[Editor's Note: On January 20, the Supreme Court granted the sales process as outlined in this article.]

After being placed under receivership, the remaining units at the Highline Metrotown tower developed by Burnaby-based real estate developer Thind Properties are now set to undergo a court-ordered sales process, according to filings in the Supreme Court.

Highline Metrotown sits at 6511 Sussex Avenue in Burnaby, directly adjacent to Metrotown Station and across the street from the Metropolis at Metrotown shopping centre. The 48-storey mixed-use tower was completed by Thind Properties in late-2023 and consists of 332 strata units.

As first reported by STOREYS, the remaining units were placed under receivership in December alongside the Minoru Square project in Richmond at the request of Toronto-based KingSett Mortgage Corporation, also known as KingSett Capital, who claimed that they were owed $146,020,840.41 pertaining to Highline Metrotown as of November 1.

According to a recent update provided by the Receiver, the outstanding debt has been cut to approximately $103 million as of January 6, with interest accruing at a daily rate of $30,077.52.

The Receiver did not detail how the debt was reduced, but Thind successfully sold Highline Metrotown's 10-storey commercial podium for $47.2 million before the receivership order came into effect, as first reported by STOREYS. The commercial podium was originally planned as office space, but is now set to be converted into a hotel called Hyatt Place Metrotown operated by Mundi Hotel Enterprises Inc.

The Sales Process

Since the receivership order came into effect, the Receiver has been working towards establishing a court-ordered sales process for all of the remaining units, and have since returned with a proposed sales process that is pending court approval.

According to the Receiver, Thind Properties retained prominent Vancouver-based real estate firm Rennie as the sales agent for Highline Metrotown back in 2017, who sold 213 of the 332 units. (Case documents note that Rennie is an unsecured creditor on Highline and that Thind Properties — 6511 Sussex Heights Development Ltd., specifically — owes them $130,582.)

Due to that experience, the Receiver has retained Rennie to now sell the remaining units, with commission set at 3.8% and to be evenly split between Rennie and the buyer's agent, so long as each transaction meets a set of requirements.

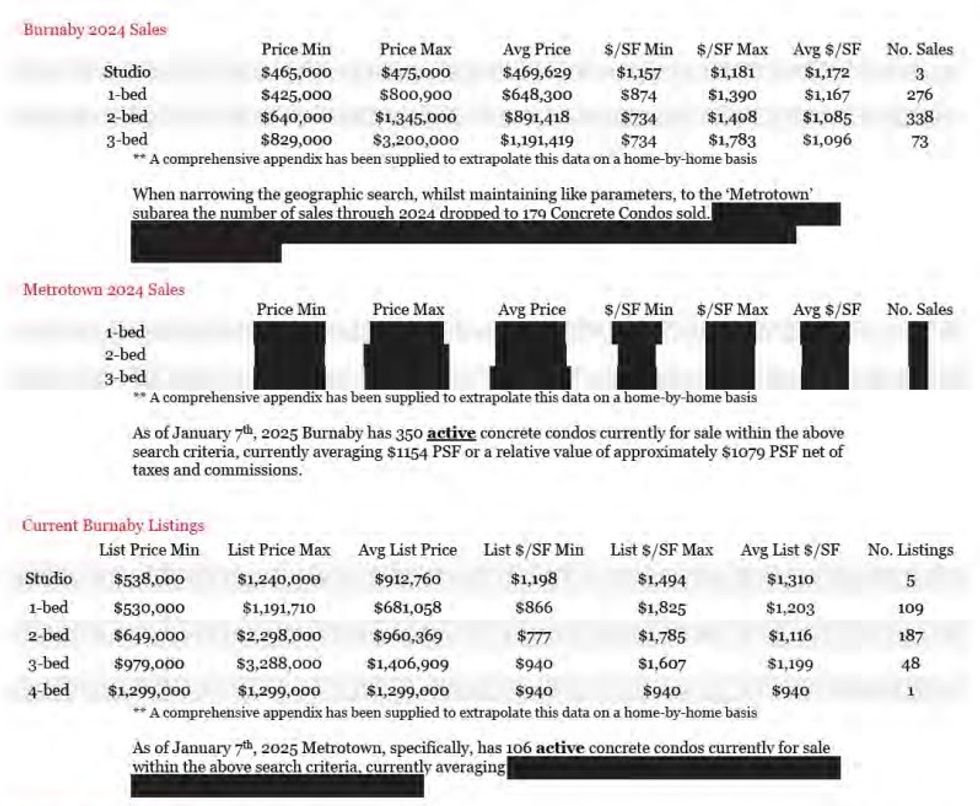

Rennie has submitted a proposal outlining suggested listing prices and minimum prices per sq. ft, which were based on the sales history of the building, sales data for similar projects in Burnaby, and input from KingSett Capital. With Rennie's estimates, the Receiver believes the remaining 119 units have an aggregate market value of over $100 million — enough for significant recovery of the debt owed to KingSett.

