Urbanation Inc. released its Q2-2020 Condominium Market Survey results today, providing the first insights on how the Greater Toronto Area (GTA) new condominium market has performed during COVID-19.

According to the survey results, in light of the COVID-19 pandemic, new condo apartment sales reached 1,385 units in the GTA, a new low since the 'Great Recession' in Q1-2009, when just 885 units sold.

On a year-over-year basis, new condo sales fell 85%, as only six projects and 1,176 units were launched for pre-sale during the quarter, which compares to 40 projects and 11,415 units launched in Q2-2019.

The absorption of units released for pre-sale during Q2-2020 totalled 67%, which Urbanation says was in line with sales absorption achieved within new project launches in the quarters leading up to the pandemic.

READ: New Rentals in Downtown Airbnb-Friendly Condos Grew 257% in June

However, the selling prices within newly launched projects in Q2-2020 averaged $889 per-sq.ft, compared to an average selling price of $1,159 per-sq.ft for new launches in the first quarter of 2020, which Urbanation says reflects a lack of new launches in the higher-priced Downtown Toronto markets during Q2-2020.

The survey results also showed that the selling prices of new project launches in Q2-2020 were notably higher than those launched in the same submarkets since the second half of 2019 – setting new highs for their respective market areas in most cases.

As a whole, the average selling prices for units in actively marketed new condo projects in development across the GTA reached a new record-high average price of $867 per-sq.ft, increasing from $864 per-sq.ft in Q1-2020 and rising 8% year-over-year.

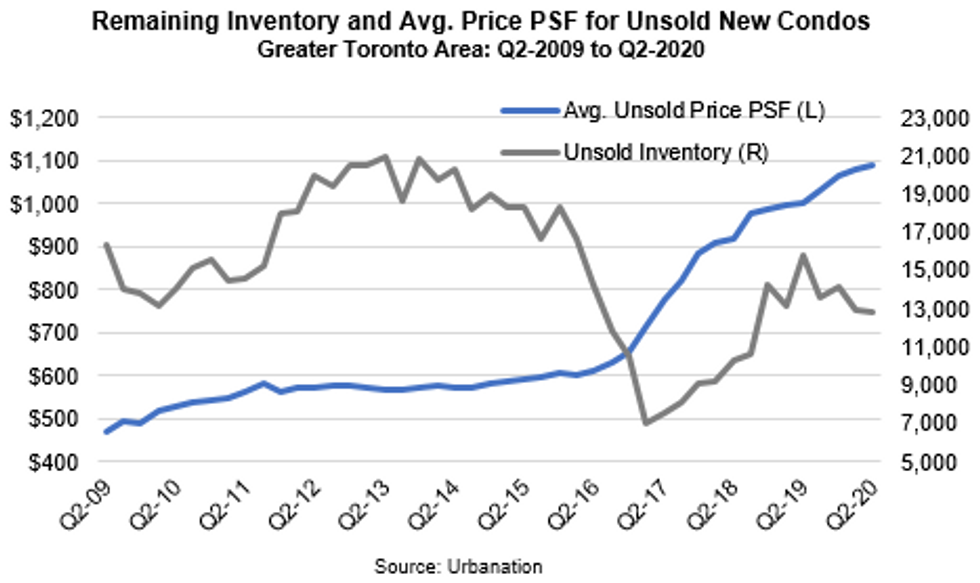

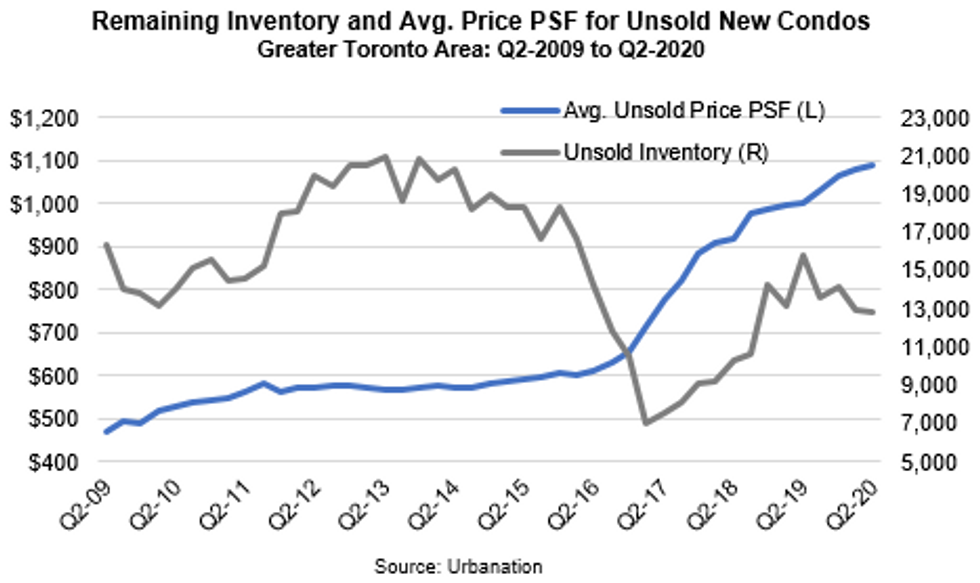

For unsold units remaining in Q2-2020, prices increased from $1,080 per-sq.ft in Q1-2020 and were up 9% year-over-year to a record high $1,087 per-sq.ft.

Urbanation says developers gained confidence during the quarter as sales continued with the move to a virtual format, inventories remained low, and many projects progressed into the construction stage.

The survey results revealed that 90% of all new condo units that were in development in the GTA were pre-sold in Q2-2020, inching up 2% from 88% year-over-year. The unsold supply of units declined 19% year-over-year to 12,778 units and fell 17% below the 10-year Q2 average of 15,468 units.

Urbanation says new condo supply is expected to see improvement in the third quarter, as the success shown within recent new launches and the stability of the resale market during COVID-19 has pulled forward some project launches into the summer that were previously delayed to the fall. As of the end of July, 2,137 units launched so far during Q3.

What's more, the survey revealed that despite below-grade condo construction having to be temporarily halted by the provincial government during April as a result of COVID-19, a total of 7,388 units started construction in the second quarter, up 45% from Q2-2019 (5,094) and increasing the total number of condos under construction to 78,212 units — marking the second-highest level on record behind Q4-2019 (78,693).

READ: The ‘905’ is Now Outperforming Toronto-Area Housing Activity: Report

Urbanation says the growth in condo construction has been fuelled by the 905 region, which saw its under construction count rise to a record high 24,690 units from 17,764 units in Q2-2019. This also happens to align with data from a new report from the Toronto Real Estate Board (TRREB), which found that housing activity in the 905 region is now outperforming the Toronto-areas as there is now a greater demand for single-detached homes and townhomes in the burbs.

Meanwhile, the number of condos under construction in the former City of Toronto — which largely represents the downtown markets — declined from 39,027 units in Q2-2019 to 34,990 units in Q2-2020. This occurred as the resale condominium data for Q2 showed that markets outside of downtown Toronto performed best in the COVID-19 period.

Shaun Hildebrand, President of Urbanation, says the GTA condo market showed resiliency in the second quarter, albeit with much lower than normal activity.

"More telling will be the second half of 2020, which will see supply pick up from growth in new launches and the nearly 14,000 units that are scheduled for completion in the next six months.”