Condo sales and listings are down in the Greater Toronto Area (GTA). Meanwhile, the rental market is heating up as would-be first-time buyers are pushed to the sidelines.

Following the ownership market as a whole, Q3 2022 condo sales were off by approximately 46% compared to Q3 2021, according to new figures from the Toronto Regional Real Estate Board (TRREB). Despite there being substantially more balance in the market in the third quarter compared to a year ago, the average selling price was up year over year, albeit by less than the current pace of inflation.

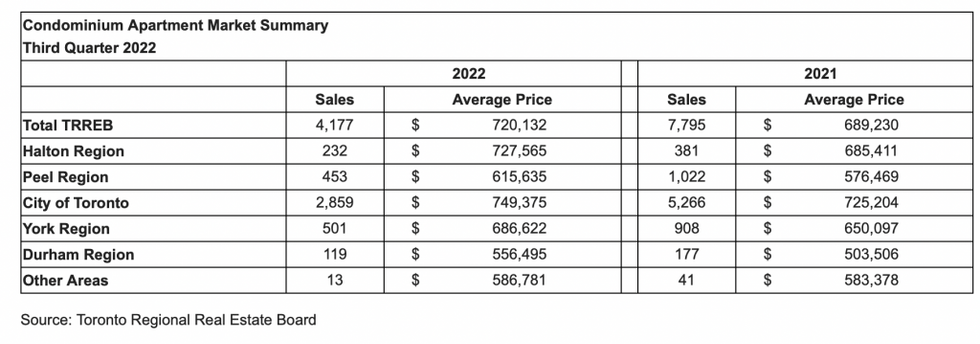

There were 4,177 condo apartment sales reported through TRREB’s MLS System in Q3 2022 compared to 7,795 in Q3 2021. The number of new listings was also down over the same period by 16% to 10,258.

The average selling price for condominium apartments in Q3 2022 was $720,132 -- up 4.5% compared to $689,230 reported for Q3 2021. In the City of Toronto, the average selling price was $749,375 -- up 3.3%.

“The pace of condo price growth has moderated as higher borrowing costs have hampered affordability since the spring,” said TRREB Chief Market Analyst Jason Mercer. “However, the impact has been mitigated to a certain degree by a dip in listings over the same period. A shorter supply of condos will likely provide some support for prices in the months ahead.”

Meanwhile, the rental market is back to where it was pre-pandemic: renters face sky-high prices, heightened demand, and increasing competition.

“The condo market remains a very important segment in the GTA housing market both in terms of ownership and rental,” said TRREB President Kevin Crigger. “The ownership side of the market has been slower, as some first-time buyers have been sidelined by higher borrowing costs and the hit on affordability. Many of these would-be buyers have shifted to the condo rental market in the short- to medium-term to meet their housing needs.”

Double-digit year-over-year rent increases continued to be the norm in Q3 2022, according to TRREB. With many would-be first-time buyers temporarily pausing their homeownership goals in the GTA due to higher borrowing costs, rental demand has remained strong in the face of falling supply. Competition for condo rentals has intensified as a result, and negotiated rents have increased dramatically, the board reports.

There were 13,366 condo apartment rental transactions reported through TRREB’s MLS system in Q3, representing a 17.3% decline compared to Q3 2021. However, similar to the second quarter, the number of rental units listed was down by a greater annual rate of 25.6%. This means that it became more difficult for renters to find a unit to meet their housing needs compared to a year ago.

“Immigration into the GTA plus non-permanent migration for school and temporary employment have all picked up markedly,” said Crigger. “Add to this the impact of higher borrowing costs on the ownership market and it becomes clear that the demand for rental housing remains strong for the foreseeable future. Investor-owned condos have been an important component of the rental stock for more than a decade. However, the decline in rental listings over the past year are a further warning sign to policymakers that the overall lack of housing in the region extends to the rental market as well.”

The average one-bedroom condominium apartment rent in Q3 2022 was up by 20.4% year-over-year to $2,481. The average two-bedroom apartment rent at 3,184 was up by 14.5% compared to the same period in 2021.

“Rental housing is an increasingly important piece of the housing puzzle," said Mercer. "While investor-owned condo units have been an important source of supply, current tight market conditions and double-digit average rent growth point to the need for additional purpose-built stock -- the construction of which has been lacking in recent years."