It’s no secret that Canada is facing a severe shortage of housing — a lack of affordability has kept buyers at bay, slowing sales and rising costs have weighed on starts, and, amidst record population growth, demand continues to outpace supply.

It’s no secret that the construction industry will be key to solving this crisis. But to do so effectively, the sector will need to address its own issues first.

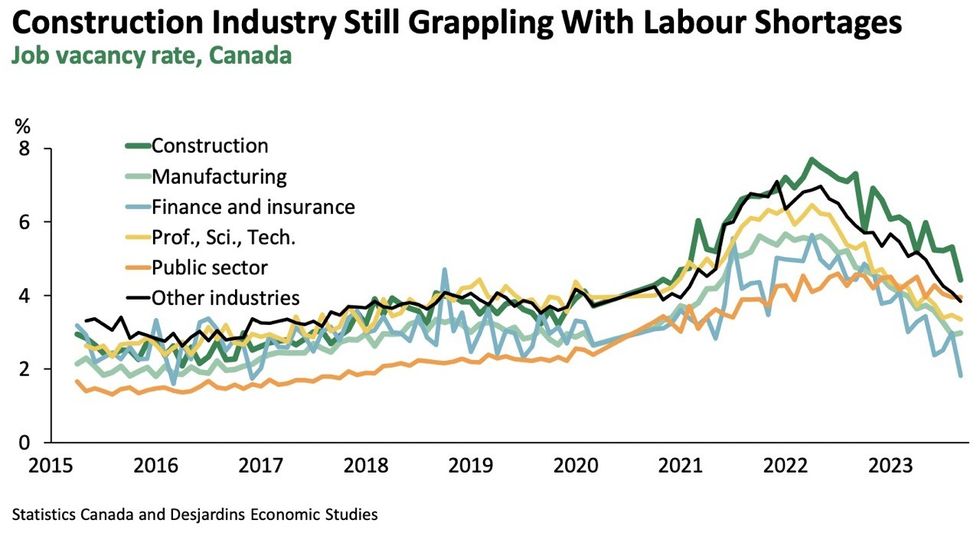

As laid out in a recent Desjardins report from Marc Desormeaux, Principal Economist, and Florence Jean-Jacobs, Principal Economist, these maladies include persistent labour shortages, the high cost of homebuilding, poor productivity, and weak economic growth.

"Not only are there job shortages within the industry that are preventing the sector from reaching its full potential, but we found that many of the people in the workforce in the construction sector are not being used to their full potential," Desormeaux told STOREYS.

"Women in the industry are facing various barriers to full participation, from harassment to discrimination. Immigrants and non-permanent residents have not been as successfully integrated into the labor force in construction as well as in other sectors. And there are challenges around productivity growth and the economic cycle, all of which will weigh on the sector's ability to produce at a level that's consistent with better affordability over the longer run."

Canada has seen two straight years of record population growth, with both 2022 and 2023 adding over one million people. From July 1 to October 1, 2023 alone, the population increased by 430,635 people, 312,758 of whom were non-permanent residents (NPRs).

Despite the surge, the report found that the pathway towards permanent residency is underused by those with construction skills — in 2022, Canada admitted just 455 permanent residents under the Federal Skilled Trades Program.

In fact, recent newcomers are more likely to work in professional services and the information industry, with just 5% employed in the construction sector, well below the 8% of Canadian jobs the sector accounts for. According to the Bank of Canada, there needs to be a “near tripling” of current non-permanent resident inflows into the construction sector in order to bring their share of the industry’s workforce up to par with the general population.

Despite the federal government’s goal of utilizing newcomers to fill labour gaps, immigration "isn’t benefiting construction as much as it does other industries," the report stated.

But as Desormeaux noted, it’s not just about admitting skilled workers into Canada who can contribute to the labour force, but making use of said skills upon their arrival. To rectify the issue, governments and the industry must introduce additional measures to attract, train, and retain skilled workers.

However, easing labour shortages will not offer a "silver bullet" for aiding the ailments of the residential construction industry, or for solving the housing supply shortage. A boost in productivity is required, too.

The report lays out several innovations introduced with success around the world, including offsite construction like pre-fabricated and modular housing, pre-approved building plans, and the adoption of new technologies, such as Building Information Modelling and Construction Management Software, both of which aid the planning process for new projects.

Richard Lyall, the President of the Residential Construction Council of Ontario (RESCON), told STOREYS a significant improvement to productivity would be made if the approvals process was sped up: "If it takes three times longer to build something, that’s going to have an impact on your productivity."

"A big part of what affects productivity is the regulatory system we operate in and the approvals process we operate in," Lyall said.

"You can build much more efficiently — and we utilize new technologies every day — but if it takes longer and longer and it's more expensive because you've got more regulations that you have to comply with, you can use all the newer methods, system, tools, and equipment you like, it's not going to be reflected in your productivity numbers."

Lyall also echoed Desjardins’ call for the introduction of a Building Information Modelling mandate, something the federal government has been "very slow" to adopt. And if the feds were to reduce development charges for first time homebuyers, just as they slashed GST on new purpose-built rentals, that would offer a “significant” boost for affordability.

For all the improvements the construction sector can make, though, the current economic cycle will continue to create “significant headwinds” in the years to come.

"The economic cycle is potentially quite challenging on the sector. We have a situation where building costs are very high, labor shortages are acute, and interest rates are elevated, which impacts the rate at which projects can be financed," Desormeaux said.

"We're going through this period of slow economic growth with all these other high costs. All of that is clearly weighing on builder sentiment. There's a risk that we have much lower overall residential construction activity in the next year, despite the pressing need for more homes."