Expropriation

Understand expropriation in Canadian real estate — what it is, how it works, and how owners are compensated when land is taken.

July 29, 2025

What is Expropriation?

Expropriation is the legal process through which government acquires private property for public use, with compensation to the owner.

Why Expropriation Matters in Real Estate

In Canadian real estate, expropriation enables infrastructure projects while protecting owners' rights to fair compensation.

Key elements:

- Must serve a public purpose (e.g., highways, utilities)

- Requires fair market compensation

- Allows for negotiation and appeals

Understanding expropriation helps property owners, developers, and investors navigate land acquisition risks.

Example of Expropriation in Action

The province expropriated land along the highway corridor to expand transit infrastructure, compensating owners at market value.

Key Takeaways

- Government acquisition of private land

- Requires public purpose and fair compensation

- Involves legal rights and appeals

- Enables public infrastructure projects

- Known as eminent domain in some contexts

Related Terms

- Eminent Domain

- Fair Market Value

- Land Assembly

- Official Plan

- Zoning

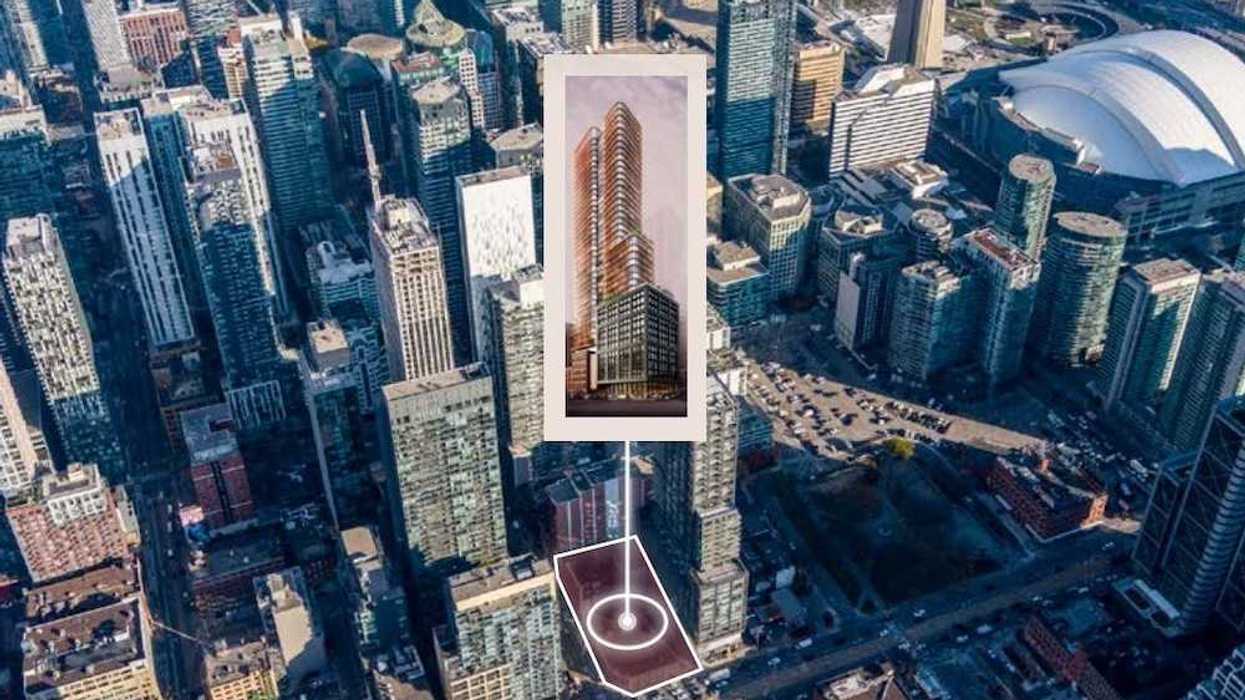

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps)

