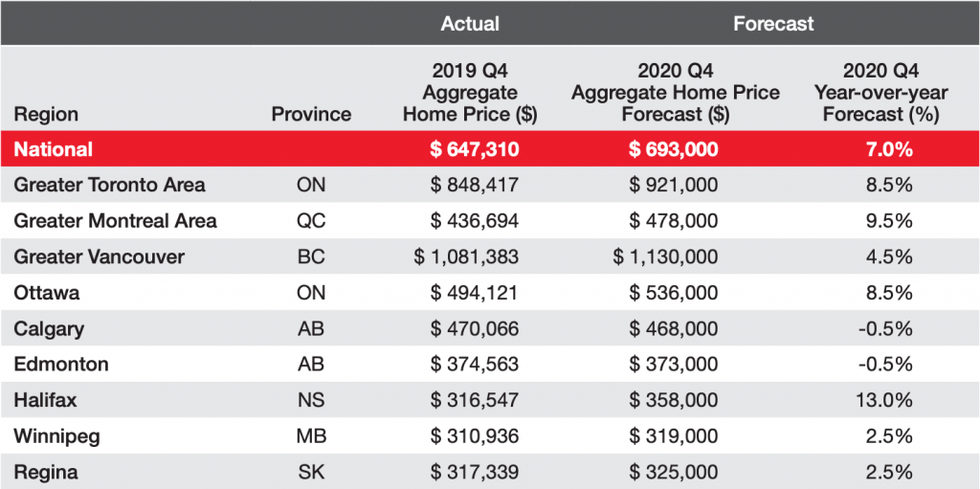

Royal LePage has projected that aggregated home prices in the Greater Toronto Area (GTA) could increase by as much as 8.5% in the fourth quarter of 2020 compared to the fourth quarter of last year, marking a notable uptick from the 4% increase that was initially predicted at the beginning of the third quarter.

On Wednesday, the Canadian real estate brokerage released its House Price Survey and Market Survey Forecast, which include insights specifically for Toronto and the GTA region. According to the findings, Torontonians continue to hunt for more space to accommodate their new COVID-19 normal. As such, Royal LePage is forecasting that prices in the Greater Toronto Area will end the year 8.5% higher than in 2019.

According to the Royal LePage House Price Survey, the aggregate price of a home in the GTA increased 11% year-over-year to $922,421 in the third quarter of 2020.

Here in Toronto, prices continued to climb in the third quarter (11.1% to $975,980), however, prices outside of the city soared as Torontonians looked for more room to live, work, and play in.

Windsor saw the highest price appreciation with prices surging 17%, while other hot spots were Oshawa (15%), Kitchener, Waterloo, and Cambridge (13.9%), Hamilton (13.7%), and Mississauga (13.5%).

READ: How Will the Second Wave of the Pandemic Affect Toronto Real Estate?

When broken down by housing type, the median price of a standard two-storey home in the GTA increased 12.2% year-over-year to $1,082,502 in the third quarter, while the price of a bungalow rose 10.6% year-over-year to $887,156.

During the same period, condominiums in the region continued to see healthy price appreciation, with the median price rising 6.8% year-over-year to $599,826.

Similar strong home price gains were noted in Toronto where the median price of a standard two-storey home increased 15.5% year-over-year to $1,483,510, and the price of a bungalow rose 11.3% year-over-year to $974,295. During the same period, the median price of a condominium grew 4.9% year-over-year to $644,903.

“Demand from the delayed spring market has continued through the third quarter. The seasonal slowdown is expected in the coming months but given the recent strength of September, we will likely see a more brisk fourth-quarter market than the previous year,” said Debra Harris, Vice President, Royal LePage Real Estate Services Limited.

Harris added that while active listings are up, the sales to listings ratio and decrease in days on market indicates that properties are being quickly absorbed by demand.

“The detached home market is outperforming the condo market, but condo demand is still considered healthy. Condo sales were up 15% in September compared to September 2019. In Toronto, we are used to strong seller markets and a balanced market can seem quiet by comparison,” said Harris.

Royal LePage has also forecast that the aggregate price of a home in the Greater Toronto Area will increase by 8.5% in Q4-2020 compared to the same quarter last year.

Nationally, the aggregate price of a home in Canada increased 8.6% year-over-year to $692,964 in the third quarter, as high demand and low inventory continued to fuel a seller’s market.

“Typical consumption patterns have been disrupted in 2020 as the pandemic has driven the household savings rate to levels not seen in decades,” said Phil Soper, president and CEO of Royal LePage. “Most Canadians have sharply reduced spending on discretionary goods and services involving a great deal of human interaction, and with mortgage rates at record lows, many have refocused on housing investments, be it renovations to accommodate work-from-home needs, a recreational property or a new property better suited for the times.”

“Home price gains realized this quarter are forecast to be sustained through December,” said Soper. “While the pace of price growth is expected to slow considerably in the final weeks of this most unusual year, it is highly unlikely we will see housing values back up.”