It’s been an interesting few weeks on the foreign home buying front, with the federal government announcing that they are extending the foreign buying ban that was launched at the start of 2023 by two years.

According to an announcement from Sunday, the federal ban will now be in effect until January 1, 2027. Prior to this past weekend, the ban was set to expire at the end of 2025.

Notably, this latest maneuver from the feds closely follows the reveal of a proposed Municipal Non-Resident Speculation Tax (MNRST) in Toronto, and the two are somewhat entwined.

Like the foreign buyer ban, the proposed MNRST is meant to clamp down on speculative home buying in cases where non-resident investors are involved. The thinking with both the ban and the tax is that less speculative home buying will help with housing affordability (or at least, prevent it from getting incrementally worse), as Toronto residents will have more supply available to them, will face less competition, and may not have to sign over their life savings (and the naming rights of their first-born child) in order to make a competitive offer on a home.

Unlike the feds’ foreign buyer ban, however, the MNRST is a carefully designed revenue tool, and its revenue potential has been slashed considerably.

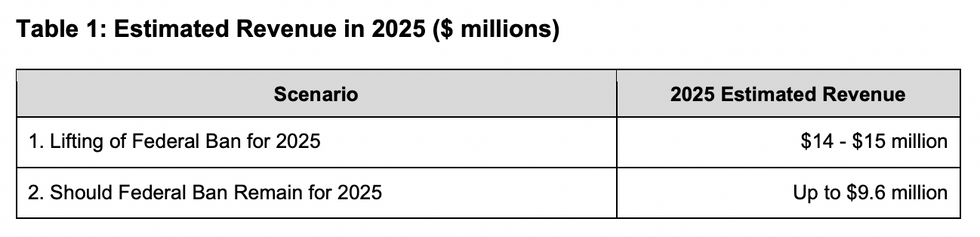

According to a mid-January report from Chief Financial Officer and Treasurer Stephen Conforti, the MNRST is expected to have two main outcomes. The obvious one is that it’s meant to discourage and mitigate speculative buying, but in addition, the tax is meant to “positively contribute” to the City of Toronto’s multi-year budgeting strategy. The MNRST was expected to bring in between $14M and $15M in revenue in 2025 alone.

However, that revenue projection was hinging on the federal government lifting its foreign buyer ban by the end of 2025. Now that the ban will stretch until 2027, the project revenue from the proposed MNRST has dropped down to $9.6M. Though $9.6M is by no means a small amount, it represents a 36% decrease off of the more optimistic projection of $15M.

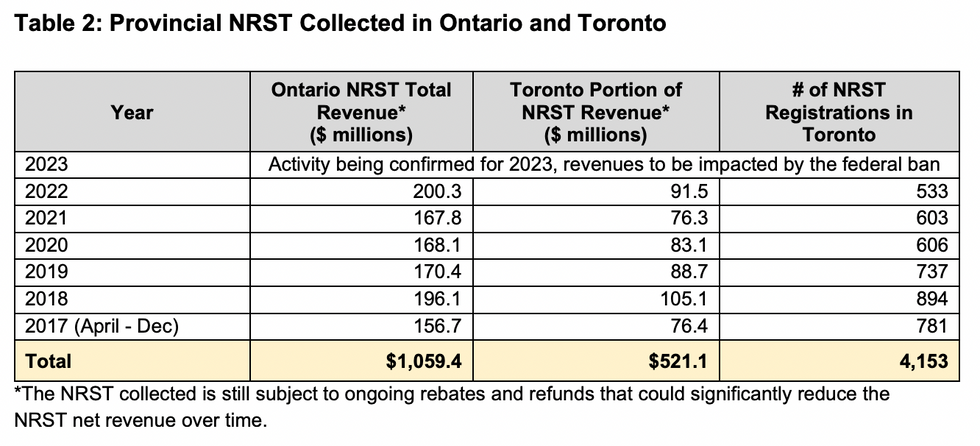

Conforti noted in the report that these estimates are based on revenues collected from the Province of Ontario’s Non-Resident Speculation Tax (NRST), which was introduced in 2017 and hiked to 25% in late 2022.

The Province has collected over $1B in revenue from the tax between 2017 and 2022, and around half of that revenue can be traced back to home purchases in the City of Toronto.

“While 2023 data is still being finalized and verified, the Province estimates that NRST revenue attributable to property purchases in Toronto is down by over 65% in 2023, resulting in an estimated $31.2M for the year, in comparison to $91.5M in 2022,” Conforti said.

Meanwhile, the MNRST — which was approved by the city’s Executive Committee last week, and will go to City Council on Tuesday — is just one of a suite of new revenue streams floated by Toronto Mayor Olivia Chow in September. Those include a new graduated Municipal Land Transfer Tax (MLTT), which was proposed in January 2023. The new MLTT rates went into effect on January 1, 2024. As well, Chow increased the Vacant Home Tax to 3%.

These policy levers are meant to help Toronto fill its gaping operating deficit, which currently clocks in at around $1.8B according to numerous reports from senior City of Toronto staff.