New condo sales in the Greater Toronto Area (GTA) fell to a 20-year low in the second half of 2022 as uncertainty crept into the market and affordability declined.

According to Urbanation's year-end Condominium Market Survey, just 5,419 new condo units were sold across the GTA between July and December 2022 -- a 68% annual decline -- as the "severe impact" of the Bank of Canada's interest rate hikes began to be felt. The figure is on-par with the lowest July-December sales total of the last 20 years, which was set during the 2008 financial crisis.

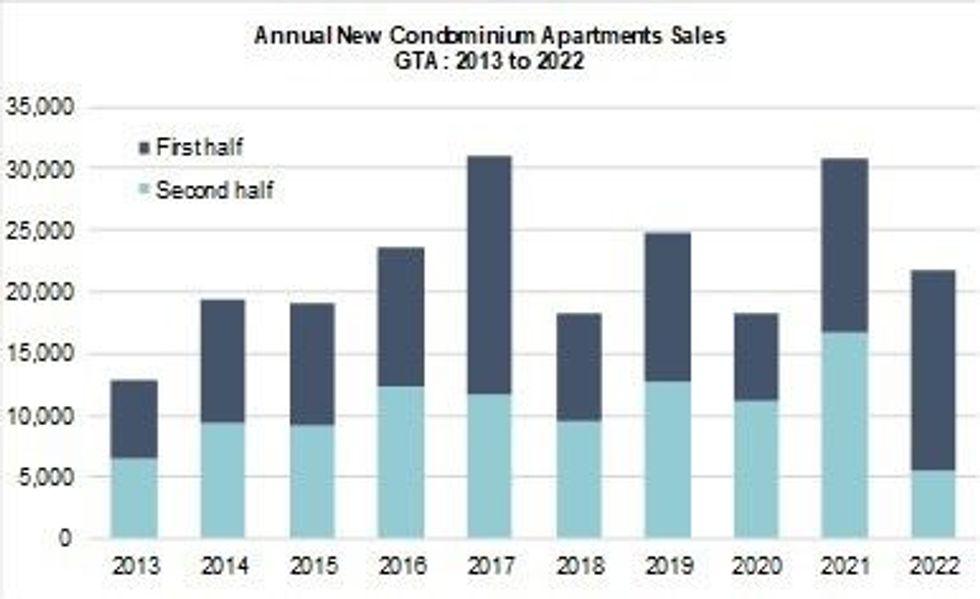

A strong start to the year kept 2022's new condo sales in line with the 10-year average, but, at 21,782 total units, sales were down 30% annually from the near record-high set in 2021. In Q4, sales were down 58% annually.

With buyers hesitating, developers pressed pause on many projects that had been slated for release during the summer and fall. While 16,227 units were launched for pre-sale in the first half of 2022, just 7,669 units were bought to market in the second, a 48% decline from the latter half of 2021.

Although developers' cautious approach kept unsold supply in line with the 15-year average, unsold new condo inventory increased 30% year over year in Q4 2022.

The market slowdown resulted in some price adjustment, but Urbanation noted that high development costs prevented any significant declines.

In Q4 2022, the average opening price for new launches fell 2% annually, to $1,329 per sq. ft, while the average asking price for unsold new condos fell 1% quarter over quarter, to $1,427 per sq. ft. Coming off the record high of $1,443 per sq. ft set in Q3 2022, the latter marked the first quarterly decline since Q4 2018.

Despite these year-end declines, the peak prices seen in early 2022 resulted in average new condo prices being up 8% annually in Q4.

A decline in average resale values -- they fell 14% between Q1 2022 and Q4, and were down 3% annually at the year's end -- led to the widest gap between prices for new and resale condos on record. At $580 per sq. ft, or 68%, the discrepancy far surpasses the previous gap of $332 per sq. ft set in Q4 2019.

A total of 32K condo units were scheduled for completion in 2023, but that figure has now been revised to 25,406. It is still a record high, though, which will assuredly be met with correspondingly high demand.

As ownership affordability remains low -- interest rates have risen 4.25% in the span of 10 months -- and immigration is poised to soar, renters will account for much of the demand. While new and resale values declined, condo rents rose as much as 20% year over year in Q4 2022.

“The slowdown in condo presales in the second half of 2022 is expected to continue into 2023," said Shaun Hildebrand, President of Urbanation.

"[This] is at odds with the need to boost housing production in the GTA over the next decade to meet increasing immigration targets and alleviate current housing supply deficits."