In news that comes as no surprise to today’s first time homebuyers, in a recent report, RBC economist Robert Hogue states that buying a home has never been more unaffordable in Canada.

Not that any would-be homebuyer needs the reminder, right?

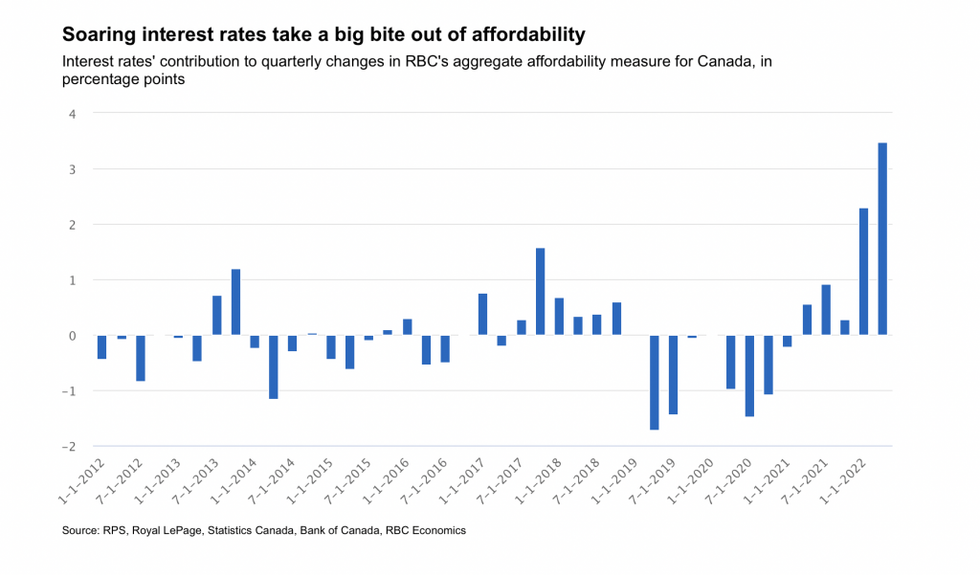

While home prices across the country have softened in recent months after a red-hot two-year run, Hogue highlights how surging interest rates have driven home ownership costs to record-high levels. The Bank of Canada has steadily hiked up its rates since March, something Hogue says has added hundreds of dollars to mortgage payments that come with a home purchase. “This, along with the jump in property values during the pandemic, have made it more difficult than ever to become a homeowner in Canada,” he writes.

