Minimum parking requirements are increasingly being reconsidered across North America, and whenever discussions arise, it's almost always as it relates to residential development.

However, for reasons not dissimilar to those regarding residential development, minimum parking requirements are also on the minds of those involved in industrial development.

On Wednesday, NAIOP Vancouver, the commercial real estate development association, and Bunt & Associates, the transportation planning firm, published a first-of-its-kind report examining minimum parking requirements for industrial sites.

The question: with British Columbia having the tightest industrial market in the country, would reducing minimum parking requirements help make more efficient use of what little industrial land we have?

The sample size: 62 industrial sites across 15 municipalities in the Metro Vancouver and Fraser Valley region, with Surrey (10), Burnaby (8), Delta (6), Vancouver (5), and Richmond (5) making up over half of the sample.

The conclusion: after visiting each of the sites and observing the parking utilization during peak hours (Tuesdays, Wednesdays, and Thursdays between 9:00 am and 11:00 am), they found that industrial sites in the Lower Mainland generally have an oversupply of parking by about 50%.

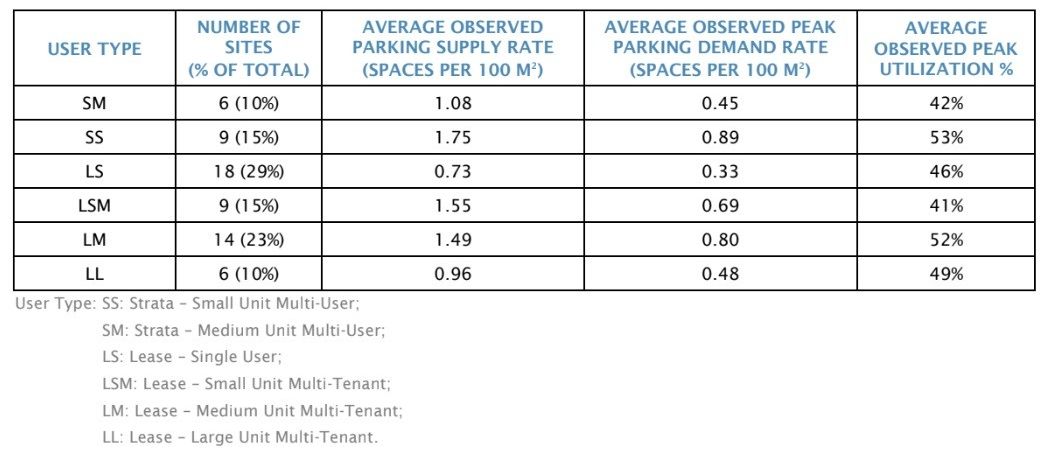

Industrial sites that the team visited included a diverse mix in terms of size (less than 30K sq. ft, between 30K sq. ft and 100K sq. ft, over 100K sq. ft), type of tenure (leasing, strata), and proximity to transit (four letter grades). The findings were equally as diverse.

By size and tenure, the results were relatively even across the board, with all surveyed sites seeing a parking utilization rate between 41% and 53%.

Parking utilization rates varied significantly from city to city.

"Sites in municipalities closer to the Metro Core tend to have higher parking utilization on average," said Bunt & Associates, who frequently serve as transportation consultants on individual development projects. "The highest parking utilization was observed at Vancouver sites, with an average utilization of 70%. North Vancouver followed closely with a utilization of 63%. The lowest parking utilization was observed at Richmond sites, with an average utilization of 32%. Chilliwack followed closely with a utilization of 34%."

Those who are familiar with the cities may be quite surprised by those numbers, perhaps skewed by the sample size and location, but the overall message is relatively clear: only two of the 62 sites — 1237 Welch Street in North Vancouver and 6971 72 Street in Delta — saw a parking utilization rate of over 90% and the vast majority were under 50%.

