With national resale activity picking up slightly in December, a new report from RBC Economics forecasts the housing market will reach a “cyclical bottom” in early 2023.

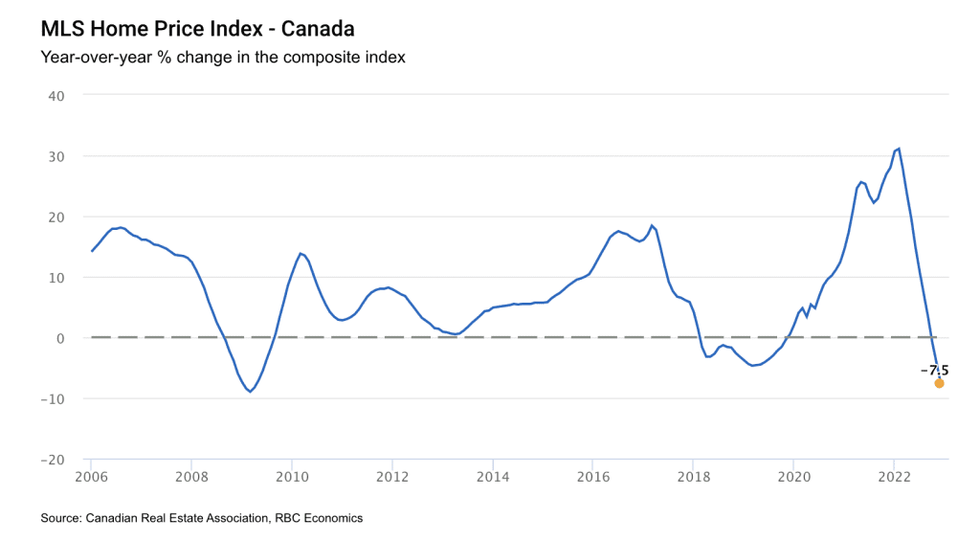

The report, authored by Assistant Chief Economist Robert Hogue, notes that home prices will still take some time to find steady ground. Canada’s MLS Home Price Index (HPI) was down 1.6% month over month in December, marking a tenth-straight month of declines. “We think it will continue to slide until spring at the earliest as poor affordability continues to weigh heavily on buyers,” writes Hogue.

READ: Canadian Home Sales Edge Up 1.3%, But Prices Continue to Slide

A slow recovery is not surprising given the trajectory of the past year. Hogue calls 2022 “a year of extremes,” pointing to the Bank of Canada’s aggressive hike campaign, which began in March, as the main driver of the market’s fall from grace.

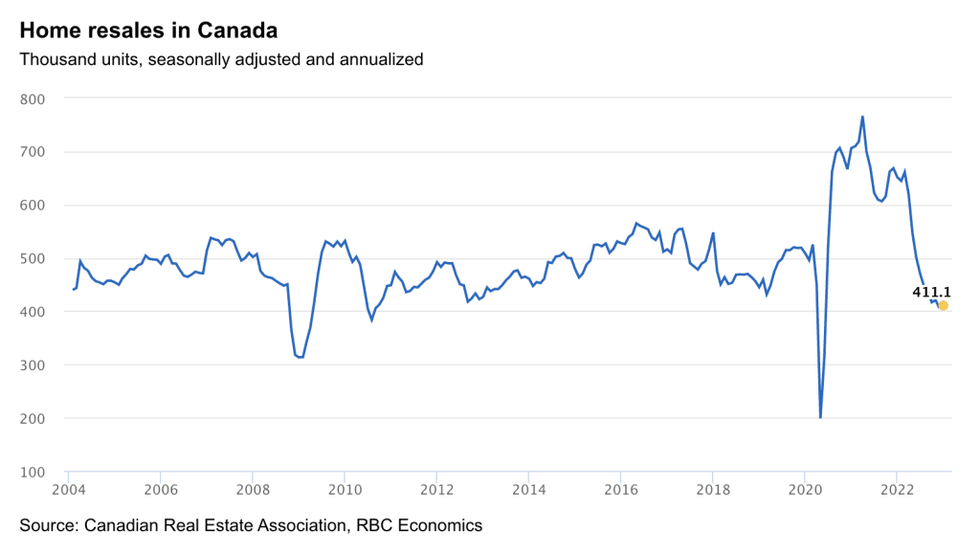

The high interest rate environment spurred a “massive correction,” which prompted home resales to sink 25% in 2022, reversing outsized gains seen in 2020 and 2021. Meanwhile, benchmark prices saw the sharpest decline on national MLS HPI record, falling 13% from the February peak.