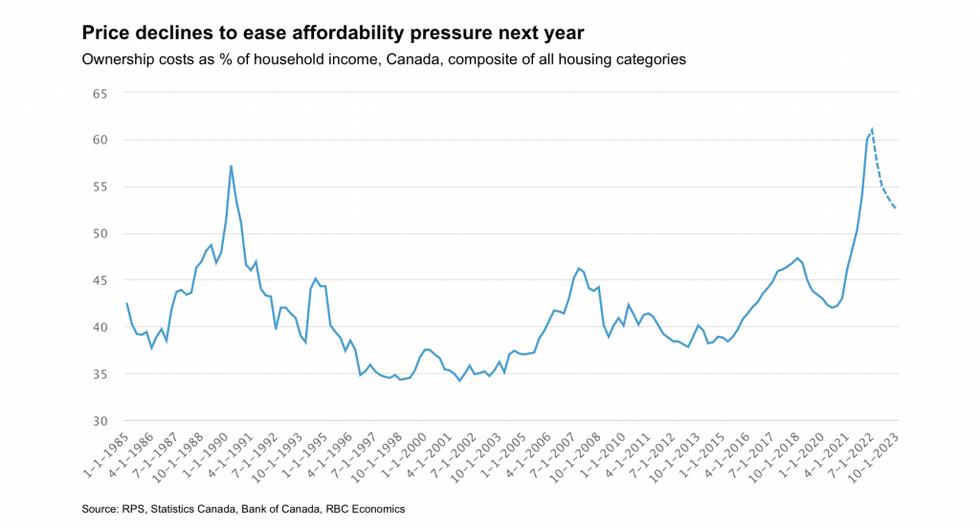

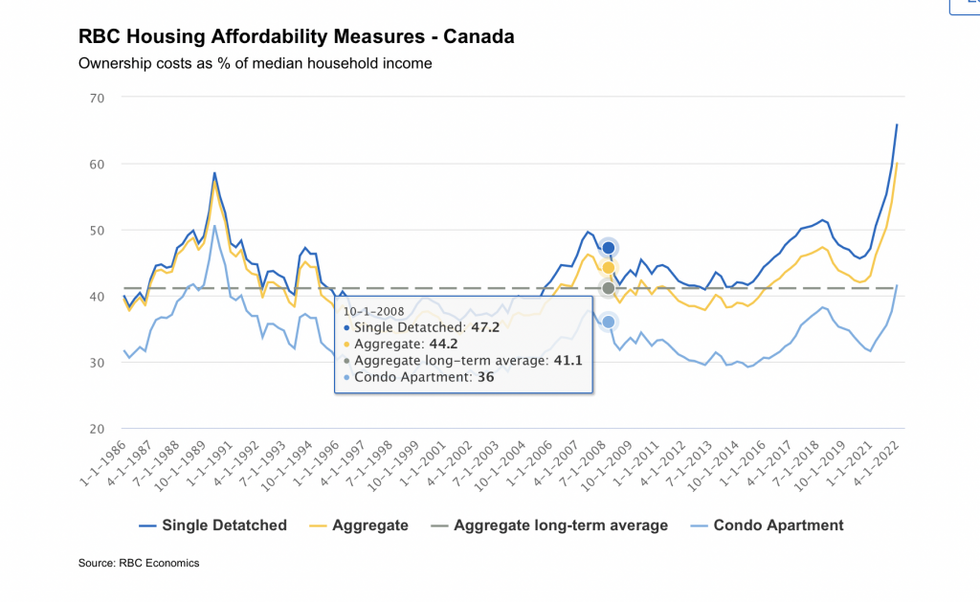

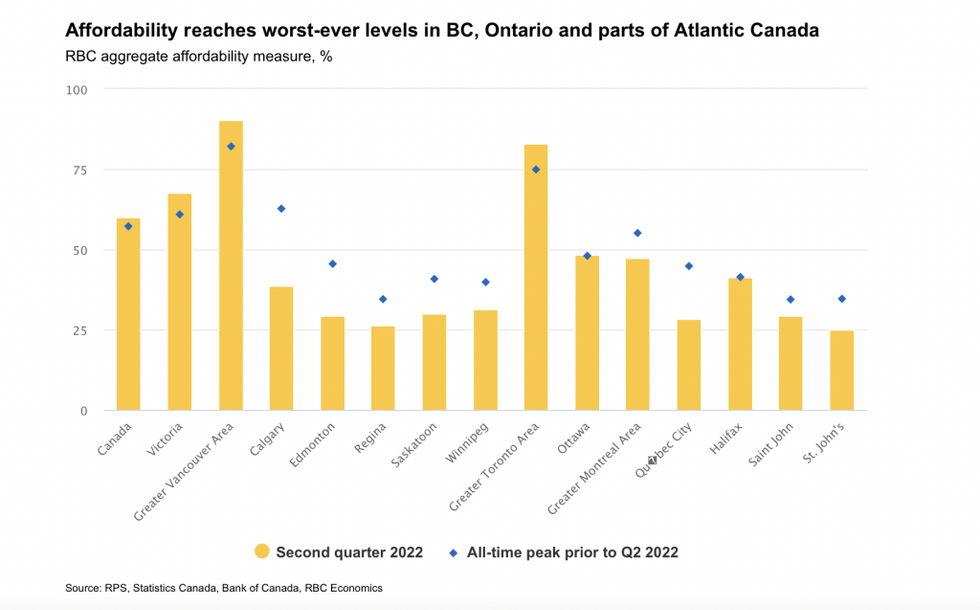

Hogue highlights that RBC’s national aggregate affordability measure -- which represents loss of affordability -- reached 60% in the second quarter of the year, surpassing the previous worst-ever point (57%) in 1990. This figure hit 90.2% in Vancouver and 83% in Toronto.

READ: Nearly Half of Canadians Putting Homebuying Plans on Hold Due to Rate Hikes

"The frenzy that drove resale activity and prices to incredible heights at the start of this year is gone," writes Hogue. "Many buyers have been forced to the sidelines either because they no longer qualify for a mortgage or have seen their purchasing budget drastically reduced. Home resales have plummeted more than 30% since February and prices are now softening, especially in Ontario and parts of British Columbia."

But it wasn’t just the infamously expensive cities like Toronto and Vancouver where housing affordability worsened thanks to climbing rates, says Hogue. It happened pretty much everywhere in Canada. “The deterioration over the past year has been off the charts in most markets, with only parts of the Prairies and Quebec having experienced deeper erosion in the past,” writes Hogue.

Hogue acknowledges that buyers in Ontario and British Columbia (BC) remain extremely challenged, but that conditions are still “manageable” in the Prairies and most of Atlantic Canada and Quebec.

There is some good news for buyers, however -- even in the pricier provinces. Hogue says that home price declines that we’ve seen since the early spring will eventually being relief to buyers. “The sharp housing market correction that began this spring is rolling back some of the spectacular price gains made during the pandemic,” writes Hogue. ”We expect benchmark prices to fall 14% nationwide by next spring -- more so in Ontario and BC. This should help lower ownership costs next year. But the likelihood of further rate hikes from the Bank of Canada is poised to intensify affordability pressures before then.”

But, in the meantime, countless homebuyers (in theory, at least) will face financial challenges on the home ownership front.

"We expect the softening in prices will continue and spread until a bottom is reached around spring time next year," writes Hogue. "We think this will lower ownership costs once interest rates stabilize."

There is an end in sight -- sort of. "Our view is unaffordability will peak at the end of this year -- though the timing is poised to vary market by market," writes Hogue. "Growing household income will partly drive the improvement that will follow. It will likely take years to fully reversed the tremendous deterioration that took place since 2021."

Ouch.