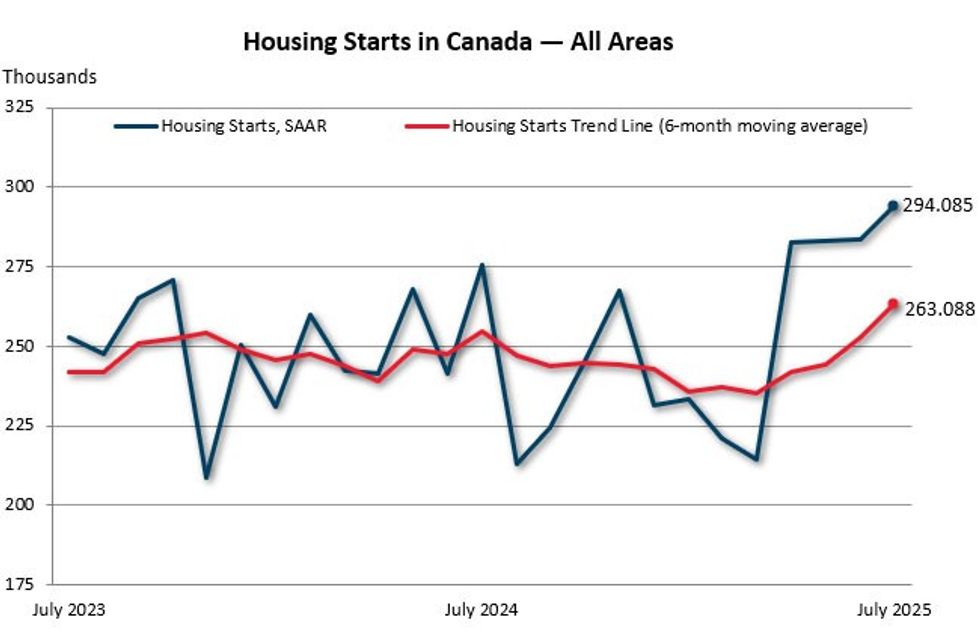

At the national level, housing starts continued to show growth in July, according to the latest data shared by the Canada Mortgage and Housing Corporation (CMHC). The agency reported that the total monthly seasonally adjusted annual rate (SAAR) of starts hit a multi-year high, rising by 4% from 283,523 units in June to 294,085 units last month.

Tania Bourassa-Ochoa, CMHC’s Deputy Chief Economist, says the first seven months of this year have been stronger than the same timeframe in 2024, thanks largely to increased multi-unit starts in the Prairie Provinces and Québec. However, she also points out that the growth we're seeing now was initiated some time ago.

"These persistently elevated national results are reflective of investment decisions made months or even years ago, highlighting the influence of previous market conditions and builder sentiment on current construction trends," Bourassa-Ochoa says.

Commentary from TD economist Rishi Sondhi underscores that starts in July hit the highest level since September 2022, and also provides further context for this growth. "The hearty trend in homebuilding is being underpinned by the rental market, where gains have likely been supported by powerful population growth in the past and government financing programs targeting this sector."

However, right now, we're seeing economic uncertainty and slowed immigration that's preventing new housing from being proposed and pre-sold, and meanwhile, rents in some major markets are on the decline. So while Sondhi says building permit levels suggest starts will remain sturdy in the near term, he also notes that foundation pouring is likely to taper off in the longer term.

"We anticipate some cooling taking place in 2026. Population growth is slowing and asking rents are dropping in several jurisdictions. Meanwhile, building activity in the ownership market is likely to remain subdued, weighed on by past declines in pre-construction home sales," he says.

Taking a closer look at July's growth, actual year-over-year housing starts were up 4% from 22,610 units in July 2024 to 23,464 units last month, and year-to-date, starts were also up 4% at 137,875 units. Zooming out, the six-month trend in housing starts, which is a six-month moving average of SAAR of total starts, increased 3.7% to 263,088 units in July.

Regionally, starts continued to vary last month, with Canada's three largest cities — Toronto, Vancouver, and Montreal — reporting substantially different outcomes.

Starting with the strongest centre, Montreal saw a 212% year-over-year increase in actual housing starts, driven by significantly higher multi-unit starts. Alberta also saw marked growth, with Edmonton posting a 36% annual increase in starts and Calgary recording a 22% year-to-date increase despite falling 24% year over year for the month of July. Nicole Lechter, senior real estate analyst with national accounting firm RSM Canada, attributes the province's impressive numbers, in part, to a lack of rent control. "With no rent control capping returns, Alberta has become a magnet for investors and the 49,000 new residents arriving in 2025," says Lechter.

In Vancouver, despite starts rising 24% year over year, Lechter says vacancies are climbing and developers are likely to pull back, adding that Indigenous-led development could help fill the gaps. "Top-tier rates [are] already at 12.2% and slower population growth [is] tempering demand," she says. "Indigenous partnerships will help sustain momentum, as they are key to unlocking housing in the region by bypassing municipal bottlenecks, accelerating approvals, and delivering large-scale rental projects."

Meanwhile Toronto continued to struggle in July, with starts falling 69% year over year and 49% year to date, driven by a decrease in multi-unit and single-detached starts. "High development costs continue to choke new rental supply in Toronto," says Lechter. "[...] Without policy reform, the downward spiral is likely to continue."