Comparable Market Analysis (CMA)

Learn how a comparable market analysis (CMA) works in Canadian real estate and how it helps buyers and sellers determine property value.

June 06, 2025

What is a Comparable Market Analysis (CMA)?

A comparable market analysis (CMA) is a pricing report prepared by real estate professionals to estimate a property’s market value based on recent sales of similar homes.

Why Comparable Market Analysis Matters in Real Estate

In Canadian real estate, CMAs are used by buyers, sellers, and agents to evaluate pricing and make competitive offers or listings.

A CMA typically includes:

- Sales of nearby properties with similar features

- Active listings and expired listings

- Price per square foot comparisons

- Adjustments for upgrades or deficiencies

While not a formal appraisal, a CMA provides insight into current market trends and helps avoid overpricing or underbidding.

Understanding CMAs is crucial for accurate home pricing, informed negotiation, and evaluating investment opportunities.

Example of Comparable Market Analysis in Action

Before listing her home, the seller’s agent conducts a CMA that compares five recently sold properties with similar size and condition.

Key Takeaways

- Estimates property value using similar sales

- Used for pricing, listing, and offers

- Prepared by licensed real estate agents

- Reflects current market trends

- Not the same as a formal appraisal

Related Terms

- Appraisal

- Fair Market Value

- Market Value

- Listing Price

- Sales-To-New-Listings Ratio (SNLR)

