Housing Affordability

Understand housing affordability in Canadian real estate — how it's measured, why it matters, and what impacts access to affordable housing.

May 22, 2025

What is Housing Affordability?

Housing affordability refers to the relationship between household income and the cost of purchasing or renting a home in a given market.

Why Housing Affordability Matters in Real Estate

In Canadian real estate, housing affordability is a critical measure of how accessible housing is for different segments of the population. It is influenced by:- Home prices and rental rates

- Interest rates and mortgage terms

- Household income and employment stability

- Government policies and incentives

Affordability is often assessed using metrics like the price-to-income ratio or shelter cost-to-income ratio. When housing costs exceed 30% of gross household income, the situation is generally considered unaffordable.

Understanding housing affordability is essential for buyers, policymakers, and developers seeking to address housing access and plan sustainable communities.

Example of Housing Affordability in Action

In a major city, the average household spends over 45% of its income on housing, indicating a significant affordability challenge.

Key Takeaways

- Measures how income relates to housing costs.

- Affects buyer access and policy decisions.

- Exceeds 30% = generally unaffordable.

- Influenced by prices, rates, and income.

- Key issue in urban planning and supply policy.

Related Terms

- Debt Service Ratios

- Government Incentive

- Mortgage Qualification

- Interest Rate

- Down Payment

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps)

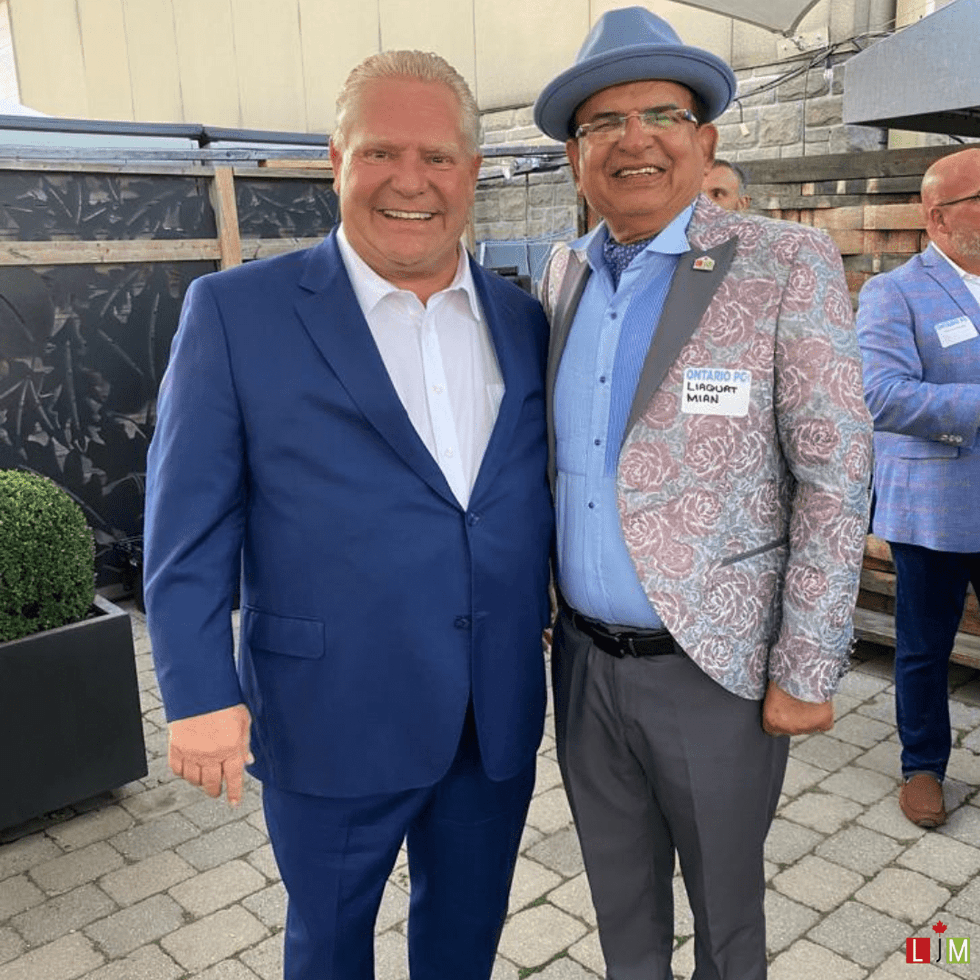

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps) Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)