The largest site surveyed is perhaps the most exemplary of the issue. The site is 19055 Airport Way in Pitt Meadows, which is also known as the 189-acre Golden Ears Business Park by Onni Group. According to the study, the Golden Ears Business Park includes a whopping 1,083 parking spots, but has a peak parking utilization rate of just 49%, meaning over 500 parking spots across the site are almost always going unused.

And while parking included in residential developments is provided in underground parkades, the vast majority of parking provided on industrial sites is provided on the surface. The average size for parking stalls can vary from site to site, but are usually around 300 sq. ft, which means 500 excess parking spots amount to 150,000 sq. ft of land, which is enough for a whole other large industrial site that could bring further economic production and jobs.

"The thing about industrial is there's such a variety of uses," says Carl Funk, Director of Industrial Planning & Development for Beedie — one of the larger industrial developers in BC, with industrial projects also in Alberta, Ontario, and Nevada. "For residential, you have one-bed, two-bed [units] and you can then get a pretty good idea of the parking count. Across the board [for industrial], it looks like we're overparking all of these sites."

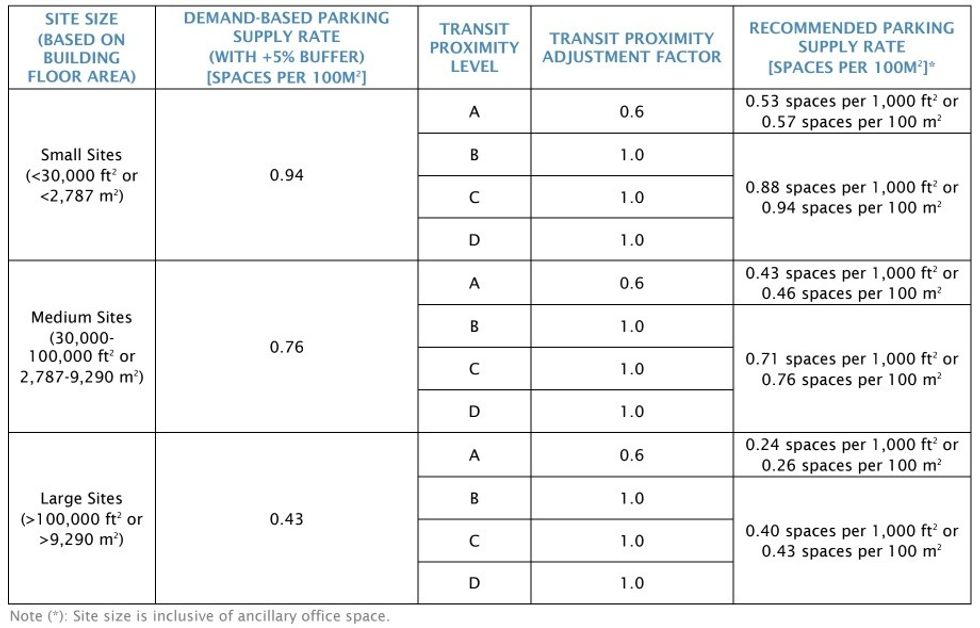

Accordingly, Bunt & Associates concluded their report with recommended parking ratios, varying by the size of the site, demand, and proximity to transit. For sites with decent to poor access to transit, Bunt & Associates concludes that a good parking ratio would be 0.94 parking spaces per 100 sq. m for small sites, 0.76 spaces per 100 sq. m for medium sites, and 0.43 spaces per sq. m for large sites. For sites with the best access to transit, the ratios can be reduced by 60% to 0.57 spaces, 0.46 spaces, and 0.26 spaces, respectively.

As was the case with residential developments, these discussions are about minimum requirements and developers can always provide more than the minimum when it's needed — a point that is often glossed over.

"There might be a situation when a company comes in looking to build a new building and, for whatever reason, might require more parking — that should be allowed," says Funk. "We need that flexibility. Allow the builder to build more industrial, but if they need more parking, that would be okay, too. Right now, it just seems like these bylaws are restricting more than they should be."