It seems that Canadian homeowner hopefuls are feeling less, well, hopeful these days.

According to a new report from Mortgage Professionals Canada (MPC), 48% of non-homeowners think they will never be able to purchase a primary residence. That figure has climbed 15 points since December of last year.

Meanwhile, just 17% of non-owners indicate that they are planning to buy a principal residence in the next two years. That share has dropped five points over the past six months.

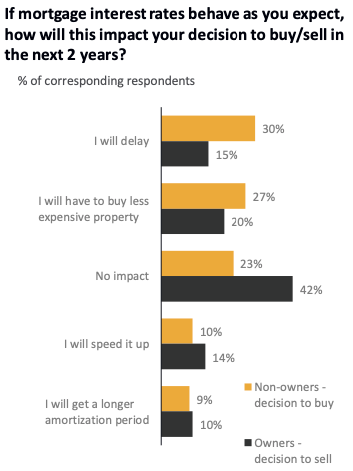

Of the proportion of non-owners who still have plans to buy at some point in the future, 77% say they will have to adjust their purchasing plans given current interest rate realities, while 30% say they will delay their purchasing plans indefinitely.

For current homeowners, the sentiments are similarly dismal, with 7% indicating to MPC that they are considering selling because they cannot afford their current mortgage. While that figure may not seem elevated at first blush, the report notes that it has “surged more than three-fold” from just 2% a year ago.

“Wave” Of Renewals Coming, Says National Association

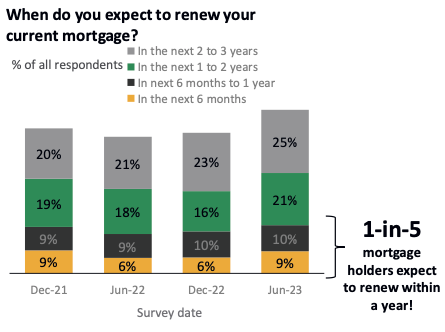

MPC warns that that the next three years will see a “wave” of mortgage renewals, with 19% of current borrowers expecting to renew over the next year, and 65% expecting to renew over the next three years. Unsurprisingly, 69% of mortgage holders express concerns that they will be renewing at higher rates.

“The size and volume of mortgages coming up on renewal remains a key risk for Canadian housing markets,” notes MPC, pointing out that the average five-year conventional mortgage rate remains “near its cycle high of 5.8%.” The national association anticipates that that figure will grow to 6.1% in H2 2023.

Despite the challenging financial circumstances, the report indicates that only 5% of current mortgage holders are paying less than the amount required by their lenders.

Conversely, close to a third of mortgage holders say they are paying a higher amount than required by their lender. This was especially true of borrowers with variable-rate products, as well as borrowers in Ontario and British Columbia. In those respective cases, 41%, 36%, and 35% of borrowers report paying more than the required amount.

Wednesday’s report was prepared by Oxford Economics for Mortgage Professionals Canada and reflects the views of 1,949 survey respondents from across the country. This particular report is released semi-annually, with the next rendition slated for release in December.