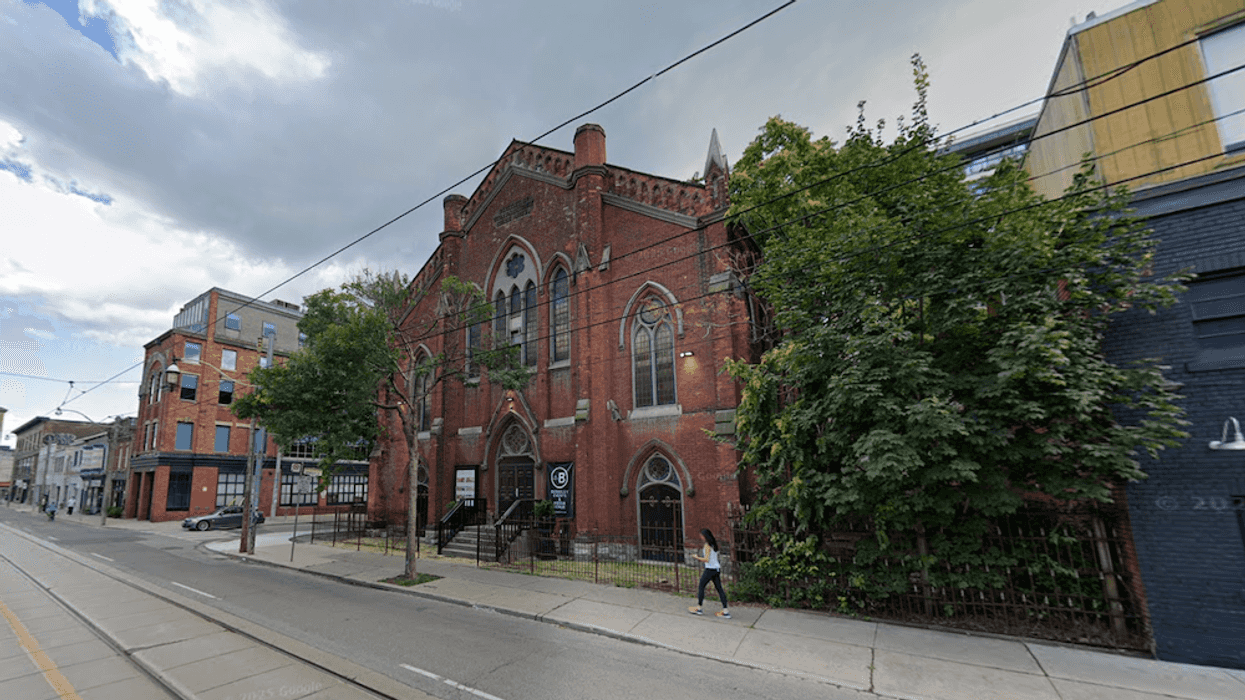

205 Queen Street, Brampton/Hazelview

205 Queen Street, Brampton/Hazelview

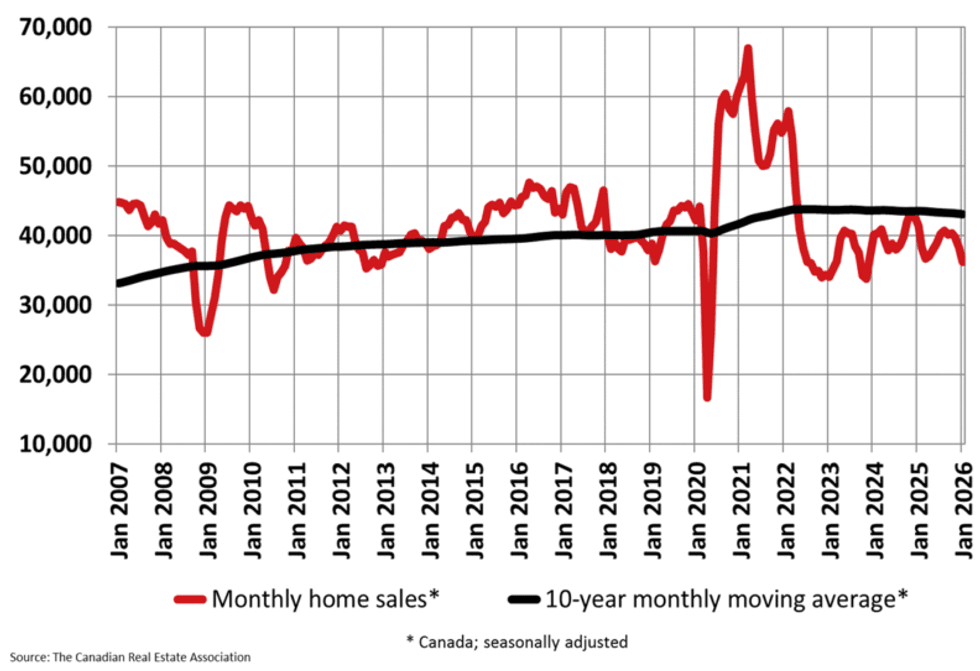

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

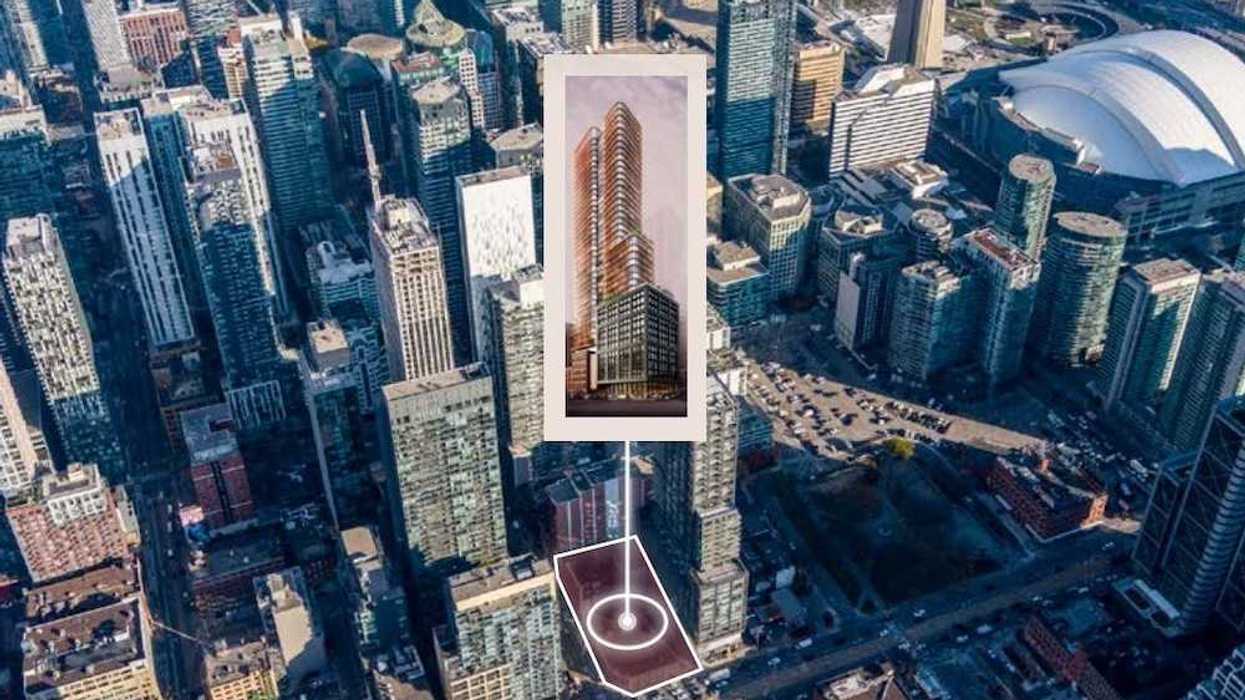

401-415 King Street West. (JLL)

401-415 King Street West. (JLL)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.