Holding the units indefinitely is unviable due to the "significant carrying costs," the Receiver says, citing the daily interest rate of $30,077.52, so they have thus set "achievable" sales prices and proposed a sales process designed for efficiency. If approved by the court, the sales process would allow the Receiver and KingSett Capital to sell units without returning to the court for approval of each sale, so long as the transactions meet the agreed upon requirements.

"The Highline Sale Process is intended to provide a flexible, efficient, and fair process for canvassing the market for potential purchasers and maximizing the value of the Remaining Units and recovery for the Debtors' stakeholders," said the Receiver. "Moreover, it is intended to significantly reduce carrying costs, and minimize the number of Court attendances required by prospectively approving the Sale Agreements and the Unit Transactions that are anticipated to materialize from the Highline Sale Process, subject, in each case, to the satisfaction of the Sale Conditions."

The Receiver also notes that there are "certain repairs that are necessary to ensure the Remaining Units are in optimal condition." Rennie estimated the costs of those repairs to be between $7,500 to $8,500 per unit, which amounts to a total of approximately $892,500 to $1,011,500. In its report, they said the work includes the installation of blinds and paint touch-ups. The Receiver is currently in the process of retaining Brasfield Builders Limited to perform those repairs.

Unpaid Strata Fees

As first reported by STOREYS in mid-November, Thind Properties also owed a bit over $800,000 on paying various strata-related fees, which resulted in the building's concierge and building manager services being suspended by the service providers as a result of non-payment.

"Unfortunately, on the balance sheet, the Strata corporation is not doing as well," said the property management firm, Tribe Management, in a notice to owners dated August 2024 previously provided to STOREYS. "The Strata is currently hampered by unpaid Accounts Receivable, primarily from the Developer, and is unable to pay its monthly bills."

In December, after KingSett Capital filed its receivership application, the strata corporation filed a response claiming that the amount owed is now approximately $1.1 million as of December 6. On December 12, the strata corporation then filed its own civil claim in the Supreme Court seeking a declaration that the amount owed is the highest-ranking registered charge.

It's unclear if the strata corporation received that declaration, but the Receiver has now asked the court to allow it to borrow $2,303,860 that would allow it to cover the amounts owed to the strata corporation and pay for the repairs in the remaining units.

"Although the Strata Liens could be paid from the sale proceeds of the Remaining Units, as the Receiver understands is customary and likely to be requested by Purchasers, Rennie has advised that the presence of the Strata Liens may deter potential purchasers from participating in the Highline Sale Process," said the Receiver.

Other liens registered against the property, as of January 10, include $1,905,810.39 to Jab Contracting Ltd., $35,411.25 to Lion’s Gate Building Maintenance Ltd., $255,079.85 to Hair Stones Limited, and $42,613.65 to 1364410 B.C. Ltd.

Furthermore, the Receiver notes that the Canada Revenue Agency notified them earlier this month that they were owed $8,152,926 in GST/HST. The Receiver said that they asked 6511 Sussex Heights Development Ltd. and representatives of Thind Properties for GST returns and supporting documentation on January 11, but that Thind has not provided them. The Receiver says that the CRA's debt is a "deemed trust claim," which gives it priority over all other charges, but that KingSett Capital has filed an application to assign 6511 Sussex Heights Development Ltd. into bankruptcy in order to "reverse the priority."

The application to approve the sales process and borrowing, among other things, will be heard on January 20.

- Thind Eclipse Brentwood Owing $189M, Placed Under Creditor Protection ›

- Thind Facing Foreclosure On Burnaby Maywood Project Acquired This Year ›

- Thind Sells Hotel Component At 48-Storey Highline Metrotown For $47.2M ›

- Thind Facing Two More Receiverships, Owes $220M To KingSett ›

- Receiver Of Thind District Northwest Project Finds $86M Stalking House Bid ›

- A Timeline Of Thind Properties And Its Insolvency ›