In many provincial markets, the story was similar. In particular, BC and Ontario saw the steepest corrections, with activity dropping off 35% and 32%, respectively. Although Alberta was something of an outlier, reporting strong market activity throughout the nation-wide correction, activity in the region still saw a 1.8% decline.

By the end of 2022, activity began to stabilize in the majority of local markets, including Toronto and the rest of southern Ontario and Vancouver and the rest of Lower Mainland BC. Only a few markets in the Prairies and Quebec were yet to see signs of stabilization by the close of 2022.

Hogue notes, however, “property values have been under intense downward pressure across Canada.” At last count, the national MLS HPI was off 13% from its February peak, and local markets are yet to see prices bottom out.

In Ontario, for example, the index is off more than 20% in some markets, including Hamilton, Kitchener-Waterloo, Cambridge, Brantford, and London. In Toronto, the index is down 14%, and in Vancouver, it’s down 8%. Calgary and St. Johns are among the few markets that have “bucked” the price correction trend.

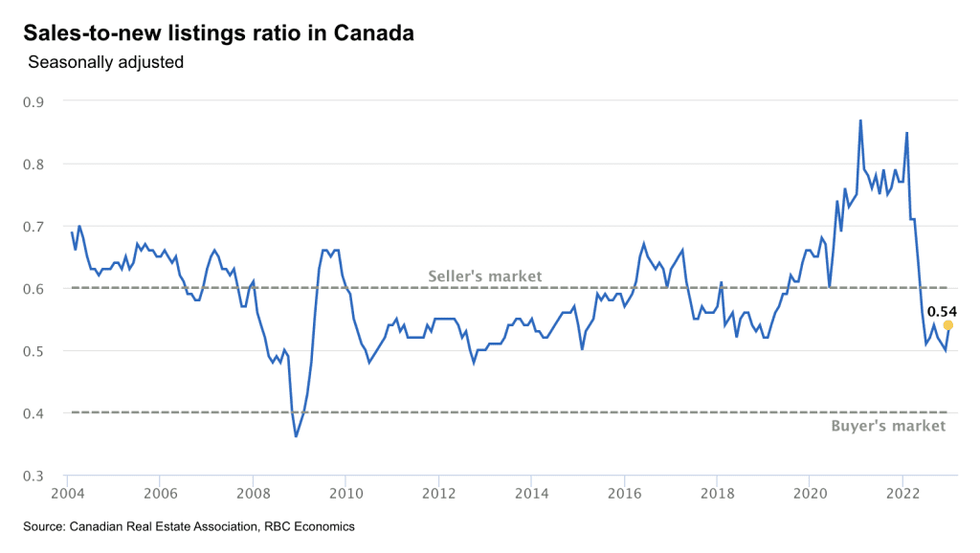

“We expect prices to depreciate further in the near term,” writes Hogue. “While the bottom for activity may be reached soon, buyers will continue to contend with poor affordability for some time. Another likely rate hike from the Bank of Canada later this month could make things even more challenging for some. Still, we think the pace of price declines will continue to ease gradually thanks to stable demand-supply conditions. These have in fact tightened slightly in December following a 6% month-over-month drop in new listings.”

He adds that as sellers eventually return to the market -- some forced to as they struggle to keep up with mortgage payments in the high interest rate environment -- more listings will come online.

Hogue concludes, “With the cyclical low point in sight, attention will soon turn to the market’s next chapter. We expect the upcoming recovery to be a largely muted affair at first. Higher interest rates and stretched affordability will continue to be huge issues for buyers throughout 2023 — and possibly beyond. This is poised to keep activity quiet and limit any price gains. Strong population growth will eventually heat things up.”