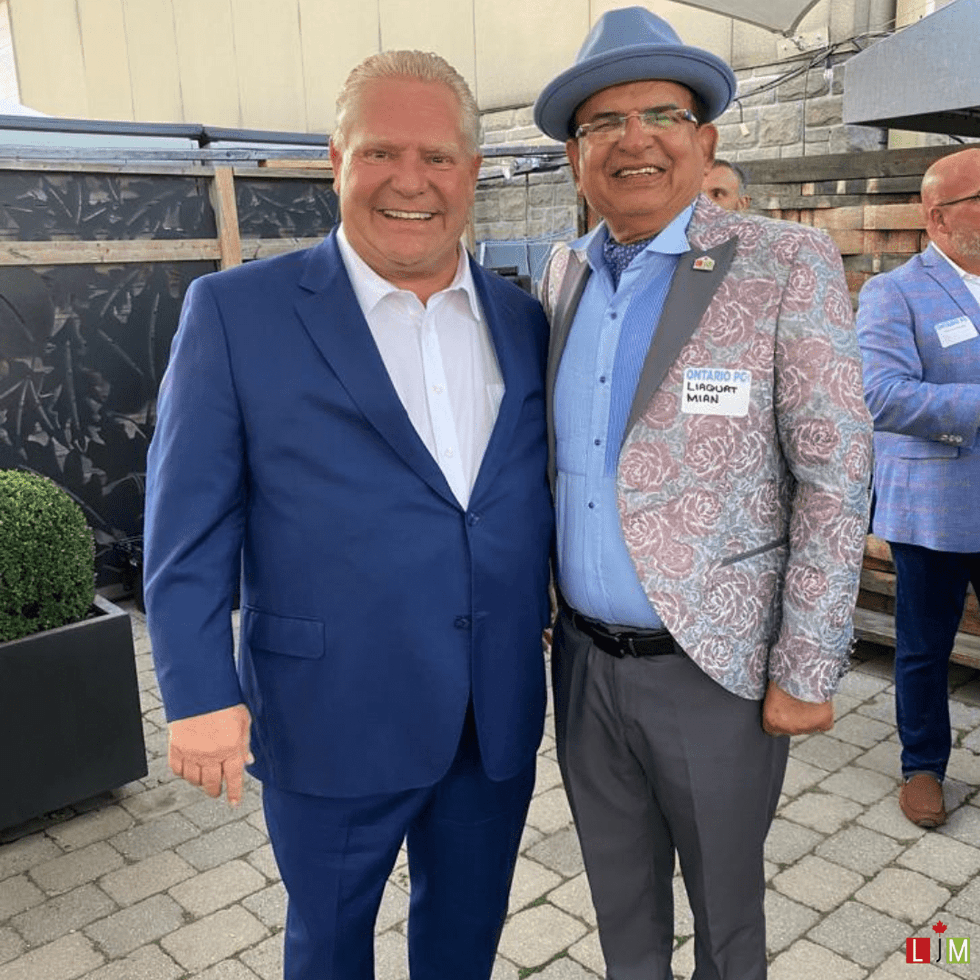

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps) Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

