbourne Street/Toronto Community Housing, Alison Brooks Architects, architectsAlliance

Rendering of 405 Sherbourne Street/Toronto Community Housing, Alison Brooks Architects, architectsAlliance

The Yonge Corporate Centre at 4100-4150 Yonge Street. (Europro)

The Yonge Corporate Centre at 4100-4150 Yonge Street. (Europro)

Jon Sailer

Jon Sailer