Corporate Restructuring

Learn about corporate restructuring in Canada — what it involves, how it protects value, and its role in distressed real estate.

July 11, 2025

What is Corporate Restructuring?

Corporate restructuring refers to the reorganization of a company’s operations, assets, or liabilities, often under court supervision, to improve financial stability or address insolvency.

Why Corporate Restructuring Matters in Real Estate

In Canadian real estate and business, restructuring helps companies avoid liquidation, preserve value, and maintain operations.

Key aspects include:

- Asset sales and debt refinancing

- Lease renegotiations and cost reductions

- Court protection under laws like the CCAA

- Stakeholder and creditor negotiations

Understanding corporate restructuring is vital for investors, creditors, and developers managing exposure to distressed firms.

Example of Corporate Restructuring in Action

The REIT entered corporate restructuring to refinance debt and sell non-core assets after a sharp decline in rental income.

Key Takeaways

- Reorganizes operations and finances

- Aims to restore business viability

- Often court-supervised

- Common in distressed real estate firms

- Protects value and jobs

Related Terms

- CCAA

- Receivership

- Insolvency

- Bankruptcy and Insolvency Act

- SISP

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps)

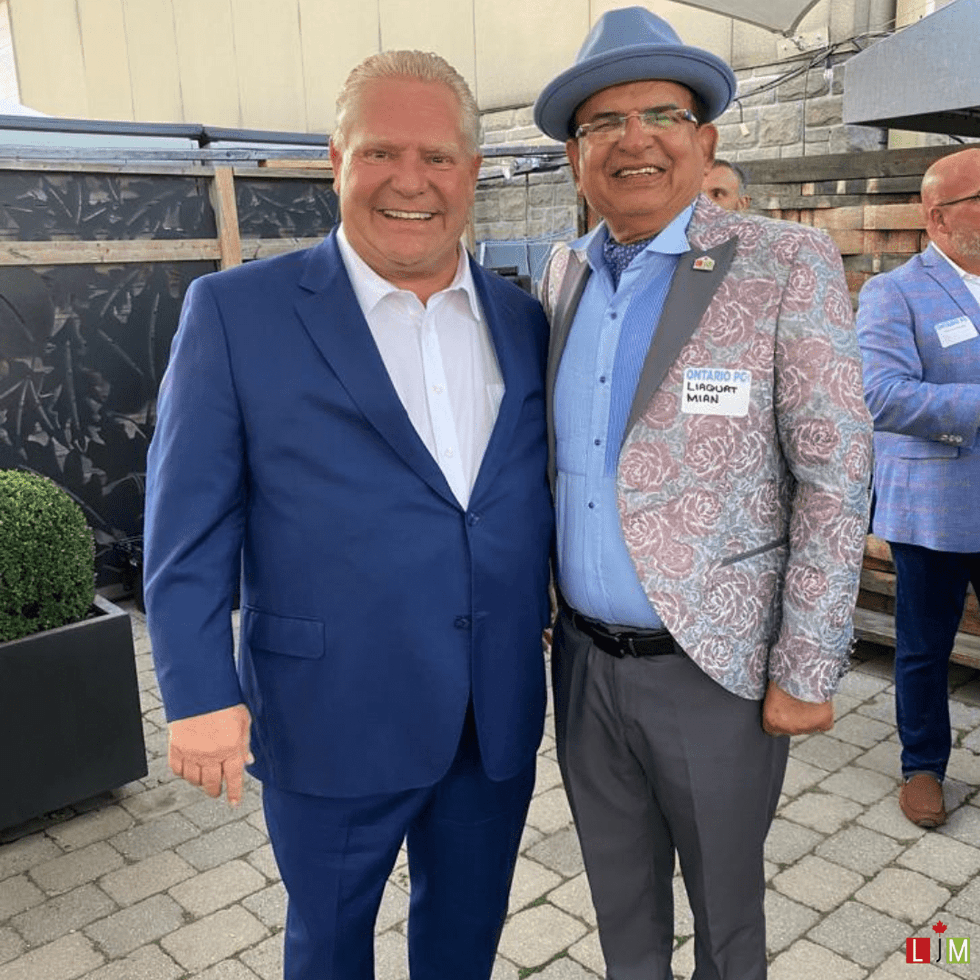

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps) Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)