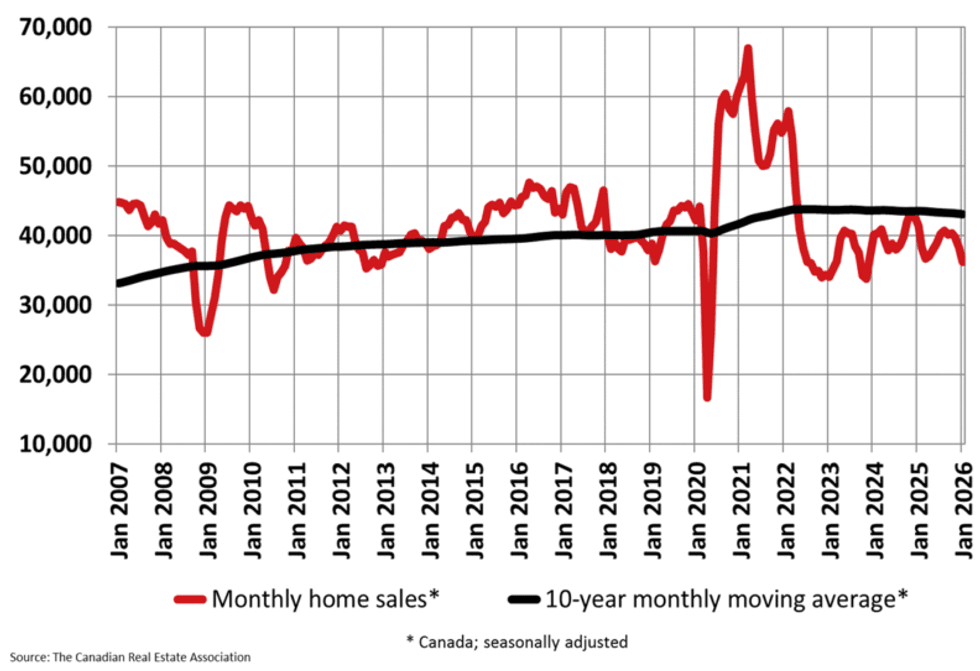

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

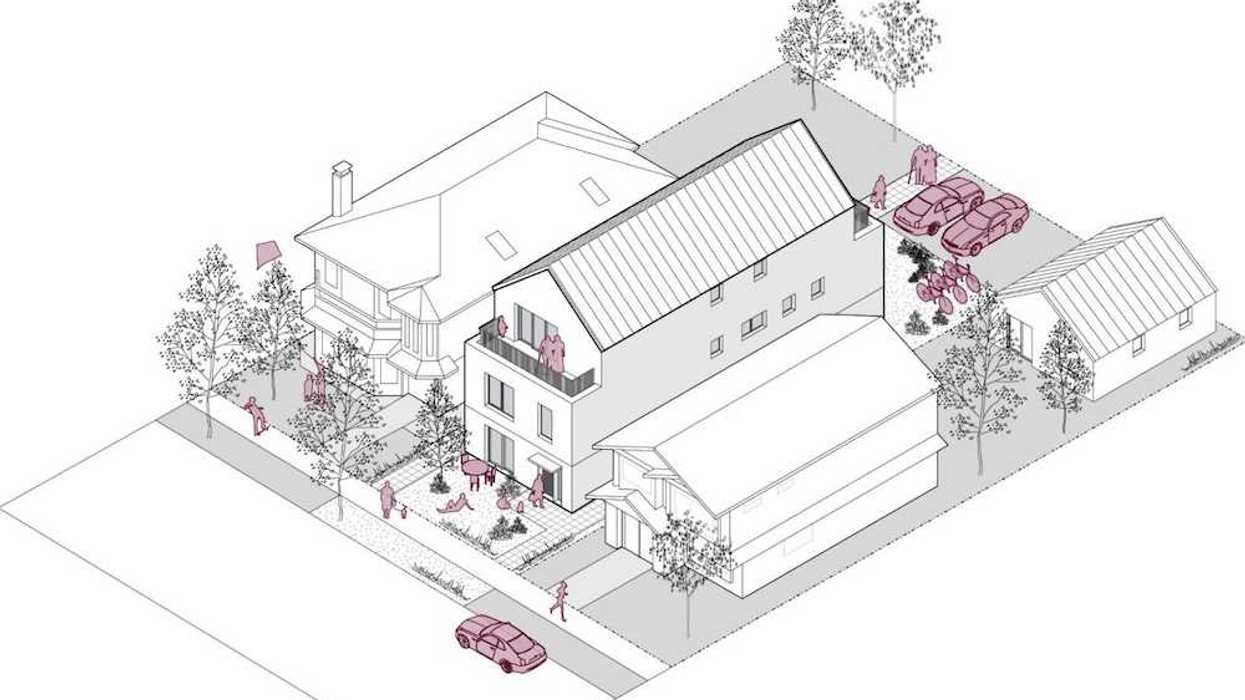

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)