The Canada Mortgage and Housing Corporation (CMHC) says there is currently little evidence of overvaluation in the Toronto real estate market.

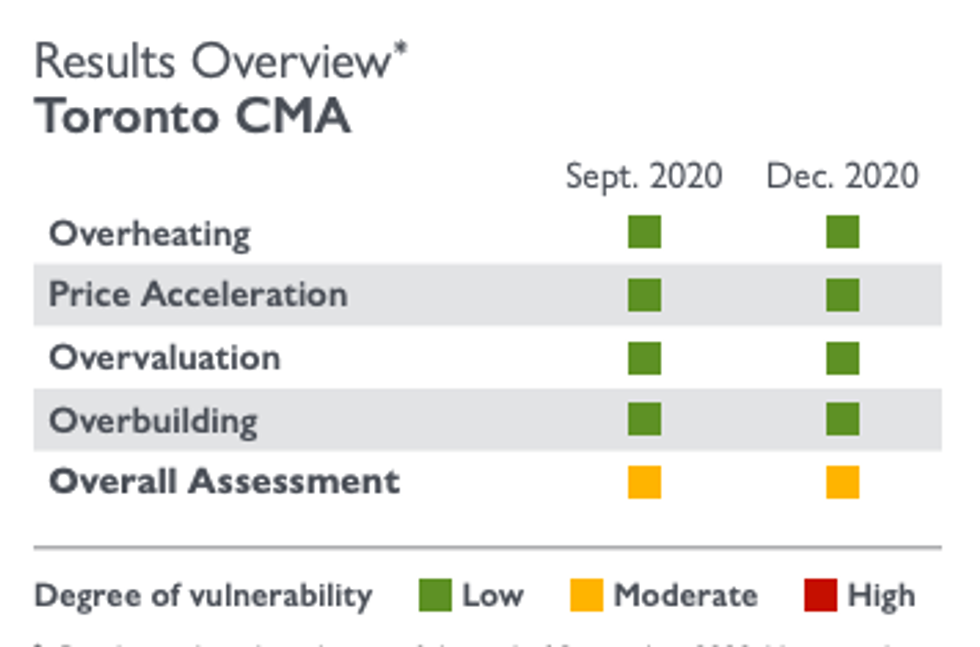

Last week, CMHC released its most recent Housing Market Assessment for the third quarter of 2020, which examines the level of vulnerability in the country’s major real estate markets by considering four factors: overbuilding, overvaluation, price acceleration, and overheating.

“Although the unprecedented income supports from governments provided temporary relief, the COVID-19 crisis negatively affected the level of permanent disposable income available to households,” said Bob Dugan, CMHC’s chief economist. “Along with the weakening of other drivers of the housing market, overvaluation imbalances increased further or started to emerge in several markets in the third quarter of 2020.”

Be that as it may, Toronto's overall assessment remains moderate, according to the latest HMA.

READ: These Are the 25 Most Competitive Housing Markets in Canada

CMHC’s Market Insights senior specialist Dana Senagama, who wrote the Toronto portion of the report, says that the Greater Toronto Area’s sales-to-new-listings-ratio (SNLR) increased up to 60.5% in the third quarter of 2020, but still remains well below the 70% threshold for an overheating real estate market.

Senagama says pent up demand from the previous quarter fueled this growth as newly relaxed pandemic restrictions boosted homebuyer confidence and facilitated more home showings and open houses.

However, the SNLR for condos was low at 42% -- favouring buyers. This comes in the wake of more restrictions being imposed on short-term rentals, which increased listings from investors who listed their properties due to the secondary rental market being weakened by pandemic job losses, which softened demand.

Simultaneously, Senagama says sales in the 905 region grew 45% year-over-year, compared to 21% in the 416. But this doesn't come as a surprise given that COVID-19 has created a shift towards home buying -- particularly low-rises -- in the suburbs -- a growing trend amid the pandemic as a result of increased telecommuting and a desire to live in less densely populated neighbourhoods.

According to CMHC, evidence of price acceleration in the GTA also remains low, while the seasonally adjusted MLS average price grew substantially (11.8%) compared to Q2. Low-rise housing dominated price growth during the third quarter: single-detached (13.7%), semi-detached (8.4%), townhouses (14.6%), condominium apartments (1.4%).

What's more, price growth was strong across the GTA -- Durham (13.2%), Toronto (11.3%), Peel (10.5%), Halton (10.3%) -- aside from the York region, where prices grew by just 5.4%.

Although the CMHC’s modelling also says there’s low evidence of overvaluation in the GTA real estate market, the report shows price levels are inconsistent with “economic fundamentals” like the pandemic-era job losses -- particularly in the services and hospitality sectors.

“The real average observed house price increased relative to the previous quarter,” says the report, “while incomes declined and the population of individuals aged 25-34 grew slightly.”

As for the countless condominium and apartment projects under constructioin in the region, the CMHC report says there’s low evidence of overbuilding because the number of completed and unabsorbed units per 10,000 population and the purpose-built rental apartment vacancy rate is below critical thresholds.

The report says despite low evidence of overbuilding, regulatory changes in some municipalities within the Toronto CMA (restricting short-term rentals) have brought on an increase in new listings of condominium apartments in the resale market.

Job losses among first-time buyers have also led to softening demand and, ultimately, resulted in fewer sales in condominium apartments in the resale market. The new home market, however, has not experienced a similar increase in supply. This has led to a 'supercharged' demand for detached homes that will only continue to drive their prices up in 2021.